Compliantly Engage Contractors in Mexico

Our workforce compliance guide to Mexico covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Mexico.

Local Time

Currency

Mexican Peso (MXN)Official Language(s)

SpanishPopulation

5.459 Million (2020)GDP

Billion USD ()GDP Growth rate

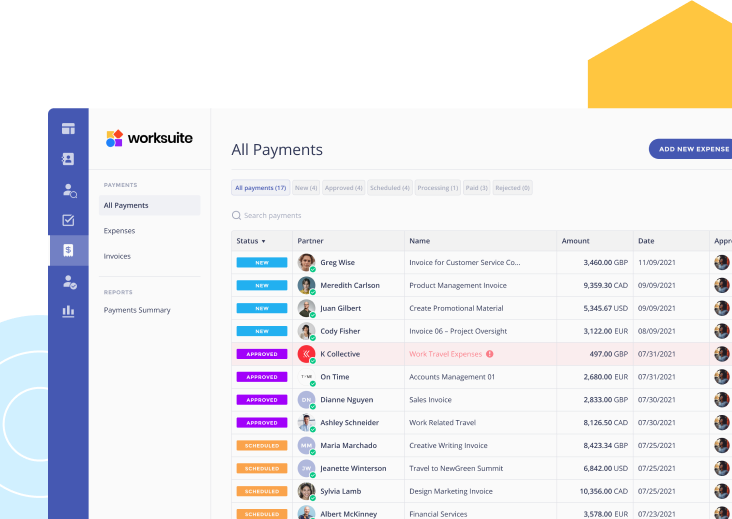

% ()Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Mexico

We work with the best legal partners in Mexico to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with Mexican law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Mexico

Any business hiring in Mexico should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses that are hiring contractors under the guise of employment.

Misunderstanding worker categories and incorrectly classifying an employee as an independent contractor could result in a business becoming responsible for substantial payments in back taxes and back pay. It is important to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies freelancers as independent contractors for you. Engaging a partner like Worksuite ensures compliance with Mexican Civil Code, and can automatically alert you when freelance talent must be engaged directly as employees, or contractors on the payroll.

Broadly speaking, the definition of an employee in Mexico revolves around the concept of subordination (i.e. the employer’s level of control over the direction of the employee) and the payment of a recurring wage or salary. If this situation exists, the Mexican Federal Labor Law deems that employment is taking place, irrespective of any agreed contracts that may be trying to frame the relationship as one of client and independent contractor.

Factors

Employee

Independent Contractor

Employment Laws

Employment contracts are governed by the Mexican Federal Labor Law (La Ley Federal del Trabajo). Unless agreed otherwise, all employment contracts are indefinite (non-fixed term).

All agreements with independent contractors must comply with Mexico’s civil laws.

Hiring Practice

During the recruitment and interview process, employers in Mexico are generally free to ask any questions they deem relevant to the candidate’s suitability for the position. Once a written contract has been signed by both parties, the employment is confirmed.

Each contractor in Mexico must be registered with the Secretaría del Trabajo y Previsión Social (STPS) as a provider of specialized services.

The hiring business and the independent contractor must work together to agree, finalize, and sign an acceptable contract to both parties.

Contractors must periodically report their contracts to both the Instituto Mexicano del Seguro Social (IMSS) and INFONAVIT.

Tax Documents

Employers must withhold and pay several taxes at source, deducting these sums from a worker’s pay and detailing the contributions on the worker’s payslip.

All employees must file an annual tax return to the Mexican authorities.

Contractors in Mexico are required to independently pay income tax (Impuesto Sobre la Renta, or ISR) on their profits and charge Impuesto al Valor Agregado (IVA, the Mexican equivalent of VAT) on their services. There is no minimum threshold for IVA registration. All contractors must register.

Payer's Tax Withholding & Reporting Requirements

Employers in Mexico must deduct four taxes at source:

- Income tax (ISR)

- Social security contributions

- National Housing Fund for Workers (INFONAVIT) contributions

- Local payroll taxes

A relatively low tax on salaries is also paid by the employer. The precise payment varies between states. These payments are tax-deductible in the employer’s annual financial accounts.

A business hiring an independent contractor in Mexico can (but are not required to) make provisional income tax withholdings from the payments it makes. In general, though, almost all contractors are paid in full – without any deductions at source.

Remuneration

Employees receive payments in Mexican pesos into a specific payroll bank account. The account is set up by the employer at a government-approved bank. The first nine hours of overtime in any given week are paid at double the employee’s agreed base rate. Any further overtime that week is paid at triple the employee’s agreed base rate. All workers must receive at least the national minimum wage

Most independent contractors in Mexico issue invoices to cover the work or projects they complete.

Workers’ Rights

Under Mexico’s Federal Labor Law, an employer can only freely terminate a worker’s employment if there are provable grounds for dismissal. In some circumstances, employees can be dismissed without cause if the employer makes a severance payment equivalent to three months’ consolidated salary, up to 32 days (depending on seniority) of consolidated salary for every year of service, plus accrued benefits earned during the last year of service.

Mexican labor legislation protects workers against discrimination in eight key areas: age, gender, race, nationality, disability, sexual preference, religion, and social/marital status.

Female workers are entitled to 12 weeks’ maternity leave at full pay, with an additional 60 days available at half-pay.

Working weeks are capped at 48 hours, with at least one rest day guaranteed each week.

Independent contractors in Mexico do not enjoy the same workplace right as employees. Effective contract negotiation is key for contractors looking to secure their rights.

The contract between an independent contractor and their client can only be terminated in line with the terms contained within the contract.

Benefits

Employees in Mexico are guaranteed certain benefits under the country’s Federal Labour Law. These include:

- A Christmas bonus of at least 15 days’ wages

- Annual holiday leave, with 25% of salary

- At least seven days of mandatory paid holidays (plus an eighth day every six years to mark the election of a new president)

- A share in 10% of the employer’s pre-tax profits

- Registration in both social security and INFONAVIT schemes

Some employees are also entitled to paid sick leave (up to 52 weeks at 60% of salary). Female employees are entitled to 12 weeks of maternity leave.

Independent contractors are not legally entitled to any benefits from their civil or commercial contract, and any benefits given may be considered as an argument for employment.

Contractors may voluntarily contribute to health services and private pensions.

When Paid

Employment payments are bi-weekly, made on the 15th and the final day of each month.

While there is no legal requirement around standard payment schedules, most invoices in Mexico use 30-day terms.

Employee

Employment Laws

Employment contracts are governed by the Mexican Federal Labor Law (La Ley Federal del Trabajo). Unless agreed otherwise, all employment contracts are indefinite (non-fixed term).

Hiring Practice

During the recruitment and interview process, employers in Mexico are generally free to ask any questions they deem relevant to the candidate’s suitability for the position. Once a written contract has been signed by both parties, the employment is confirmed.

Tax Documents

Employers must withhold and pay several taxes at source, deducting these sums from a worker’s pay and detailing the contributions on the worker’s payslip.

All employees must file an annual tax return to the Mexican authorities.

Payer's Tax Withholding & Reporting Requirements

Employers in Mexico must deduct four taxes at source:

- Income tax (ISR)

- Social security contributions

- National Housing Fund for Workers (INFONAVIT) contributions

- Local payroll taxes

A relatively low tax on salaries is also paid by the employer. The precise payment varies between states. These payments are tax-deductible in the employer’s annual financial accounts.

Remuneration

Employees receive payments in Mexican pesos into a specific payroll bank account. The account is set up by the employer at a government-approved bank. The first nine hours of overtime in any given week are paid at double the employee’s agreed base rate. Any further overtime that week is paid at triple the employee’s agreed base rate. All workers must receive at least the national minimum wage

Workers’ Rights

Under Mexico’s Federal Labor Law, an employer can only freely terminate a worker’s employment if there are provable grounds for dismissal. In some circumstances, employees can be dismissed without cause if the employer makes a severance payment equivalent to three months’ consolidated salary, up to 32 days (depending on seniority) of consolidated salary for every year of service, plus accrued benefits earned during the last year of service.

Mexican labor legislation protects workers against discrimination in eight key areas: age, gender, race, nationality, disability, sexual preference, religion, and social/marital status.

Female workers are entitled to 12 weeks’ maternity leave at full pay, with an additional 60 days available at half-pay.

Working weeks are capped at 48 hours, with at least one rest day guaranteed each week.

Benefits

Employees in Mexico are guaranteed certain benefits under the country’s Federal Labour Law. These include:

- A Christmas bonus of at least 15 days’ wages

- Annual holiday leave, with 25% of salary

- At least seven days of mandatory paid holidays (plus an eighth day every six years to mark the election of a new president)

- A share in 10% of the employer’s pre-tax profits

- Registration in both social security and INFONAVIT schemes

Some employees are also entitled to paid sick leave (up to 52 weeks at 60% of salary). Female employees are entitled to 12 weeks of maternity leave.

When Paid

Employment payments are bi-weekly, made on the 15th and the final day of each month.

Independent Contractor

Employment Laws

All agreements with independent contractors must comply with Mexico’s civil laws.

Hiring Practice

Each contractor in Mexico must be registered with the Secretaría del Trabajo y Previsión Social (STPS) as a provider of specialized services.

The hiring business and the independent contractor must work together to agree, finalize, and sign an acceptable contract to both parties.

Contractors must periodically report their contracts to both the Instituto Mexicano del Seguro Social (IMSS) and INFONAVIT.

Tax Documents

Contractors in Mexico are required to independently pay income tax (Impuesto Sobre la Renta, or ISR) on their profits and charge Impuesto al Valor Agregado (IVA, the Mexican equivalent of VAT) on their services. There is no minimum threshold for IVA registration. All contractors must register.

Payer's Tax Withholding & Reporting Requirements

A business hiring an independent contractor in Mexico can (but are not required to) make provisional income tax withholdings from the payments it makes. In general, though, almost all contractors are paid in full – without any deductions at source.

Remuneration

Most independent contractors in Mexico issue invoices to cover the work or projects they complete.

Workers’ Rights

Independent contractors in Mexico do not enjoy the same workplace right as employees. Effective contract negotiation is key for contractors looking to secure their rights.

The contract between an independent contractor and their client can only be terminated in line with the terms contained within the contract.

Benefits

Independent contractors are not legally entitled to any benefits from their civil or commercial contract, and any benefits given may be considered as an argument for employment.

Contractors may voluntarily contribute to health services and private pensions.

When Paid

While there is no legal requirement around standard payment schedules, most invoices in Mexico use 30-day terms.

Who classifies as an Independent Contractor in Mexico?

Labor relationships in Mexico are regulated by the Federal Labor Law. This legislation details when a worker has been deemed an employee or an independent contractor. Understanding these differences is crucial to businesses wishing to hire an independent contractor. Failure to fully understand what constitutes an employee rather than an independent contractor could leave an employer exposed to significant financial risk.

Classifying workers as employees or contractors is a complex process in most countries around the world. In Mexico, guidelines exist under the Federal Labor Law. The main guideline relates to subordination. In 1995, the country’s Second Collegiate Circuit Court on Labor Matters in the Fourth Circuit deemed that employment was defined by an employer’s ability to issue work orders and an employee’s obligation to obey those orders.

In Mexico, an employee can only be a named person. A company cannot act as an employee. However, a company or an individual can act as an independent contractor. The most common understanding of an employment relationship in Mexico hangs on the concept of subordinance. If the employer can dictate when and how the service provider fulfills their duties, the relationship is likely to be one between employer and employee.

As a broad guide, companies wanting to hire independent contractors in Mexico should be able to answer yes to these questions:

- Could your chosen contractor, if they wanted to, hire additional personnel to fulfill the services they have promised you?

- Does your chosen contractor have other sources of income beyond that coming from your business?

- Does your chosen contractor provide specialized services you could not easily find in the labor market?

- Do you plan to involve your chosen contractor in a range of workplace activities?

Contracting Models

If you are considering hiring an independent contractor, it is essential to seek professional advice to ensure your arrangement does not risk being reclassified by the Mexican tax authorities. Any use of deceptive practices around subcontracting or the provision of specialized services could carry a prison sentence of up to nine years.

Independent contractors in Mexico work under one of two main categories: self-employed freelancers, or operating as a company.

- Self-employed freelancer: Independent contractors can work as freelancers without establishing their own company. This provides a quick route to self-employment in Mexico.

- Operating as a company: independent contractors can establish their own company and work under this company as a legal entity. This model makes it easier for clients to engage with the independent contractor, as the client only has to pay the contractor’s invoices, rather than handling their tax and other deductions.

Emendations to the Ley Federal del Trabajo also define the specific types of contracts companies should use to hire contractors. The following types of contracts are permissible under Mexican federal law:

- Contracts for a fixed time, when required by the nature of the work

- Contracts for an indeterminate time

- Contracts for seasonal work

- Contracts for a trial period

Companies that hire independent contractors in Mexico should have those workers register with the Mexican tax authorities as independent service providers. They should also provide and keep official, signed pay receipts. They should also avoid creating exclusive relationships or imposing non-compete requirements, which could indicate the presence of an employer-employee relationship instead.

Engagement Models

Emendations to the Ley Federal del Trabajo outline the types of contracts companies should use to hire contractors. The following types of contracts are permissible under Mexican federal law:

- Contracts for a fixed time, when required by the nature of the work

- Contracts for an indeterminate time

- Contracts for seasonal work

- Contracts for a trial period

A. Direct engagement of the independent contractor as self-employed or registered via their own limited company.

- Service contract (indeterminate): Under this type of contract, the independent contractor carries out a particular task or job for a client for a fee. Importantly, this type of contract allows the client to inspect and supervise the contractor’s work, and even to give instructions for the contractor to follow. Once the client has formally accepted the work, the contractor has no further contractual obligation to make changes.

- Contract for work (determinate): Similar to the above contact details, these contracts are differentiated only by limitations to a fixed time, when required by the nature of the work, for seasonal work, a trial period.

B. Third party: These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Umbrella company: Here, the hiring company engages with an umbrella company, which has a license to supply its own contractors to deliver the contracted services. The client company pays the umbrella company directly, in accordance with the terms of the contract. The umbrella company then pays the contractor through a separate contractual arrangement. Under this model, the contract itself is between the client company and the umbrella company.

- Hiring partner: The client company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Payments

Companies hiring independent contractors in Mexico should avoid making payments directly through their payroll system. Beyond these guidelines, there are no specific lawful requirements related to paying independent contractors in Mexico. The contract should stipulate the preferred payment method agreed upon by both parties.

Contractor Taxes

Independent contractors in Mexico are responsible for their own tax affairs. They must file a tax return with the Mexican government and pay any income tax and VAT due on their declared profits and turnover. Contractors can also voluntarily make healthcare and private pension contributions. However, they are not entitled to any unemployment benefits.

The tax affairs of employees are more straightforward. Income tax, social security, INFONAVIT, and local payroll taxes are all deducted at the source. However, employees must still file a tax return with the Mexican authorities.

Under legislation released in April 2021, contractors in Mexico must now report their contracts periodically to the IMSS and INFONAVIT.

Employment in Mexico

We can simplify hiring full-time workers in Mexico by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Mexico without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Mexico

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Mexico?

Look no further.

Talk to an Expert