Compliantly Engage Contractors in the United Kingdom

Our workforce compliance guide to the United Kingdom covers everything you need to compliantly hire, onboard, manage and pay independent contractors in the UK.

Local Time

Currency

Pound Sterling (GBP)Official Language(s)

EnglishPopulation

66.9 Million (2022)GDP

2708 Billion USD (2020)GDP Growth rate

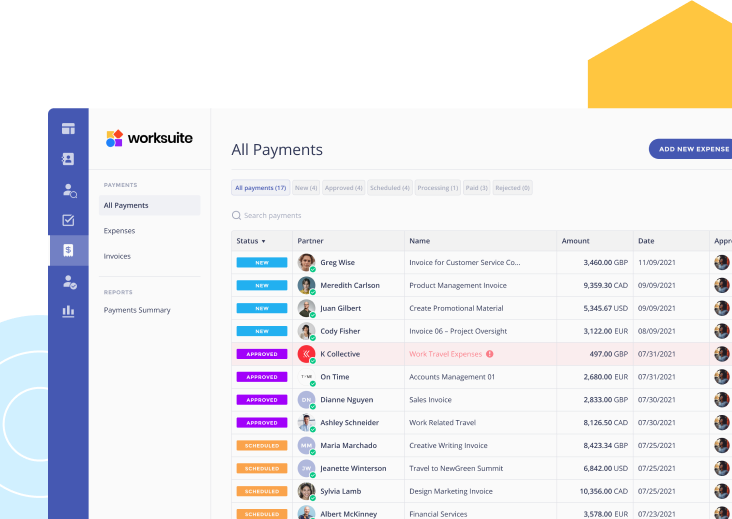

7.5% (2021)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in the United Kingdom.

We work with the best legal partners in the United Kingdom to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with the UK law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

October 2022 Update

The United Kingdom government is undergoing leadership change that is widely expected to impact the tax policies of the HMRC (Her Majesty’s Revenue & Commission). As described in greater detail below, the primary tax legislation impacting engagement of freelancers in the UK is known as IR35. The current version of the IR35 rules, which went into effect April of 2021, have been the subject of much discussion and political positioning by PM candidates. It is widely expected that the latest premiership will pursue some form of legislative change to IR35, ranging from a potential repeal to a major rewrite of the legislation.

Worksuite recognizes the impact this political uncertainty in the UK has on our customers and the UK-based talent communities they entrust to our platform. When new rules or laws go into effect, whether it be in the UK or any of the 150+ countries we support, Worksuite customers can rest assured our compliance products and services will be up-to-date, providing you the protection and confidence you need to engage talent anywhere.

Contractor Classification in the UK

Any business hiring in the UK should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses hiring contractors under the guise of employment.

Understanding the distinctions between employees and independent contractors (or self-employed workers) is critical to compliantly engaging workers in the UK. It is essential to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies freelancers as independent contractors for you and lets you know when freelance talent must be engaged as a payrolled contractor or employed directly.

In the UK there are multiple sources of employment law that cover both employees and independent contractors. UK employment law may also vary slightly between its four geographical zones of Great Britain (England, Scotland, Wales) and Northern Ireland.

Factors

Employee

Independent Contractor

Employment Laws

In Great Britain (England, Scotland, Wales), this is governed by the Westminster Government in England through the Department for Work and Pension (DWP), along with various employment laws within Acts of Parliament (such as the Employment Rights Act 1996, the National Minimum Wage Act 1998, and the Working Time Regulations 1998), regulations, common law, and case law. In Northern Ireland, employment law is governed by the Northern Ireland Assembly, although there is significant alignment with British employment law.

Independent contractors are not defined in UK law, and so there is a reliance upon case law (precedence).

Hiring Practice

The individual must submit their CV (or resumé) to the employer, and some employers will also ask the individual to provide references. Once a decision has been made, the employer must deliver a formal job offer in writing to the individual. Once the individual has been offered and has accepted the job, the employer must acquire the individual’s personal information such as date of birth, proof of right to work in the UK, national identification (e.g. passport), proof of address, national insurance number, and most recent P45 (see below).

Contractors can be hired directly or via a third party, such as a staffing agency. Contractors may be found via word-of-mouth, jobs boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The key contractor operating models are:

- Sole trader

- Personal Services Company (LLC or PLC)

Tax Filing Documents

Employees receive a P60 form from their employer at the end of each tax year (6 April to 5 April), and a P45 form upon the termination of employment.

Employees are not required to submit any tax forms in relation to their income earned via employment. However, they will need to include some details from these forms as part of any tax self-assessments for additional self-employed work.

Tax codes and national insurance (NI) numbers are issued by Her Majesty’s Revenue and Customs (HMRC).

Contractors must file their own tax returns by registering for HMRC’s Self-Assessment process. They may also need to register for Value Added Tax (VAT)

Payer Tax Filing Requirements

Employers must obtain new employees’ most recent P45 form. If the employee does not have a P45 form available, employers can use HMRC’s New Starter Checklist form.

Employers are required to withhold employees’ tax and national insurance at the time of payment to the employee. This occurs through the PAYE payroll scheme. Employers report end-of-year expenses paid to each employee via a P11D form or using HMRC’s PAYE Online service.

Employers must give all employees a P60 form at the end of the tax year. Most businesses generate these forms using payroll software. Alternatively, HMRC’s Basic PAYE Tools can be used to generate the forms.

Hiring companies do not withhold any of the contractor’s payment for tax purposes.

Changes to the IR35 tax law (April 2021) place more responsibilities on hiring companies to determine the contractor’s employment status. This can be done using HMRC’s Check Employment Status for Tax (CEST) tool.

If the hiring company is classed as a small business, the contractor can be considered a subcontractor to the hiring company. However, if the hiring company is a medium or large business, the company must perform the IR35 assessment and generate an employment status statement before hiring the contractor.

Other Tax Filing Requirements

Upon termination of employment, the employer must issue the employee with a P45 form, which shows how much tax the employee has paid in the current tax year (6 April to 5 April). Employees must issue a P45 by law.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Contractors operating as a business typically submit an invoice every month. Contractors operating without a business (i.e., as a sole trader) may be paid via any preferred method, and often require a payment receipt.

The hiring company and contractor may also negotiate a payment structure, including any up-front payment, partial payments, and a final payment upon completion of the work.

Worker’s Rights

Employment rights include National Minimum Wage (NMW), Statutory Sick Pay, Statutory Redundancy Pay, maternity/paternity pay and leave, parental pay and leave, notice periods, flexible working, emergency time off work, rest breaks and nights off, maximum hours per week (unless the employee opts out), automatic enrollment in a pension scheme, request for flexible working, a minimum notice period of dismissal, and statutory redundancy pay.

Contractors do not have standard employees’ rights. However, they have rights regarding health and safety, and protection against unfair discrimination.

Benefits

The employer pays all employee benefits.

Contractors’ benefits are governed by the content of the contract.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due.

Contractors send an invoice (or another form of payment request), and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most cases.

Employee

Employment Laws

In Great Britain (England, Scotland, Wales), this is governed by the Westminster Government in England through the Department for Work and Pension (DWP), along with various employment laws within Acts of Parliament (such as the Employment Rights Act 1996, the National Minimum Wage Act 1998, and the Working Time Regulations 1998), regulations, common law, and case law. In Northern Ireland, employment law is governed by the Northern Ireland Assembly, although there is significant alignment with British employment law.

Hiring Practice

The individual must submit their CV (or resumé) to the employer, and some employers will also ask the individual to provide references. Once a decision has been made, the employer must deliver a formal job offer in writing to the individual. Once the individual has been offered and has accepted the job, the employer must acquire the individual’s personal information such as date of birth, proof of right to work in the UK, national identification (e.g. passport), proof of address, national insurance number, and most recent P45 (see below).

Tax Filing Documents

Employees receive a P60 form from their employer at the end of each tax year (6 April to 5 April), and a P45 form upon the termination of employment.

Employees are not required to submit any tax forms in relation to their income earned via employment. However, they will need to include some details from these forms as part of any tax self-assessments for additional self-employed work.

Tax codes and national insurance (NI) numbers are issued by Her Majesty’s Revenue and Customs (HMRC).

Payer Tax Filing Requirements

Employers must obtain new employees’ most recent P45 form. If the employee does not have a P45 form available, employers can use HMRC’s New Starter Checklist form.

Employers are required to withhold employees’ tax and national insurance at the time of payment to the employee. This occurs through the PAYE payroll scheme. Employers report end-of-year expenses paid to each employee via a P11D form or using HMRC’s PAYE Online service.

Employers must give all employees a P60 form at the end of the tax year. Most businesses generate these forms using payroll software. Alternatively, HMRC’s Basic PAYE Tools can be used to generate the forms.

Other Tax Filing Requirements

Upon termination of employment, the employer must issue the employee with a P45 form, which shows how much tax the employee has paid in the current tax year (6 April to 5 April). Employees must issue a P45 by law.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Worker’s Rights

Employment rights include National Minimum Wage (NMW), Statutory Sick Pay, Statutory Redundancy Pay, maternity/paternity pay and leave, parental pay and leave, notice periods, flexible working, emergency time off work, rest breaks and nights off, maximum hours per week (unless the employee opts out), automatic enrollment in a pension scheme, request for flexible working, a minimum notice period of dismissal, and statutory redundancy pay.

Benefits

The employer pays all employee benefits.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due.

Independent Contractor

Employment Laws

Independent contractors are not defined in UK law, and so there is a reliance upon case law (precedence).

Hiring Practice

Contractors can be hired directly or via a third party, such as a staffing agency. Contractors may be found via word-of-mouth, jobs boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The key contractor operating models are:

- Sole trader

- Personal Services Company (LLC or PLC)

Tax Filing Documents

Contractors must file their own tax returns by registering for HMRC’s Self-Assessment process. They may also need to register for Value Added Tax (VAT)

Payer Tax Filing Requirements

Hiring companies do not withhold any of the contractor’s payment for tax purposes.

Changes to the IR35 tax law (April 2021) place more responsibilities on hiring companies to determine the contractor’s employment status. This can be done using HMRC’s Check Employment Status for Tax (CEST) tool.

If the hiring company is classed as a small business, the contractor can be considered a subcontractor to the hiring company. However, if the hiring company is a medium or large business, the company must perform the IR35 assessment and generate an employment status statement before hiring the contractor.

Other Tax Filing Requirements

Remuneration

Contractors operating as a business typically submit an invoice every month. Contractors operating without a business (i.e., as a sole trader) may be paid via any preferred method, and often require a payment receipt.

The hiring company and contractor may also negotiate a payment structure, including any up-front payment, partial payments, and a final payment upon completion of the work.

Worker’s Rights

Contractors do not have standard employees’ rights. However, they have rights regarding health and safety, and protection against unfair discrimination.

Benefits

Contractors’ benefits are governed by the content of the contract.

When Paid

Contractors send an invoice (or another form of payment request), and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most cases.

Who classifies as an Independent Contractor in the UK?

In the UK, an individual is classified as an independent contractor or an employee based on the reality of the relationship between the individual and the hiring company. There is no single body of law in the UK that specifies this distinction. Instead, multiple factors are considered. Individuals are generally considered to be independent contractors if they:

- Are described as a contractor in the contract itself.

- Can be (or are expected to be) dismissed once the contracted work is complete.

- Can refuse to perform a task (unless that task is part of their contract).

- Are paid for a specific project or task, rather than on a recurring basis.

- Are not entitled to a minimum amount of work or a minimum amount of pay.

- Are not listed on the hiring company’s normal payroll.

- Are subject to relatively little control by the hiring company, such as when, where, and how they complete their tasks.

- Are not performing a core business function or operation.

- Have a right to substitute another contractor to perform the work (such as a subcontractor or the individual’s own employee).

- Have a right to work for another client or competitor at the same time (so long as this is not prohibited by the contract or an NDA).

- Are not entitled to benefits (sick leave, maternity/paternity leave, etc).

- Do not have their income tax withheld from their payment; they file their own tax returns.

Sole traders and PSCs: In the UK, independent contractors typically either operate as a self-employed “sole trader” or they create a “personal services company” (PSC) such as a limited liability partnership (LLP) or public limited company (PLC). For companies looking to hire an independent contractor, hiring an individual who is working as a “sole trader” can be risky, as it is possible the relationship may become an employer-employee relationship, which places additional financial and legal obligations on the employer. Instead, it can be less risky to work with an individual who is operating as a PSC.

What is IR35?

IR35 rules (named after an Inland Revenue (IR) press release from 1999) were introduced to prevent contractors from working “off payroll” as a way of avoiding tax and national insurance contributions. IR35 tries to ensure that when contractors are effectively working in the same manner as employees, those contractors pay the same national insurance and income tax contributions as employees.

IR35 rules apply when a contractor provides services to a client via an ‘intermediary’, such as their own company, a partnership, or a personal service company (PSC). The IR35 rules were originally introduced in April 2000, but changes in April 2021 placed greater responsibility on medium and large-sized companies (along with public sector organisations) to assess the contractor’s employment status.

There are several aspects of IR35 that are worth noting:

‘Inside’ vs ‘Outside’ IR35: A contractor can be ‘inside’ or ‘outside’ IR35. Being ‘inside’ IR35 means the contractor is working within the remit of the powers of IR35. In short, the contractor is subject to the same income tax and national insurance contributions as if they were an employee. If a contractor is assessed as being ‘inside’ IR35, they may also be able to benefit from employee rights. Being ‘outside’ IR35 means the IR35 rules do not apply. The contractor can pay themselves a salary, plus further dividends which are exempt from national insurance contributions.

A contractor who is ‘inside’ IR35 will typically:

- Not have their own professional business identity or branding

- Be paid on a regular schedule, not on a per-project or task basis

- Receive employee benefits (such as sick pay)

- Use the client’s equipment, rather than their own

- Work at the client’s site, rather than their premises

- Work for a single client for a long period, rather than multiple clients in parallel

- Personally carry out and deliver the contracted work/tasks, rather than substituting another person (e.g., a subcontractor) to perform the work

- Be closely supervised by the client, with little control over when or how the work is performed

- Not expend any personal costs to fix or correct faulty or subpar work

Check Employment Status for Tax (CEST): The CEST tool provided by HMRC allows a hiring company (or a contractor themself) to perform an employment status assessment. The tool can be used to understand (a) if the IR35 rules apply to a contract, and (b) if a particular piece of work is classed as employment or self-employment. The tool runs through a series of questions, whereby each response affects the subsequent questions that are asked. The questions can include (as of April 2022):

- Has the worker ever sent a substitute to do this work?

- Does your organisation have the right to move the worker from the task they originally agreed to do?

- Does your organisation have the right to decide how the work is done?

- Does your organisation have the right to decide the worker’s working hours?

- Will the worker have to buy equipment before your organisation pays them?

- How will the worker be paid for this work?

- If your organisation was not happy with the work, would the worker have to put it right?

- Will you provide the worker with paid-for corporate benefits?

IR35 rules apply to an individual contract. This means that a contractor may undertake some contracts that are ‘inside’ IR35 and some contracts that are ‘outside’ IR35.

Engagement models

There are two primary engagement models for working with independent contractors in the UK.

A. Direct engagement

Direct engagement of the worker as self-employed or registered via their own limited company. To facilitate direct engagements, there are two general types of contracts to use with independent contractors:

- Work Contract. Under a work contract, the contractor is required to deliver a piece of work or a certain outcome in exchange for a one-off fixed remuneration. Each contract relates to the delivery of a single ‘work’. The contractor bears the risk under this contract and is obliged to fix any errors or other defects until the contractual specifications of the work are achieved.

- Service Contract. Through a service contract, the contractor provides services to the client during a defined period of time and under certain conditions – all of which are detailed in the contract. The contractor bears no risk if the services provided do not ultimately achieve what the client had wanted, so long as the services meet the requirements of the contract.

B. Umbrella company

These firms come in two forms, and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

The contractual relationship is between the umbrella company and the client, with the umbrella company running payroll and administration for the contractor. The umbrella company invoices the client directly while paying the contractor via PAYE as a standard employee. Umbrella companies levy a fee on the contractor to cover their costs.

- Staffing agency. Here, the hiring company engages with a staffing agency, which in turn supplies one of its own contractors to deliver the contracted services. The hiring company pays the staffing agency directly, in accordance with the terms of the contract with the agency. The agency will pay the independent contractor through a separate contractual arrangement. Under this model, the contract is between the hiring company and the staffing agency.

- Hiring partner. The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Taxes

In the UK, independent contractors must pay tax on all income above £12,570 (for the 2022/23 tax year). Independent contractors manage their own tax payments to HMRC, typically via the Self-Assessment process. Depending on their level of self-employed income, independent contractors might need to register to pay Value Added Tax (VAT). Unlike employees, independent contractors do not need to pay Class 1 National Insurance Contributions (NICs). However, they do need to pay Class 2 and Class 4 NICs.

It is important to note that an individual’s employment status (as an employee, contractor, or worker) does not necessarily determine their tax status. In the UK, these determinations are made by an employment tribunal and a tax tribunal (or HMRC), which are separate. One decision may influence the other, but this is not guaranteed.

Hiring Full Time in the UK

We can simplify hiring full-time workers in the UK by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in the UK without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to compliantly engage Contractors in the United Kingdom?

Look no further.

Talk to an Expert