Compliantly Engage Contractors in Germany

Our workforce compliance guide to Germany covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Germany.

Local Time

Currency

Euro (EUR)Official Language(s)

GermanPopulation

83 Million (2019)Economic Region

European UnionGDP

3806 Billion USD (2020)GDP Growth rate

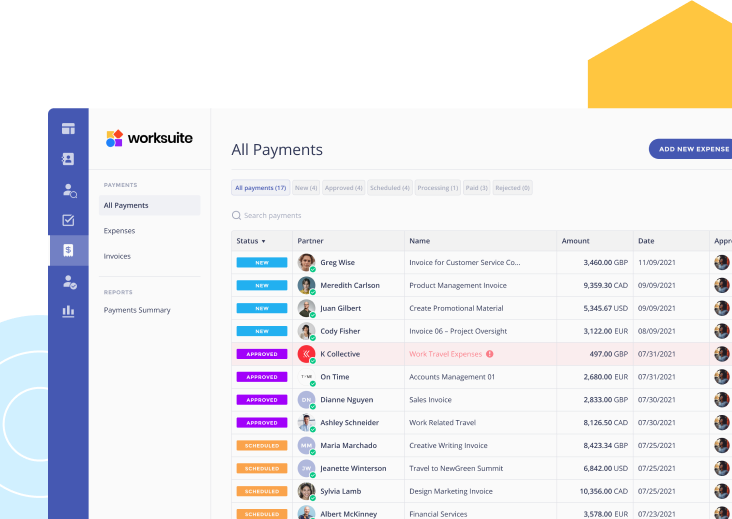

-4.9% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Germany.

We work with the best legal partners in Germany to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with the German law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Germany

Any business hiring in Germany should understand the important legal distinction between who is classified as an employee, and who can be engaged as an independent contractor. Fines or penalties may be issued to businesses who are hiring employees under the guise of independent contractors or freelancers.

In Germany, merely describing an individual as an independent contractor has no legal significance. Instead, various factors are taken into account to determine the true legal status of the individual. Therefore, understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Germany.

It is important to work with a partner like Worksuite to ensure that you have an engagement framework that properly classifies freelancers able to work as independent contractors. Alternatively, Worksuite can automatically alert you when freelance talent must be engaged directly as employees, or contractors on payroll.

Factors

Employee

Independent Contractor

Employment Laws

German Civil Code, German Commercial Code (Handelsgesetzbuch, or ‘HGB’). Case law (rulings by labor courts and administrative courts). Various employment acts (including German Act on Continued Remuneration; German Act on Protection Against Unfair Dismissal).

Hiring Practice

Candidates are typically required to submit a CV, cover letter, copies of references and relevant certificates, and often also a photo. Once a decision has been made, the employer must deliver a formal job offer in writing to the individual. Once the individual has been offered and has accepted the job, the employer must acquire the individual’s personal information such as date of birth, national identification (e.g. passport), proof of address.

The German Civil Code and other aspects of labor law do not precisely govern the practices for engaging independent contractors.

The most common independent contractor operating models are:

- Freelancer (Freiberufler or Freier Mitarbeiter – see below)

- Business enterprise

Tax Filing Documents

Employees pay their income tax (Lohnsteuer), health insurance, and other social security contributions directly from their salary payments via PAYE (pay-as-you-earn). Employees do not need to file their own tax returns.

Employee’s tax documents include: Est 1 V (personal information); Anlage N (income); Anlage vorsorgeaufwand (insurance details).

Independent contractors must file their own tax returns at the end of each year. This can be done via the official ELSTER (Elektronische Steuererklärung) service or by using a tax software tool.

Independent contractors filing documents include: Statement of annual income; ID number: bank account details; details of child benefits; proof of any income earned outside Germany.

Payer Tax Filing Requirements

Employers are required to withhold employees’ income tax (Lohnsteuer), health insurance, and social security contributions at time of payment to the employee. This occurs through the PAYE system.

Hiring companies do not withhold any of the independent contractor’s payment for tax purposes or social security contributions.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Independent contractors submit an invoice on a periodic basis, typically monthly.

Worker’s Rights

Employment rights include statutory paid annual leave; statutory paid public holidays; statutory paid sick leave; national statutory minimum wage; statutory notice period; emergency time off work; maximum hours per week (unless the employee opts out), mandatory enrollment in a pension scheme; minimum notice period of dismissal, statutory redundancy pay; protection against discrimination.

Employees are protected against dismissal by the German Act on Protection Against Unfair Dismissal. Special protections are also given to particular groups of employees, such as pregnant employees.

Beyond a contractual notice period, independent contractors have no protection against termination without cause. Hiring companies can generally terminate an independent contractor without giving a reason. Independent contractors also lack health and safety protections and do not fall under the working time regulations.

Benefits

All employee benefits are paid by the employer. Employees make mandatory contributions to the pension, healthcare, unemployment, and nursing home schemes, but employers pay half the costs.

Independent contractors do not receive any employee benefits from their clients. However, some small compensations may be provided under limited circumstances.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. The schedule of payments is not subject to variation.

Contractors send an invoice (or other form of payment request), and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most cases.

Employee

Employment Laws

German Civil Code, German Commercial Code (Handelsgesetzbuch, or ‘HGB’). Case law (rulings by labor courts and administrative courts). Various employment acts (including German Act on Continued Remuneration; German Act on Protection Against Unfair Dismissal).

Hiring Practice

Candidates are typically required to submit a CV, cover letter, copies of references and relevant certificates, and often also a photo. Once a decision has been made, the employer must deliver a formal job offer in writing to the individual. Once the individual has been offered and has accepted the job, the employer must acquire the individual’s personal information such as date of birth, national identification (e.g. passport), proof of address.

Tax Filing Documents

Employees pay their income tax (Lohnsteuer), health insurance, and other social security contributions directly from their salary payments via PAYE (pay-as-you-earn). Employees do not need to file their own tax returns.

Employee’s tax documents include: Est 1 V (personal information); Anlage N (income); Anlage vorsorgeaufwand (insurance details).

Payer Tax Filing Requirements

Employers are required to withhold employees’ income tax (Lohnsteuer), health insurance, and social security contributions at time of payment to the employee. This occurs through the PAYE system.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Worker’s Rights

Employment rights include statutory paid annual leave; statutory paid public holidays; statutory paid sick leave; national statutory minimum wage; statutory notice period; emergency time off work; maximum hours per week (unless the employee opts out), mandatory enrollment in a pension scheme; minimum notice period of dismissal, statutory redundancy pay; protection against discrimination.

Employees are protected against dismissal by the German Act on Protection Against Unfair Dismissal. Special protections are also given to particular groups of employees, such as pregnant employees.

Benefits

All employee benefits are paid by the employer. Employees make mandatory contributions to the pension, healthcare, unemployment, and nursing home schemes, but employers pay half the costs.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. The schedule of payments is not subject to variation.

Independent Contractor

Employment Laws

Hiring Practice

The German Civil Code and other aspects of labor law do not precisely govern the practices for engaging independent contractors.

The most common independent contractor operating models are:

- Freelancer (Freiberufler or Freier Mitarbeiter – see below)

- Business enterprise

Tax Filing Documents

Independent contractors must file their own tax returns at the end of each year. This can be done via the official ELSTER (Elektronische Steuererklärung) service or by using a tax software tool.

Independent contractors filing documents include: Statement of annual income; ID number: bank account details; details of child benefits; proof of any income earned outside Germany.

Payer Tax Filing Requirements

Hiring companies do not withhold any of the independent contractor’s payment for tax purposes or social security contributions.

Remuneration

Independent contractors submit an invoice on a periodic basis, typically monthly.

Worker’s Rights

Beyond a contractual notice period, independent contractors have no protection against termination without cause. Hiring companies can generally terminate an independent contractor without giving a reason. Independent contractors also lack health and safety protections and do not fall under the working time regulations.

Benefits

Independent contractors do not receive any employee benefits from their clients. However, some small compensations may be provided under limited circumstances.

When Paid

Contractors send an invoice (or other form of payment request), and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most cases.

Who classifies as an Independent Contractor in Germany?

In Germany, the primary criteria for distinguishing between an employee and an independent contractor is whether the individual is overly dependent on the hiring company. This applies to both direction and control of the services being provided and whether the contribution of a single client’s compensation is a dominant portion of the independent contractor’s overall income. This can involve a full assessment of personal dependency and economic dependency.

In practice, individuals are generally considered to be independent contractors if they:

- They can determine their own time and place of work.

- Do not need to notify, nor request permission from, the hiring company regarding periods of absence (e.g., holidays).

- Provide their own equipment (or most of their own equipment) and are not dependent on the hiring company’s resources.

- Receive payment for specific works or tasks completed rather than a fixed salary.

- Are not obliged to attend regular company meetings (such as team meetings or training sessions).

- Have a right to substitute someone else to perform the work (e.g. an employee of the independent contractor or a subcontractor).

- Work for (or have a right to work for) other clients at the same time.

- Openly advertise their services in the marketplace.

- Do not possess an email address, phone number, or business cards that are branded by the client company

Contracting Models

In Germany, individuals who work as independent contractors generally operate under one of three categories: a Gewerbetreibender (business enterprise); a Freiberufler (professional freelancer); or a Freier Mitarbeiter (contract freelancer). The latter two are often both called ‘freelancers’, although there are differences (see below). The German tax office ultimately decides which status an independent contractor falls under.

- Freelancer / Freiberufler: Individuals operating under this status are considered to be freelancers working in ‘liberal professions’. They provide professional services on a self-employed basis, they take responsibility over their own work, and they tend to run a professional firm or practice. These freelancers generally provide services that require significant professional knowledge and expertise (including medical and financial consulting), and they are required to possess at least a university degree to qualify for this status.

- Freelancer / Freier Mitarbeiter. Individuals operating under this status are also freelancers, but they are typically hired for a specific period of time and/or for a specific project.

- Business enterprise: This is not defined in German law. However, it is generally considered to include independent contractors who do not fall into the ‘freelancer’ category and also do not operate in the agricultural or forestry sectors.

Engagement Models

There are two primary engagement models for working with independent contractors in Germany:

A. Direct engagement of the worker as self-employed or registered via their own limited company. To facilitate direct engagements there are two general types of contracts to use with independent contractors: using a work contract (Werkvertrag) or a service contract (Dienstvertrag)

- Work Contract (Werkvertrag): Under a work contract, the contractor is required to deliver a piece of work or certain outcome in exchange for a one-off fixed remuneration. Each contract relates to the delivery of a single ‘work’. The contractor bears the risk under this contract and is obliged to fix any errors or other defects until the contractual specifications of the work are achieved.

- Service Contract (Dienstvertrag): Through a service contract, the contractor provides services to the client during a defined period of time and under certain conditions – all of which are detailed in the contract. The contractor bears no risk if the services provided do not ultimately achieve what the client had wanted, so long as the services meet the requirements of the contract.

B. Umbrella company. These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Staffing agency: Here, the hiring company engages with a staffing agency or umbrella company, which has an AUG (Arbeitsnehmerüberlassung) license to supply its own contractors to deliver the contracted services or engage pre-identified workers on their client’s behalf. The hiring company pays the staffing agency directly, in accordance with the terms of the contract with the agency. The agency will pay the independent contractor through a separate contractual arrangement. Under this model, the contract is between the hiring company and the staffing agency.

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Taxes

In Germany, independent contractors must pay tax on all income above €9,984 (for the 2022/23 tax year). Independent contractors manage their own tax payments to the official ELSTER (Elektronische Steuererklärung) service or by using a tax software tool. Contractors might also need to pay Value Added Tax (VAT) and local trade tax. To pay their income tax and be able to issue invoices, contractors need to register with the German tax office (Finanzamt) for both an Identifikationsnummer (tax ID number) and a Steuernummer (a unique ID number for freelancers).

Social security

In Germany, independent contractors need to obtain their own social security provisions, including health insurance (Krankenversicherung). Independent contractors who do not have their own employees are required to make contributions to the national statutory pension scheme (Rentenversicherung). Clients of independent contractors are not required to withhold or pay into social security on behalf of the independent contractor.

Employment in Germany

We can simplify hiring full-time workers in Germany by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Germany without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Germany

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Germany?

Look no further.

Talk to an Expert