Get Total Peace Of Mind With Automated Tax Forms

Handling the taxes for your freelancers has never been easier. Automate your 1099s, form delivery, and e-filing straight from the Worksuite dashboard.

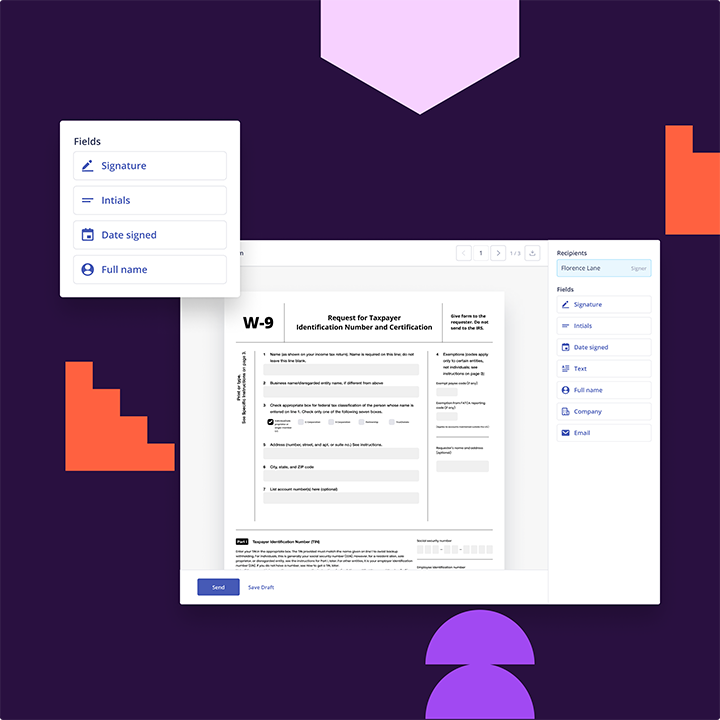

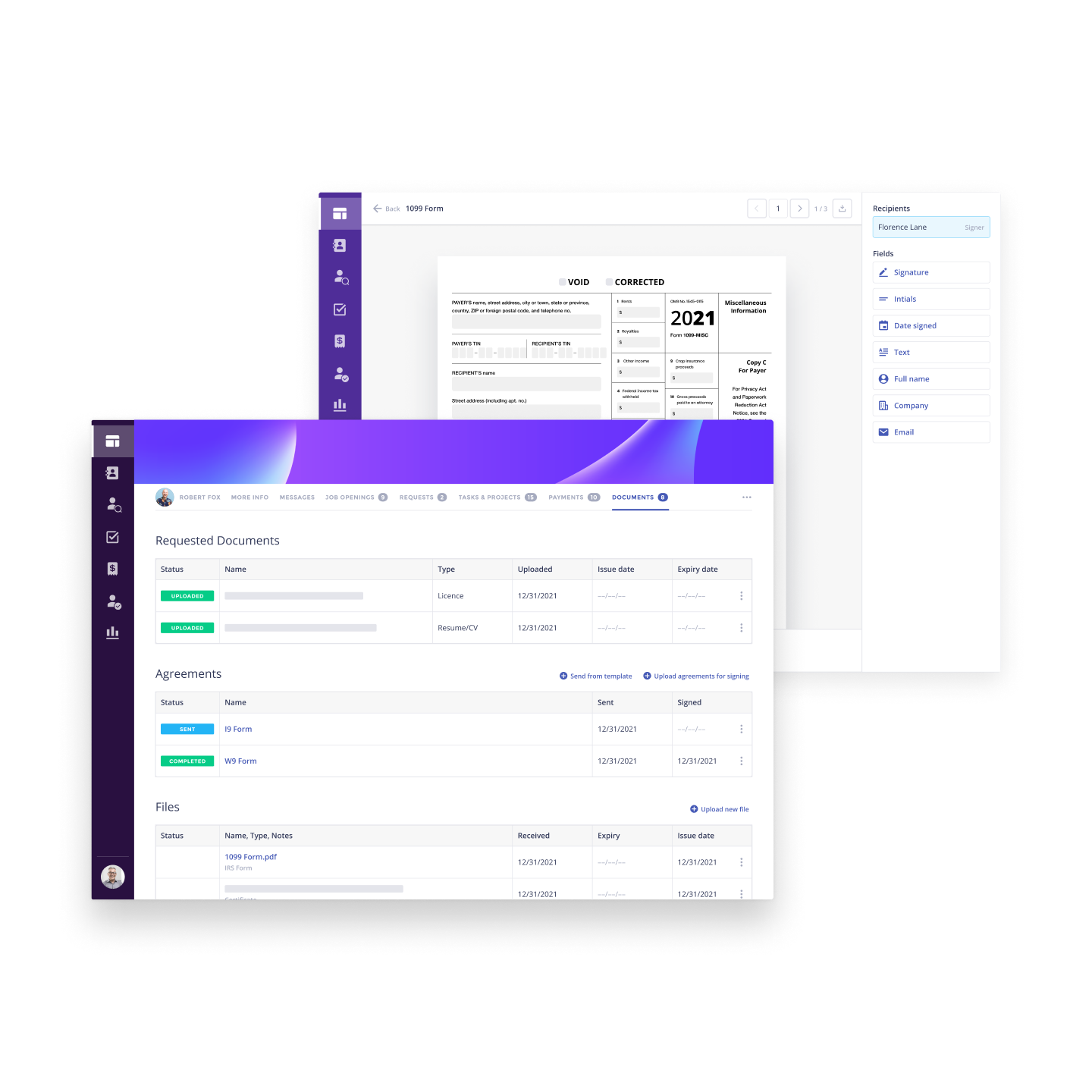

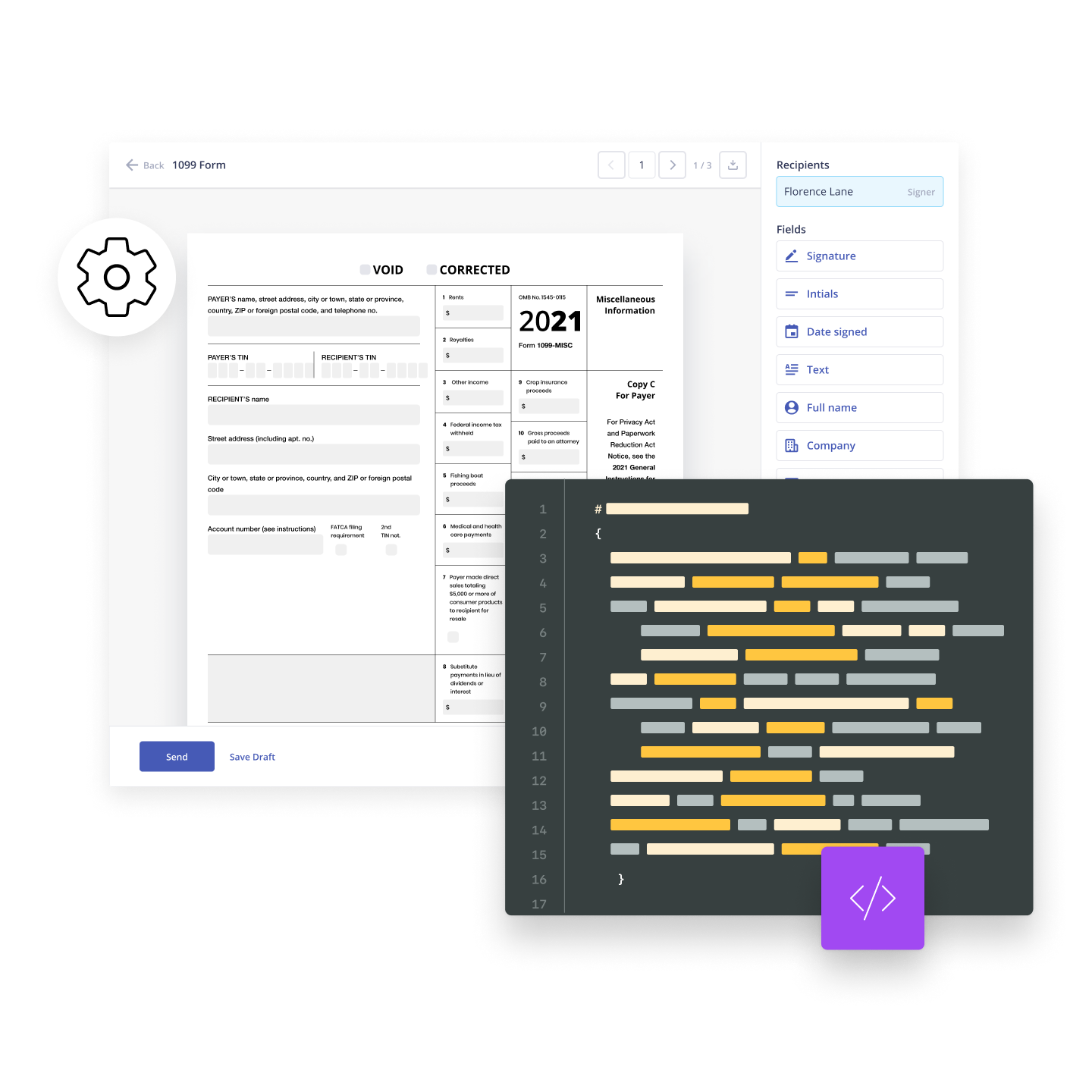

Automated 1099 Generation

Turn your existing data into professional 1099 forms with just a few clicks.

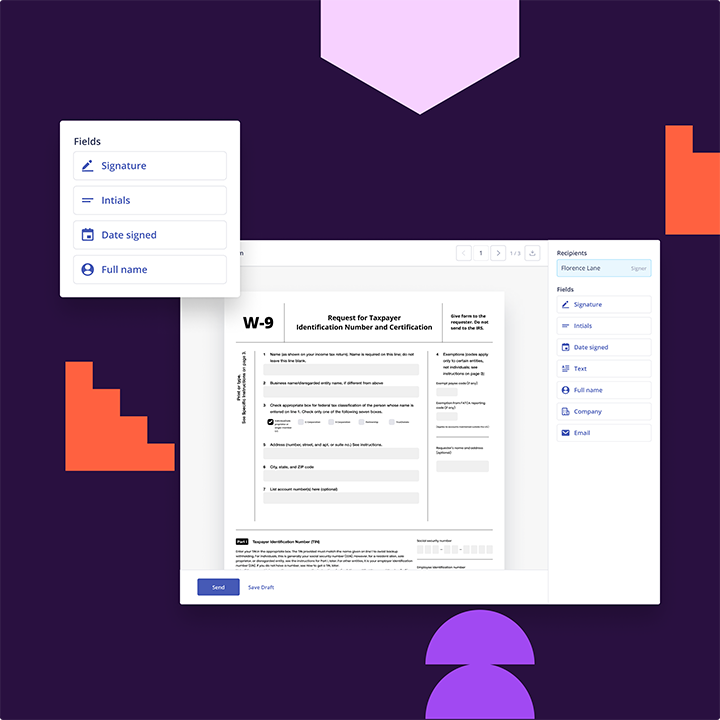

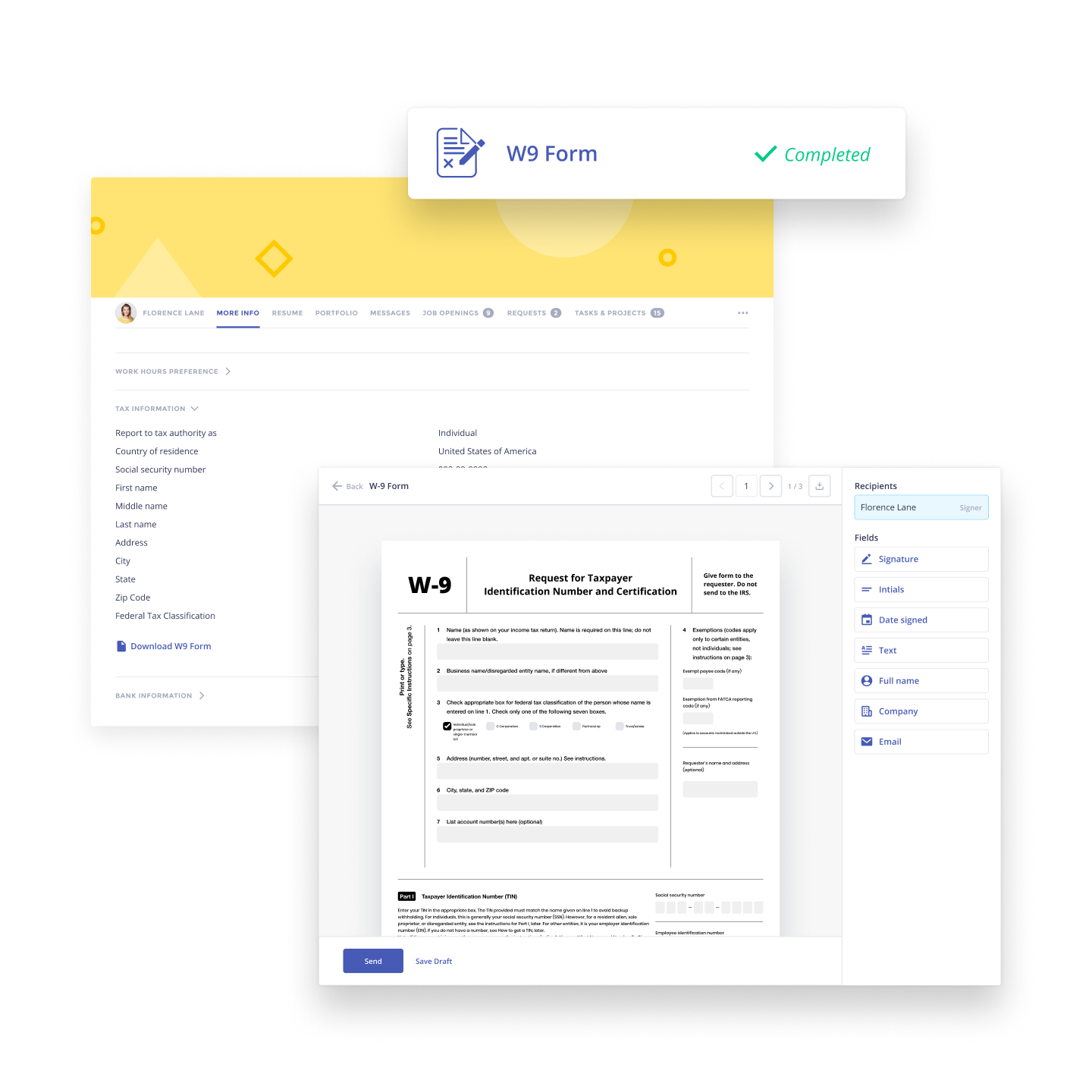

Collect Missing Information

Reduce your risk of IRS penalties. Worksuite ensures you can easily collect missing tax information and W9s from your contractors.

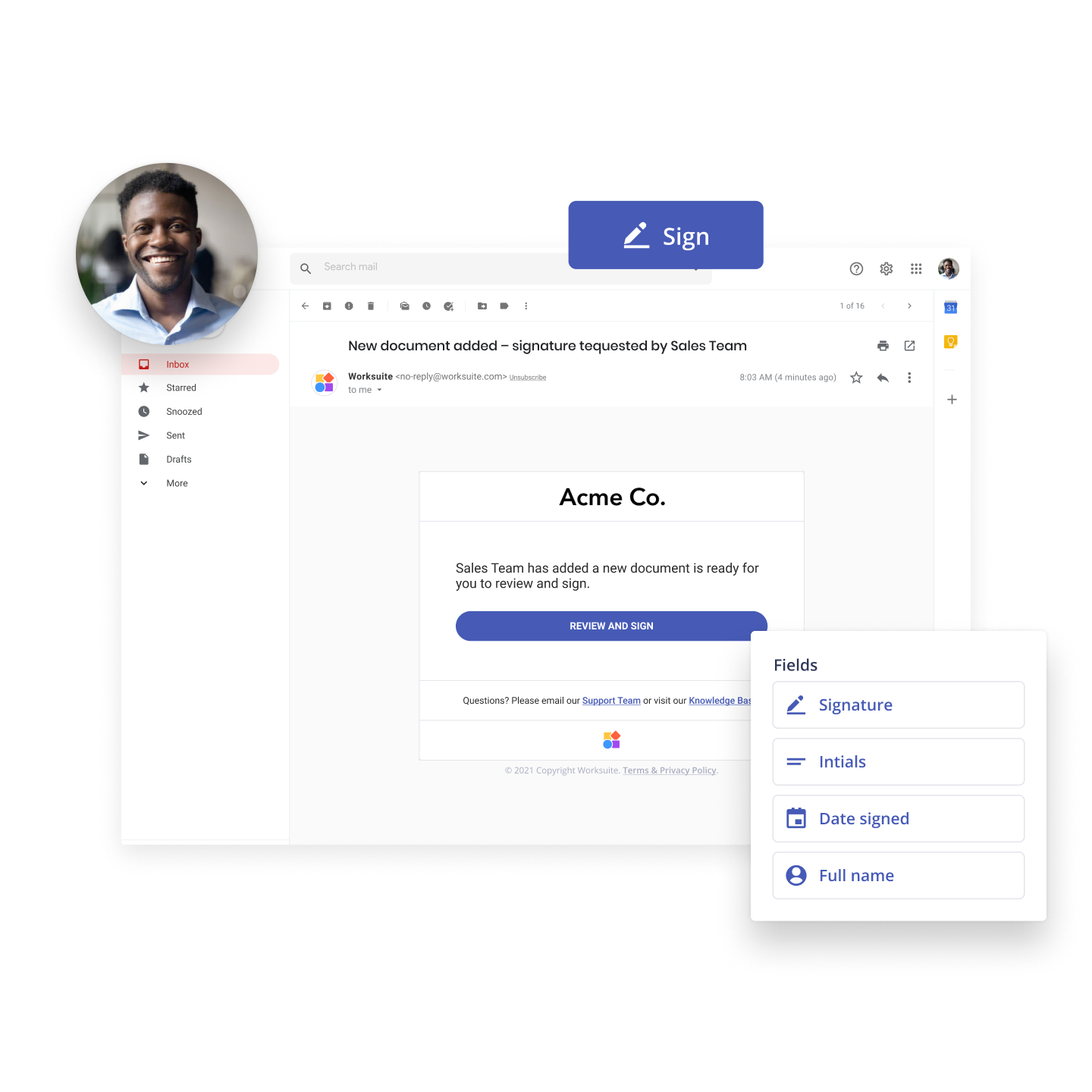

Mail And E-Deliver Forms

Enable automated physical or electronic delivery of tax forms to your freelancers.

IRS E-Filing

Worksuite ensures all your necessary tax forms are promptly filed with the IRS to avoid penalties.

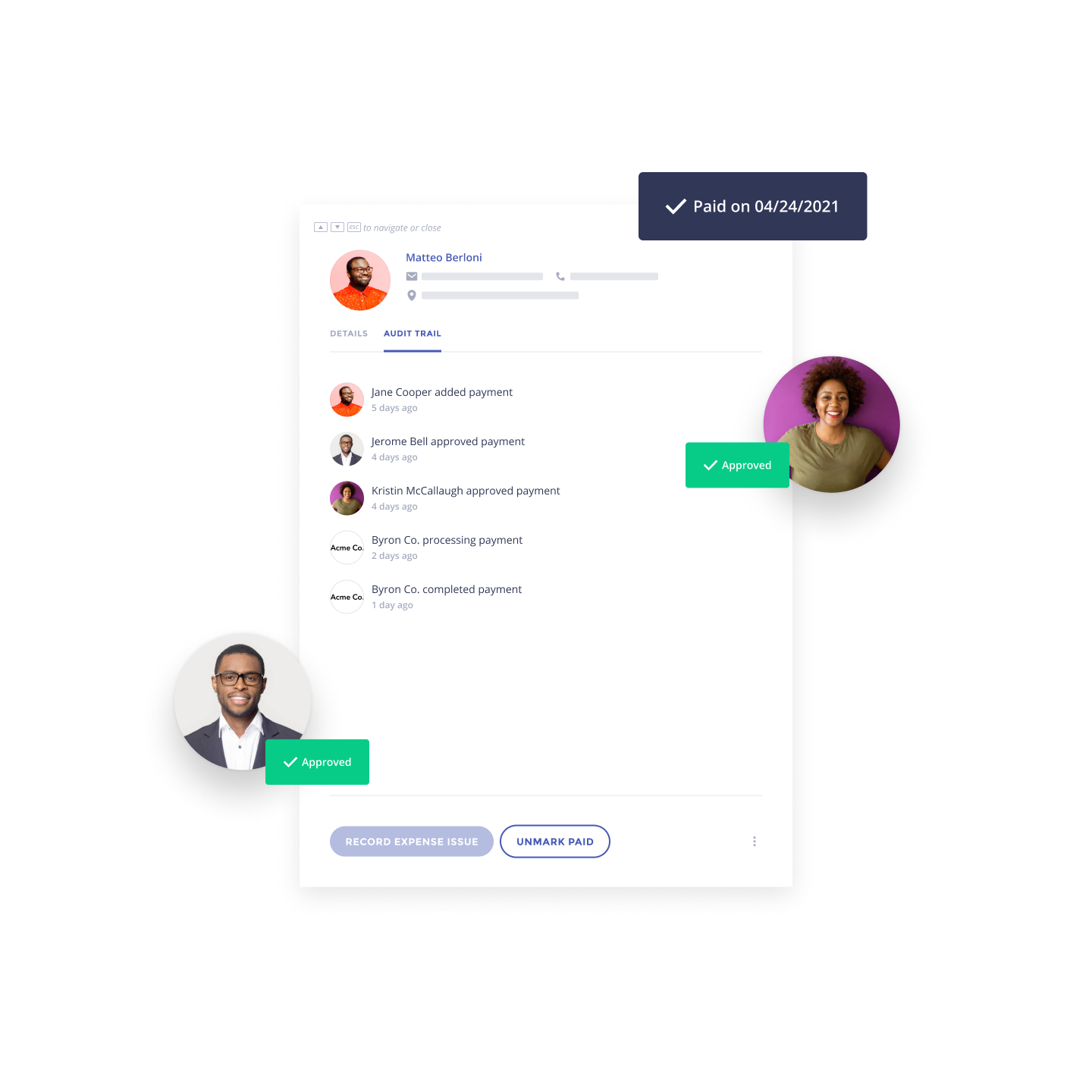

Accounting Trail

Track the progress of your tax forms – from delivering them to your contractors all the way through to successful e-filing with the IRS.

Ongoing Support

Need a little help with your tax forms? Our support team is here to guide you and your contractors smoothly through the 1099 process.

Explore More Business Solutions

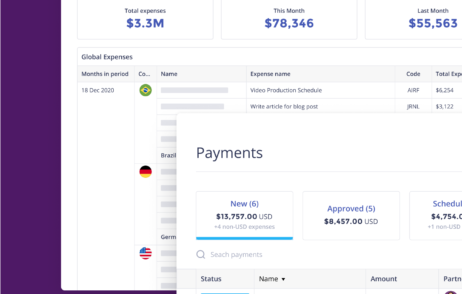

Global Payouts

Powerful, integrated solutions let you quickly approve, schedule, and pay your contractors at scale across [number] countries and [number] currencies.

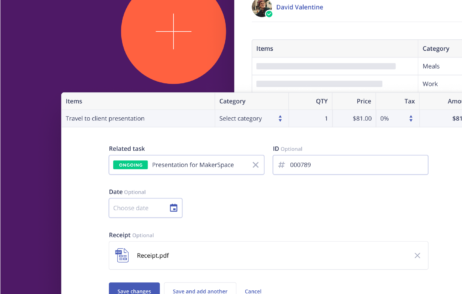

Invoice Management

Improve the user experience for your freelancers and your teams. Worksuite Pay gives you the flexibility to manage your invoices, get approvals, and track your budget.

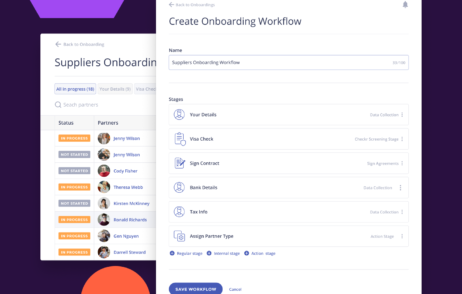

Onboarding & Compliance

Create customized onboarding workflows that ensure your contractors can set up profiles and complete your engagement process quickly and compliantly.