Compliantly Engage Contractors in Portugal

Our workforce compliance guide to Portugal covers everything you need to compliantly hire, onboard, manage and pay independent contractors and employees in Portugal.

Local Time

Currency

Euro (EUR)Official Language(s)

PortuguesePopulation

10.31 Million (2020)Economic Region

European UnionGDP

231.3 Billion USD (2020)GDP Growth rate

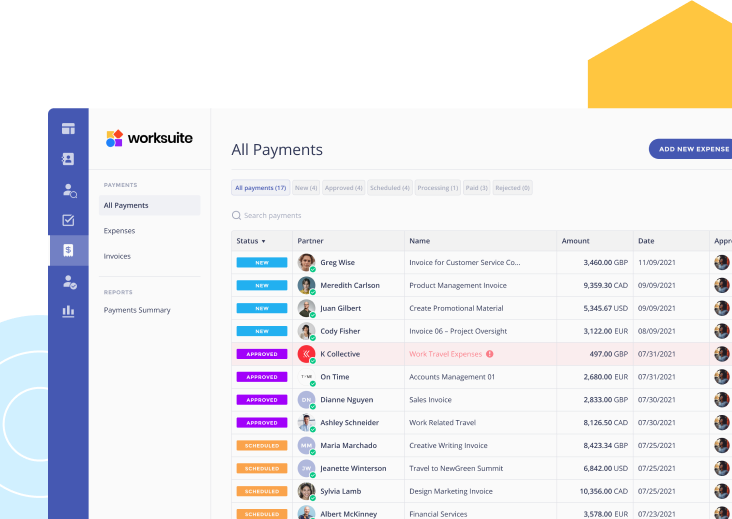

-7.6% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Portugal

We work with the best legal partners in Portugal to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with Portuguese law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractors & Freelancers in Portugal

Any business hiring in Portugal should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses that are hiring independent contractors under the guise of employment.

Understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Portugal. It is important to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies freelancers as independent contractors for you and lets you know when freelance talent must be engaged as a payrolled independent contractor or employed directly.

This is critical to compliantly engaging workers in Portugal and thereby avoiding severe legal, financial, and other penalties.

Factors

Employee

Independent Contractor

Employment Laws

Portuguese Labor Code; Portuguese Civil Code; Social Security Contributory Code; various social security and labor acts and frameworks; collective bargaining agreements; judicial precedent (case law)

Some provisions from the Portuguese Civil Code may apply to independent contractors when the contract has not already covered them.

Hiring Practice

Hiring practices are similar to many other countries. Candidates will typically submit a CV (which may include a photo) and a 1-page cover letter. Hiring steps include one or more rounds of interviews and, often, assessments. Employers issue successful candidates with an offer letter, after which the employment contract is signed.

Independent contractors can be hired directly or via an intermediary, such as a staffing agency or umbrella company. Independent contractors may be found via word of mouth, job boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the independent contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The two most common categories of independent contractor are:

- Self-employed/sole trader (Empresário em Nome Individual)

- Limited company

Tax Filing Documents

Employees are subject to income tax which is withheld at source. This means employees are typically not required to submit any tax forms in relation to their income earned via employment, unless they have additional sources of income that are not taxed at source.

In 2021, the government introduced an additional “solidarity tax” of 2.5% on income over EUR 80,000 per year, and 5% on income over EUR 250,000 per year.

Contractors who are residents and operating on a self-employed basis pay progressive personal income tax, while non-residents pay a flat rate of 25%. Contractors operating as a business pay a flat corporate tax rate of 21%, while SMEs pay a flat rate of 17%. Contractors operating as a business and earning over EUR 10,000 must register to pay (VAT) (Imposto Sobre o Valor Agregado (IVA)). The “solidarity tax” also applies to contractors earning above EUR 80,000 per year.

The tax year runs from 1 January to 31 December. Tax returns for the prior year must be submitted by 30 June, and taxes must be paid by 31 August. Tax returns and tax payments must be submitted via the tax authority’s Tax Portal (Portal das Financas).

Payer Tax Withholding and Reporting Requirements

The tax year aligns with the calendar year (1 January to 31 December). Employees’ income tax is deducted from their salary at source by their employer. Social security contributions in Portugal are 34.75%, of which the employee pays 11% and the employer pays 23.75% (or 22.3% for non-profit organizations)

Independent contractors pay their own social security contributions at 29.6% of income. However, if 80% or more of the contractor’s income is derived from a single client, that client must also pay 5% of the contractor’s annual fees as social security contributions.

For contractors who also work as employees (although not for the same company) , they may not need to pay additional social security contributions where this is already covered by the employment deductions.

Other Tax Filing Requirements

NA

NA

Remuneration

Employees are paid on a monthly basis.

Independent contractors are paid according to a schedule defined within the contract.

Workers’ Rights

Employees’ rights include: strong termination protections; a maximum 40-hour work week (this may be reduced by collective bargaining); mandatory severance compensation;

There are no statutory benefits for independent contractors.

Benefits

Statutory employee benefits include: paid holiday leave (minimum of 22 days); maternity and paternity leave; marriage leave; and sick leave. Additional benefits come from collective bargaining and include: school allowances; social benefits; transports allowances; and meal allowances.

Independent contractors’ benefits are governed by the content of the contract.

When Paid

Employees are paid on a monthly basis directly into their bank account

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Employee

Employment Laws

Portuguese Labor Code; Portuguese Civil Code; Social Security Contributory Code; various social security and labor acts and frameworks; collective bargaining agreements; judicial precedent (case law)

Hiring Practice

Hiring practices are similar to many other countries. Candidates will typically submit a CV (which may include a photo) and a 1-page cover letter. Hiring steps include one or more rounds of interviews and, often, assessments. Employers issue successful candidates with an offer letter, after which the employment contract is signed.

Tax Filing Documents

Employees are subject to income tax which is withheld at source. This means employees are typically not required to submit any tax forms in relation to their income earned via employment, unless they have additional sources of income that are not taxed at source.

In 2021, the government introduced an additional “solidarity tax” of 2.5% on income over EUR 80,000 per year, and 5% on income over EUR 250,000 per year.

Payer Tax Withholding and Reporting Requirements

The tax year aligns with the calendar year (1 January to 31 December). Employees’ income tax is deducted from their salary at source by their employer. Social security contributions in Portugal are 34.75%, of which the employee pays 11% and the employer pays 23.75% (or 22.3% for non-profit organizations)

Other Tax Filing Requirements

NA

Remuneration

Employees are paid on a monthly basis.

Workers’ Rights

Employees’ rights include: strong termination protections; a maximum 40-hour work week (this may be reduced by collective bargaining); mandatory severance compensation;

Benefits

Statutory employee benefits include: paid holiday leave (minimum of 22 days); maternity and paternity leave; marriage leave; and sick leave. Additional benefits come from collective bargaining and include: school allowances; social benefits; transports allowances; and meal allowances.

When Paid

Employees are paid on a monthly basis directly into their bank account

Independent Contractor

Employment Laws

Some provisions from the Portuguese Civil Code may apply to independent contractors when the contract has not already covered them.

Hiring Practice

Independent contractors can be hired directly or via an intermediary, such as a staffing agency or umbrella company. Independent contractors may be found via word of mouth, job boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the independent contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The two most common categories of independent contractor are:

- Self-employed/sole trader (Empresário em Nome Individual)

- Limited company

Tax Filing Documents

Contractors who are residents and operating on a self-employed basis pay progressive personal income tax, while non-residents pay a flat rate of 25%. Contractors operating as a business pay a flat corporate tax rate of 21%, while SMEs pay a flat rate of 17%. Contractors operating as a business and earning over EUR 10,000 must register to pay (VAT) (Imposto Sobre o Valor Agregado (IVA)). The “solidarity tax” also applies to contractors earning above EUR 80,000 per year.

The tax year runs from 1 January to 31 December. Tax returns for the prior year must be submitted by 30 June, and taxes must be paid by 31 August. Tax returns and tax payments must be submitted via the tax authority’s Tax Portal (Portal das Financas).

Payer Tax Withholding and Reporting Requirements

Independent contractors pay their own social security contributions at 29.6% of income. However, if 80% or more of the contractor’s income is derived from a single client, that client must also pay 5% of the contractor’s annual fees as social security contributions.

For contractors who also work as employees (although not for the same company) , they may not need to pay additional social security contributions where this is already covered by the employment deductions.

Other Tax Filing Requirements

NA

Remuneration

Independent contractors are paid according to a schedule defined within the contract.

Workers’ Rights

There are no statutory benefits for independent contractors.

Benefits

Independent contractors’ benefits are governed by the content of the contract.

When Paid

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Who classifies as an Independent Contractor in Portugal

Self-employment as an independent contractor is a popular income model for many individuals, and the self-employment rate in Portugal is higher than the EU average. The Covid pandemic has prompted an even greater increase in the number of Portuguese individuals working as self-employed independent contractors.

Portuguese law distinguishes between employees and independent contractors. In essence, an employee undertakes work in exchange for a salary, while an independent contractor is hired and paid for achieving a specific end result as stipulated in their contract. The level of direction and supervision (“legal subordination”) of the individual is the key criterion in making this distinction in Portugal, with employees working under very close supervision and contractors enjoying far greater freedom in how they achieve the results required of their contract.

If the real substance of the company-contractor relationship proves to effectively be an employment relationship, the hiring company may suffer legal and financial penalties (including payroll taxes). It is therefore important to leverage an employment service partner like Worksuite when hiring in Portugal in order to ensure that independent contractors fall under the correct working relationship with your business.

The Portuguese Labor code and case law outline three core elements determining that an individual is an employee: (1) undertaking work, (2) for financial compensation, (3) under direct authority from the employer (i.e., “legal subordination”). While legal subordination is the key criterion in distinguishing between an employee and an independent contractor, in reality this can be difficult to determine and therefore a range of factors are looked at. Individuals are generally considered to be independent contractors if they:

- Are subject to relatively little control by the hiring company, which means they are free to decide when, where, and how they complete their tasks.

- Do not have fixed hours of work that are determined by the hiring company.

- Are able to choose the location from which to undertake their work.

- Provide their own equipment, rather than receiving it from the hiring company.

- Can be (or are expected to be) dismissed once the contracted work is complete.

- Are not integrated into the hiring company’s organizational structure.

- Are paid for a specific project or task rather than on a recurring basis.

- Can refuse to perform a task (unless that task is part of their contract).

- Are not entitled to a minimum amount of work or a minimum amount of pay.

- Are not listed on the hiring company’s normal payroll.

If a dispute about the status of an individual is brought before the Portuguese courts, the burden of proof will automatically fall upon the hiring company to demonstrate that the individual qualifies as an independent contractor rather than an employee.

Contracting Models

There are two main categories under which independent contractors operate in Portugal:

- Self-employed/sole trader (Empresário em Nome Individual): This is the most common category for independent contractors in Portugal, as it offers a fast route to working as a contractor with little administrative overhead. Self-employed freelancers must file their own tax returns and pay their own taxes and social security contributions, and they naturally have unlimited liability for all business debts they incur. To register as a sole trader, individuals need a Portuguese residency card, a tax number (Número de Identificação Fiscal) from the Portuguese Tax Office, and a social security number from the social security agency.

- Limited company: Independent contractors can also set up a limited company. The most common types in Portugal are: Limited Liability Company by Quotas (sociedade por quotas) (LLCQ); Limited Liability Company by Shares (sociedade anónima) (LLC); General Partnership (sociedade em nome coletivo); Limited Partnership (sociedade em comandita); Cooperative (cooperativa); Individual Limited Liability Establishment (estabelecimento individual de responsabilidade limitada) (EIRL); and Sole Proprietorship (empresário em nome individual) (ENI). Each of these structures entails different tax implications.

Engagement models

There are two main types of contracting model for working with independent contractors in Portugal.

A. Direct engagement of the contractor as self-employed or registered via their own company. Under this model, the hiring company engages directly with the independent contractor – either as an individual sole trader, or as a limited company (see above) – and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the contract.

B. Third party. These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Temp agency: Here, the hiring company engages with a staffing agency, which in turn supplies one of its own independent contractors to deliver the contracted services. The hiring company pays the staffing agency directly, in accordance with the terms of the contract. The contract is, therefore, between the hiring company and the staffing agency, while the agency pays the independent contractor through a separate contractual arrangement.

- Umbrella company: Independent contractors can also work through an umbrella company. This turns a ‘self-employed’ individual into a legal ‘employee’ of the umbrella company itself. The contractual relationship is between the umbrella company and the client, with the umbrella company running payroll and administration for the independent contractor. The umbrella company invoices the client directly, while paying the contractor via PAYE as a standard employee. Umbrella companies levy a fee on the contractor to cover their costs.

- Hiring company: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Payments

Companies hiring independent contractors in Portugal should avoid making payments directly through their payroll system. Beyond these guidelines, there are no specific legal requirements related to paying contractors in Portugal. The contract should stipulate the preferred payment method agreed upon by both parties.

Tax and Social Security

Employees’ income tax is deducted from their salary at source by their employer. The tax rate in Portugal is variable. Moreover, in 2021 the government introduced an additional “solidarity tax” of 2.5% on income over EUR 80,000 per year, and 5% on income over EUR 250,000 per year.

Independent contractors who are residents and operating on a self-employed basis pay progressive personal income tax, while non-residents pay a flat rate of 25%. Contractors operating as a business pay a flat corporate tax rate of 21%, while SMEs pay a flat rate of 17%. Contractors operating as a business and earning over EUR 10,000 must register to pay (VAT) (Imposto Sobre o Valor Agregado (IVA)). The “solidarity tax” also applies to contractors earning above EUR 80,000 per year.

The tax year in Portugal aligns with the calendar year (1 January to 31 December). Independent contractors, and employees who have additional income that is not taxed at source, must file tax returns (IRS) by 30 June and pay any taxes that are due by 31 August. Tax returns and tax payments must be submitted via the tax authority’s Tax Portal (Portal das Financas).

Social security contributions in Portugal are 34.75%, of which the employee pays 11% and the employer pays 23.75% (or 22.3% for non-profit organizations). Independent contractors pay their own social security contributions at 29.6%. However, if 80% or more of the contractor’s income comes from a single client, that client must also pay 5% of the contractor’s annual fees as social security contributions.

Employment in Portugal

We can simplify hiring full-time workers in Portugal by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Portugal without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Portugal?

Look no further

Talk to an Expert