Compliantly Engage Contractors in Qatar

Our workforce compliance guide to Qatar covers everything you need to compliantly hire, onboard, manage and pay independent contractors and employees in Qatar.

Local Time

Currency

Qatari Riyal (QR)Official Language(s)

Population

2.881 Million ()GDP

146 Billion USD (2020)GDP Growth rate

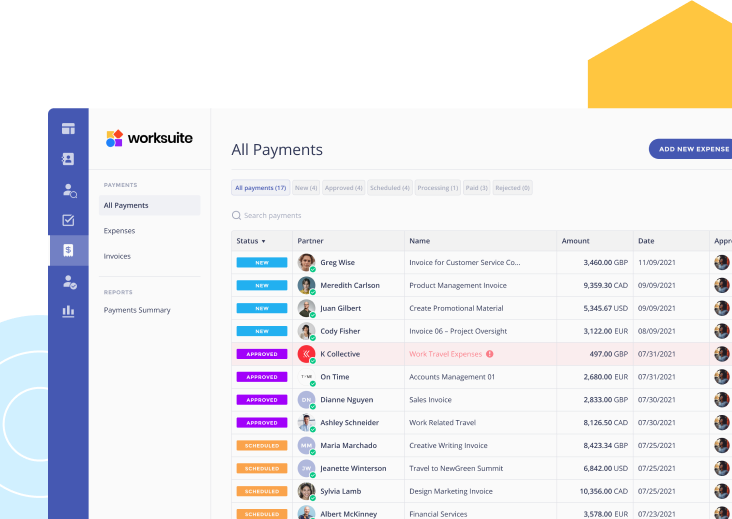

-3.7% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Qatar

We work with the best legal partners in Qatar to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with Qatari law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Qatar

Any business hiring in Qatar should understand the legal landscape around engaging with individuals and companies operating in Qatar. Unlike in many other countries, there is relatively little meaningful legal distinction between an employee and an independent contractor per se. Instead, hiring abroad in Qatar looks closely at whether the individual is a citizen of Qatar or the Gulf Cooperation Council (GCC) countries, or a foreign national. All foreign nationals operating in Qatar must have either formed their own company (with part-ownership by a Qatari national being mandatory) or otherwise be under a sponsored work visa at all times.

It is important to work with a partner like Worksuite to ensure you understand the legal landscape in Qatar. This is critical to compliantly engaging workers in Qatar and thereby avoiding severe legal, financial, and other penalties.

Factors

Employee

Independent Contractor

Employment Laws

Entities operating in the State of Qatar are subject to the Labor Law (Qatar Law No. 14 [2004]), Expat Law (Qatar Law no. 21 [2015]), Qatari civil law, and other edicts issued by the Ministry of Administrative Development, Labor and Social Affairs (MADLSA). Entities operating in the Qatar Financial Center (QFC) may be subject to different laws.

There are certain categories of worker to which Labor Law does not apply, including those working in the petroleum sector; the police and armed forces; casual workers (less than four weeks on a single engagement); domestic staff; and those working in agriculture.

There are minimal specific laws governing independent contractors. In general, laws covering employees also apply to independent contractors.

Hiring Practice

Candidates will generally apply for vacancies via jobs boards or other means, with the hiring process following the norms expected elsewhere. Employment and criminal history is generally required; and for some roles, employees will need to provide a validated (e.g., notarized) copy of their university degree. Upon securing a role, the employer must issue the employee with either an employment contract (Service Contract) or an agreement letter. All contracts must be in Arabic; they can be duplicated in another language too, but only the Arabic version will be considered legally valid.

All employees require a work permit from the Ministry of Labor. Additionally, all foreign nationals (i.e., non-Qatari nationals and non-Gulf Cooperation Council [GCC]) nationals) must obtain a sponsored visa to work in Qatar.

Independent contractors who do not work under an umbrella company or otherwise operate as a business will need to obtain a sponsored work visa from each new client.

Tax Filing Documents

There is no personal income tax per se in Qatar. In essence, individuals are liable for business tax under the Companies Tax law if they generate income from a Qatari source via any commercial activity, even if they are not resident in Qatar. However, residents of Qatar who are also nationals of Qatar or the Gulf Cooperation Council (GCC) countries are exempt from tax.

Independent contractors are treated as a business entity and pay taxes in the same manner as an employer.

Taxes and returns can both be filed via the Dhareeba Tax Portal.

Independent contractors are treated as a business entity and pay taxes in the same manner as an employer.

Payer Tax Withholding and Reporting Requirements

As there is no personal income tax system, employers do not withhold any tax from their employees’ salaries. Employees pay their own business taxes under the Companies Tax law requirements relating to commercial activity (see above).

Companies pay Corporate Income Tax (CIT) at 10% of profits. However, final income tax is proportional to the percentage of Qatari ownership in the company.

Companies submit their tax returns to the General Tax Authority (GTA). The return must include audited annual financial statements if the company’s capital is greater than QAR 200,000, if total income is greater than QAR 500,000, or if the company’s head office is not located in Qatar

Hiring companies do not withhold any tax from independent contractors’ payments.

Other Tax Filing Requirements

Unlike in many countries, the tax year aligns with the calendar year (1 January to 31 December). Tax returns and accompanying payments are both due within four months of the end of the tax year, meaning 30 April. All tax returns and related documents must use Arabic.

There is no difference for independent contractors.

Remuneration

Employees are paid on a monthly basis

Contractors are paid on the basis as agreed upon within the contract.

Workers’ Rights

Qatar Labor Law grants certain rights to employees. These include: maximum of six days’ work per week; maximum of ten hours’ work per day; minimum wage of QAR 1,000 (USD 275) per month, plus a minimum food allowance of QAR 300 (USD 82) and accommodation allowance of QAR 500 (USD 137); minimum notice period; paid sick leave (full pay up to two weeks; half pay for the next four weeks; zero pay thereafter up to week twelve); eight public holidays (including three days for Eid El-Fitr and three for Eid Al-Adha).

Labor Law does not provide workers’ rights to independent contractors.

Benefits

Benefits include a food and accommodation allowance. Free healthcare is provided by the state-run Hamad Medical Corporation. Qatari nationals may receive more favorable benefits compared with foreign nationals. There are no other statutory social security contributions.

Independent contractors’ benefits are governed by the content of the contract

When Paid

Employees are paid on a monthly basis directly into their bank account.

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Employee

Employment Laws

Entities operating in the State of Qatar are subject to the Labor Law (Qatar Law No. 14 [2004]), Expat Law (Qatar Law no. 21 [2015]), Qatari civil law, and other edicts issued by the Ministry of Administrative Development, Labor and Social Affairs (MADLSA). Entities operating in the Qatar Financial Center (QFC) may be subject to different laws.

There are certain categories of worker to which Labor Law does not apply, including those working in the petroleum sector; the police and armed forces; casual workers (less than four weeks on a single engagement); domestic staff; and those working in agriculture.

Hiring Practice

Candidates will generally apply for vacancies via jobs boards or other means, with the hiring process following the norms expected elsewhere. Employment and criminal history is generally required; and for some roles, employees will need to provide a validated (e.g., notarized) copy of their university degree. Upon securing a role, the employer must issue the employee with either an employment contract (Service Contract) or an agreement letter. All contracts must be in Arabic; they can be duplicated in another language too, but only the Arabic version will be considered legally valid.

All employees require a work permit from the Ministry of Labor. Additionally, all foreign nationals (i.e., non-Qatari nationals and non-Gulf Cooperation Council [GCC]) nationals) must obtain a sponsored visa to work in Qatar.

Tax Filing Documents

There is no personal income tax per se in Qatar. In essence, individuals are liable for business tax under the Companies Tax law if they generate income from a Qatari source via any commercial activity, even if they are not resident in Qatar. However, residents of Qatar who are also nationals of Qatar or the Gulf Cooperation Council (GCC) countries are exempt from tax.

Independent contractors are treated as a business entity and pay taxes in the same manner as an employer.

Taxes and returns can both be filed via the Dhareeba Tax Portal.

Payer Tax Withholding and Reporting Requirements

As there is no personal income tax system, employers do not withhold any tax from their employees’ salaries. Employees pay their own business taxes under the Companies Tax law requirements relating to commercial activity (see above).

Companies pay Corporate Income Tax (CIT) at 10% of profits. However, final income tax is proportional to the percentage of Qatari ownership in the company.

Companies submit their tax returns to the General Tax Authority (GTA). The return must include audited annual financial statements if the company’s capital is greater than QAR 200,000, if total income is greater than QAR 500,000, or if the company’s head office is not located in Qatar

Other Tax Filing Requirements

Unlike in many countries, the tax year aligns with the calendar year (1 January to 31 December). Tax returns and accompanying payments are both due within four months of the end of the tax year, meaning 30 April. All tax returns and related documents must use Arabic.

Remuneration

Employees are paid on a monthly basis

Workers’ Rights

Qatar Labor Law grants certain rights to employees. These include: maximum of six days’ work per week; maximum of ten hours’ work per day; minimum wage of QAR 1,000 (USD 275) per month, plus a minimum food allowance of QAR 300 (USD 82) and accommodation allowance of QAR 500 (USD 137); minimum notice period; paid sick leave (full pay up to two weeks; half pay for the next four weeks; zero pay thereafter up to week twelve); eight public holidays (including three days for Eid El-Fitr and three for Eid Al-Adha).

Benefits

Benefits include a food and accommodation allowance. Free healthcare is provided by the state-run Hamad Medical Corporation. Qatari nationals may receive more favorable benefits compared with foreign nationals. There are no other statutory social security contributions.

When Paid

Employees are paid on a monthly basis directly into their bank account.

Independent Contractor

Employment Laws

There are minimal specific laws governing independent contractors. In general, laws covering employees also apply to independent contractors.

Hiring Practice

Independent contractors who do not work under an umbrella company or otherwise operate as a business will need to obtain a sponsored work visa from each new client.

Tax Filing Documents

Independent contractors are treated as a business entity and pay taxes in the same manner as an employer.

Payer Tax Withholding and Reporting Requirements

Hiring companies do not withhold any tax from independent contractors’ payments.

Other Tax Filing Requirements

There is no difference for independent contractors.

Remuneration

Contractors are paid on the basis as agreed upon within the contract.

Workers’ Rights

Labor Law does not provide workers’ rights to independent contractors.

Benefits

Independent contractors’ benefits are governed by the content of the contract

When Paid

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Who classifies as an Independent Contractor in Qatar?

Qatari law does not legally distinguish between employees and independent contractors. Instead, the primary legal distinction is the citizenship status of the individual. Individuals who are citizens of Qatar or a GCC country only need a work permit to engage in work, whether as an employee or independent contractor. However, it is likely they will have already established or be a partner in a company.

On the other hand, foreign nationals who have not formed a company will require visa sponsorship for all work undertaken in Qatar. This means there is no legal distinction between whether they work on a series of shorter-term contracts (each of which must be signed by the hiring company as the sponsor) or on a longer-term traditional ‘employment’ contract (which also requires sponsorship by the employer).

There are a large number of foreign nationals working in Qatar, the vast majority of whom work as employees under employment visas sponsored by their employer. It is highly unlikely that Qatari nationals, or nationals of other GCC countries, would be operating as independent contractors without having also established their own company. As such, a hiring company is likely to find itself engaging with either non-Qatari and non-GCC nationals as either independent contractors or companies, or otherwise Qatari/GCC nationals operating under their own company.

Hiring companies must note that it is illegal in Qatar for an individual to operate as an independent freelancer without both a sponsor and a work permit issued by the Ministry of Labor. This means that whenever a hiring company begins discussions with an independent contractor, it would be prudent to first obtain proof of their existing visa sponsorship.

Because independent freelancing (i.e., without a visa sponsor) is illegal in Qatar, the category of “independent contractor” does not exist in the same way as it does in many countries. Individuals are either under an employment contract (for which foreign nationals always require sponsorship) or are an owner or part-owner in a company.

Contracting Models

There are effectively only two categories of independent contractors in Qatar: those who have not formed their own company (and therefore require sponsorship for every work contract) and those who have.

A. Self-employed (sponsored): This refers to individuals who work as independent contractors but have not formed their own company. These individuals still pay business tax as commercial entities (see above), but the hiring company will need to sponsor their visa for the duration of the contract.

B. Company: Independent contractors can also set up a company in Qatar. The most common legal business structure is the Limited Liability Company (LLC), which requires at least two shareholders and at least QAR 200,000 in share capital, 51% of which must be owned by a Qatari national. Other structures include the Joint Company, Equities Partnership Company, Particular Partnership Company, Shareholding Company, Limited Partnership Company, and Branch Office / Subsidiary. The latter can be completely foreign-owned.

Engagement Models

There are two main engagement models for working with independent contractors in Qatar.

A. Direct engagement. This can involve hiring the contractor as an employee, or establishing a business-to-business contract.

- Employment contract. Under this model, the hiring company engages directly with the independent contractor and establishes an employment contract. The hiring company must sponsor the contractor’s work visa for the duration of the contract.

- Business-to-business contract. Under this model, the hiring company engages with the independent contractor via the company in which the contractor is an owner or partner. This results in the establishment of a business-to-business contract. The hiring company does not need to provide any visa sponsorship.

B. Third party. These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Temp agency: Here, the hiring company engages with a staffing agency, which in turn supplies one of its own independent contractors to deliver the contracted services. The hiring company pays the staffing agency directly, in accordance with the terms of the contract. The contract is, therefore, between the hiring company and the staffing agency, while the agency pays the independent contractor through a separate contractual arrangement.

- Umbrella company: Some independent contractors may work under an umbrella company. In this case, the contractor is responsible for finding and fulfilling their work, but they are an employee of the umbrella company, which manages payroll and applies an administration fee on the independent contractor’s earnings. In Qatar, umbrella companies provide independent contractors with the added benefit of being able to work on multiple contracts under a single work permit.

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up employment contracts or business-to-business contracts, onboard and manage contractors, and pay contractors.

Contractor Payments

If engaging with an individual who has not formed their own company, the hiring company will need to establish an employment contract and pay the individual via payroll. If engaging with an individual in their capacity as owner of a company, the hiring company establishes a business-to-business contract and pays any invoices as per the terms of the contract. In general, all tax forms, payment forms, invoices, and other official business and contractual documentation must be in Arabic.

Tax and Social Security

There is no personal income tax system in Qatar. Employees therefore pay no income tax, while companies (including individuals engaged in commercial activities) generally pay a flat rate of 10% of their profits as Corporate Income Tax (CIT). Qatari companies who pay non-resident entities are liable for an additional tax. There are no mandatory social security contributions in Qatar.

Looking to Compliantly Engage Contractors in Qatar?

Look no further

Talk to an Expert