Compliantly Engage Contractors in Spain

Our workforce compliance guide to Spain covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Spain.

Local Time

Currency

Euro (EUR)Official Language(s)

SpanishPopulation

47.42 Million (2021)Economic Region

European UnionGDP

1427 Billion USD (2021)GDP Growth rate

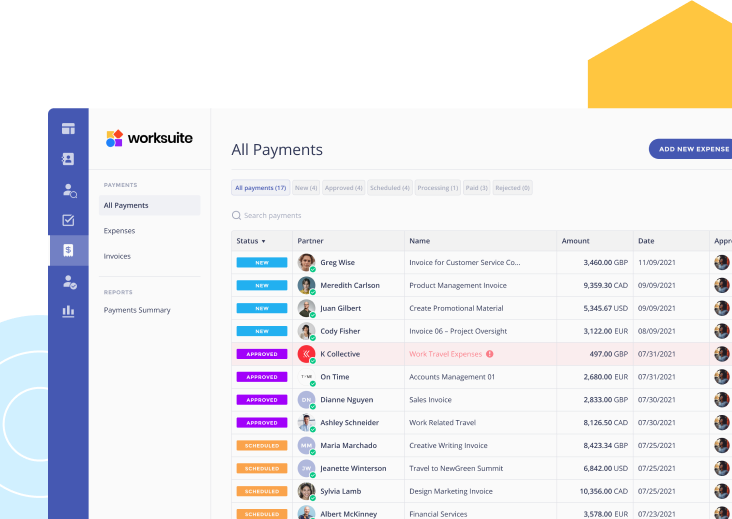

% ()Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Spain.

We work with the best legal partners in Spain to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with Spanish law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Independent Contractor Classification in Spain

Any business hiring in Spain should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties, including the payment of up to four years of missing social security contributions, may be imposed on businesses that are hiring contractors under the guise of employment.

In Spain, there is no clear definition of what constitutes employment. However, the Workers’ Statute (Estatuto de los Trabajadores) outlines the typical characteristics of employment and five key factors (dependence, alienation, personal nature of relationship, payment, and exclusivity and assiduity) that help to differentiate between employees and independent contractors. Understanding these distinctions is both challenging and critical to compliantly engaging workers in Spain.

It is important to work with a partner like Worksuite to ensure you have an engagement framework that properly classifies freelancers able to work as independent contractors. Alternatively, Worksuite can automatically alert you when freelance talent must be engaged directly as employees, or contractors on payroll.

Factors

Employee

Independent Contractor

Employment Laws

Employees in Spain benefit from strictly defined employment laws. These are outlined in the Workers’ Statute (Estatuto de los Trabajadores).

Independent contractors do not enjoy the same employment-related laws as employees. However, the 2007 Independent Contractors’ Law (Estatuto del Trabajo Autónomo) does apply specifically to self-employed workers.

Hiring Practice

A typical job in Spain is advertised in Spanish (94% of the population speaks Spanish). Candidates are shortlisted and interviewed, and then the successful applicant receives a formal offer. The formal employment contract must detail the job position, salary, benefits, probationary period, grounds for dismissal, and termination requirements.

Independent contractors in Spain must formally enter into a written or verbal contract for services with the principal (client). This contract outlines the work to be completed, the agreed fees, and the timescale in which the work must be done.

Tax Filing Documents

All employees in Spain must complete an annual tax return (Modelo 100) in their first year of employment. Beyond that, it is only necessary if the employee earns more than €12,000 in a year.

As well as the annual personal income tax form (Modelo 100), independent contractors must complete the Modelo 130 or Modelo 131 form every quarter.

A minority of independent contractors in Spain must also file the Modelo 840 form for business tax.

Payer's Tax Withholding & Reporting Requirements

Employers withhold their employees’ income tax (Impuesto de Renta sobre las Personas Físicas, or IRPF) and social security payments. They must make those payments to the Agencia Tributaria by the 20th of each month.

Payments to independent contractors in Spain are made without any deductions. The contractor is responsible for reporting their income and paying their own income tax, VAT, and social security contributions.

Companies hiring independent contractors in Spain must complete a Modelo 111 form quarterly and a Modelo 190 form annually.

Other Tax Filing Requirements

Employees with other sources of global income must declare that income on a Declaración de la Renta, which must be filed by 30 June each year.

Independent contractors in Spain must register for VAT (Impuesto de Valor Añadido, or IVA) and file both quarterly (Modelo 303) and annual (Modelo 390) VAT statements. Independent contractors must also register for Spanish business tax (Impuesto de Actividades Económicas, or IAE), even if they will not meet the minimum earnings threshold of €1m per annum

Remuneration

Employees are paid on an hourly or monthly basis.

Independent contractors charge a fixed fee and submit an invoice after the completion of the work.

Workers Rights

Employees in Spain have various rights enshrined in law under the Workers’ Statute (Estatuto de los Trabajadores), including:

- 22 business days of paid annual leave per year

- Ten public holidays per year

- Temporary disability benefit of at least 60% of their regular salary

- A minimum of 16 weeks of maternity leave (mother) and 16 days of paternity leave (father)

- Severance pay (if an employment agreement is terminated without notice)

- Maximum 40 hours as a standard working week

- Compulsory overtime payments

- Overtime hours capped at a maximum of 80 hours per year

Independent contractors do not enjoy the same employment-related laws as employees. However, workers identified as ‘economically dependent independent contractors’ under Spain’s 2007 Independent Contractors’ Law (Estatuto del Trabajo Autónomo) enjoy specific extra benefits, including:

- Formal written contracts

- Termination rules

- 18 working days’ holiday per year

Benefits

Employers must make contributions to the Social Security Fund (Tresorería General de la Seguridad Social or TGSS) equivalent to 29.9% of an employee’s salary. Employees must make contributions of 6.4% of their salary.

Independent contractors in Spain must contribute to a social security scheme designed exclusively for self-employed workers (régimen especial trabajadores autónomos). These contributions give self-employed workers access to Spain’s healthcare system and, after 15 years, a Spanish pension. Businesses hiring independent contractors do not make any social security contributions on the contractor’s behalf.

Independent contractors must seek private insurance policies if they wish to be protected in case of unemployment or work-related illness, and be entitled to accident benefits.

When Paid

Employees in Spain are paid monthly in arrears. Most companies in Spain make 14 payments in a year, with extra payments in July and December.

Independent contractors are paid once they have completed their task and submitted an invoice. Standard payment terms in Spain are 30 days, with a maximum of 60 days permitted under Spanish law. Late payment interest (European Central Bank rate, plus 8%), plus a late payment fee of €40, is automatically applied to any invoice not paid within the agreed deadline.

Employee

Employment Laws

Employees in Spain benefit from strictly defined employment laws. These are outlined in the Workers’ Statute (Estatuto de los Trabajadores).

Hiring Practice

A typical job in Spain is advertised in Spanish (94% of the population speaks Spanish). Candidates are shortlisted and interviewed, and then the successful applicant receives a formal offer. The formal employment contract must detail the job position, salary, benefits, probationary period, grounds for dismissal, and termination requirements.

Tax Filing Documents

All employees in Spain must complete an annual tax return (Modelo 100) in their first year of employment. Beyond that, it is only necessary if the employee earns more than €12,000 in a year.

Payer's Tax Withholding & Reporting Requirements

Employers withhold their employees’ income tax (Impuesto de Renta sobre las Personas Físicas, or IRPF) and social security payments. They must make those payments to the Agencia Tributaria by the 20th of each month.

Other Tax Filing Requirements

Employees with other sources of global income must declare that income on a Declaración de la Renta, which must be filed by 30 June each year.

Remuneration

Employees are paid on an hourly or monthly basis.

Workers Rights

Employees in Spain have various rights enshrined in law under the Workers’ Statute (Estatuto de los Trabajadores), including:

- 22 business days of paid annual leave per year

- Ten public holidays per year

- Temporary disability benefit of at least 60% of their regular salary

- A minimum of 16 weeks of maternity leave (mother) and 16 days of paternity leave (father)

- Severance pay (if an employment agreement is terminated without notice)

- Maximum 40 hours as a standard working week

- Compulsory overtime payments

- Overtime hours capped at a maximum of 80 hours per year

Benefits

Employers must make contributions to the Social Security Fund (Tresorería General de la Seguridad Social or TGSS) equivalent to 29.9% of an employee’s salary. Employees must make contributions of 6.4% of their salary.

When Paid

Employees in Spain are paid monthly in arrears. Most companies in Spain make 14 payments in a year, with extra payments in July and December.

Independent Contractor

Employment Laws

Independent contractors do not enjoy the same employment-related laws as employees. However, the 2007 Independent Contractors’ Law (Estatuto del Trabajo Autónomo) does apply specifically to self-employed workers.

Hiring Practice

Independent contractors in Spain must formally enter into a written or verbal contract for services with the principal (client). This contract outlines the work to be completed, the agreed fees, and the timescale in which the work must be done.

Tax Filing Documents

As well as the annual personal income tax form (Modelo 100), independent contractors must complete the Modelo 130 or Modelo 131 form every quarter.

A minority of independent contractors in Spain must also file the Modelo 840 form for business tax.

Payer's Tax Withholding & Reporting Requirements

Payments to independent contractors in Spain are made without any deductions. The contractor is responsible for reporting their income and paying their own income tax, VAT, and social security contributions.

Companies hiring independent contractors in Spain must complete a Modelo 111 form quarterly and a Modelo 190 form annually.

Other Tax Filing Requirements

Independent contractors in Spain must register for VAT (Impuesto de Valor Añadido, or IVA) and file both quarterly (Modelo 303) and annual (Modelo 390) VAT statements. Independent contractors must also register for Spanish business tax (Impuesto de Actividades Económicas, or IAE), even if they will not meet the minimum earnings threshold of €1m per annum

Remuneration

Independent contractors charge a fixed fee and submit an invoice after the completion of the work.

Workers Rights

Independent contractors do not enjoy the same employment-related laws as employees. However, workers identified as ‘economically dependent independent contractors’ under Spain’s 2007 Independent Contractors’ Law (Estatuto del Trabajo Autónomo) enjoy specific extra benefits, including:

- Formal written contracts

- Termination rules

- 18 working days’ holiday per year

Benefits

Independent contractors in Spain must contribute to a social security scheme designed exclusively for self-employed workers (régimen especial trabajadores autónomos). These contributions give self-employed workers access to Spain’s healthcare system and, after 15 years, a Spanish pension. Businesses hiring independent contractors do not make any social security contributions on the contractor’s behalf.

Independent contractors must seek private insurance policies if they wish to be protected in case of unemployment or work-related illness, and be entitled to accident benefits.

When Paid

Independent contractors are paid once they have completed their task and submitted an invoice. Standard payment terms in Spain are 30 days, with a maximum of 60 days permitted under Spanish law. Late payment interest (European Central Bank rate, plus 8%), plus a late payment fee of €40, is automatically applied to any invoice not paid within the agreed deadline.

Who classifies as Independent Contractor in Spain

Self-employment as an independent contractor is a popular income model for many individuals. However, Spanish law does not definitively identify what constitutes an employment contract. The Workers’ Statute (Estatuto de los Trabajadores) is the closest thing to a formal guide. It gives employment a “statutory assumption” status, with independent contractors having to clearly show their status (through separate contracts) to avoid being assumed to be employees.

In Spain, independent contractors are self-employed workers who operate outside of the traditional system whereby salaries or wages are directly withheld by the employer. Because their income is received from invoicing their clients, rather than in the form of a salary or wage, all independent contractors must file their own individual tax income returns, register for VAT, and make their own social security contributions. Spanish courts have developed five factors that help to determine whether a worker is an employee or a contractor.

- Dependence. Does the worker operate within the organization and receive direct instructions, and ongoing monitoring, from a superior? A typical measure of this might be if the worker is subject to the company’s disciplinary procedures. If so, they are likely to be an employee rather than an independent contractor. Other factors include whether the worker is subject to a timetable imposed by the company, and whether the worker operates their financial and contractual relationship with the company through their own business.

- Alienation. Does the worker retain ownership of the outcome of their work? If not, they are likely to be an employee. If the worker is exempt from risk, they are also likely to be an employee. This can be demonstrated by the employer assuming labor costs and incorporating assets produced by the employee into the business, and workers not being exposed to any kind of economic risk by completing their work.

- The personal nature of the relationship. If the worker was only hired because of their specific skills, and cannot be easily replaced or exchanged, then they are likely to be an employee.

- Payment. Does the worker receive a set and regular salary? If so, they are likely to be an employee. Independent contractors are paid one-off fees by their clients.

- Exclusivity and assiduity. If a worker has been engaged exclusively with a single company for a prolonged period, and a master/subordinate relationship exists, they are likely to be classed as an employee. In contrast, an independent contractor maintains a level of distance between them and the company that uses their services, and can make a profit or a loss during the process of completing their work.

Contracting Models in Spain

Independent contractors in Spain work under one of two main categories: sole trader or limited company.

- Sole trader: Independent contractors operating as sole traders (autonomos) can quickly begin to accept work as an independent contractor. Sole traders must register for VAT (Impuesto de Valor Añadido, or IVA) and file annual VAT and income tax returns. They must also make social security contributions.

- Limited company: Independent contractors can set up a company by incorporating it with the Mercantile Registry (Registro Mercantil Central, or RMC). This process costs €3,000. As well as VAT and income tax returns, limited companies must also file a corporation tax (impuesto de sociedades) return.

Engagement Models

There are two primary engagement models for working with independent contractors in Spain:

A. Direct engagement of the independent contractor, either under their personal name (if operating as a sole trader or autonomo) or under the company’s name (if operating as a limited company). Under these arrangements, the contractor agrees to provide a set service for a specified fee. They invoice the client when the work is complete and normally receive payment within 30 days.

B. Umbrella company. A contractor can also be hired through an umbrella company, which formally acts as the contractor’s employer. The client pays the umbrella company for the completed work, and the umbrella company deducts its fees and any necessary tax and social security deductions before paying the contractor.

Contractor Payments

In the vast majority of cases, independent contractors in Spain are paid directly (without deductions) once they have completed their work and issued a relevant invoice. The fee is fixed in the agreed contract between the two parties. Standard payment terms in Spain are typically 30 days, stretching to a maximum of 60 days. Late payment interest and penalty fees are automatically due if an invoice is not paid within the specified deadline.

Taxes and social security

Independent contractors hired on a direct engagement are not on a company’s payroll. Their fees are paid without any deductions at source towards tax or other benefits. In Spain, the responsibility for reporting and paying taxes, and for making social security contributions, lies entirely with the independent contractor.

Independent contractors must file an annual personal income tax form (Modelo 100) and register for VAT (Impuesto de Valor Añadido, or IVA). If the contractor operates through a limited company, they are also responsible for filing a corporation tax (impuesto de sociedades) return.

Finally, independent contractors must also register for Spanish business tax (Impuesto de Actividades Económicas, or IAE), even if they will not meet the minimum earnings threshold of €1m per annum.

Employment in Spain

We can simplify hiring full-time workers in Spain by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Spain without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Spain?

Look no further.

Talk to an Expert