Compliantly Engage Contractors in the United States

Our workforce compliance guide to the United States covers everything you need to compliantly hire, onboard, manage and pay independent contractors in the US.

Local Time

Currency

US Dollar (USD)Official Language(s)

EnglishPopulation

329 Million (2020)GDP

20000.94 Billion USD (2020)GDP Growth rate

-3.5% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in the United States

We work with the best legal partners in the United States to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with the US law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in the United States

Any business hiring in the United States should understand the important legal distinction between who is classified as an employee and who can be engaged as an independent contractor. Fines or penalties may be issued to businesses that are hiring employees under the guise of independent contractors or freelancers.

In the United States, describing or referring to an individual as an independent contractor, when in the context of a relationship between the individual and a company, has legal significance. Various factors and acknowledged tests, as well as multiple jurisdictions, are taken into account to determine the propriety of the independent contractor classification. Therefore, understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in the United States.

It is important to work with a partner like Worksuite to ensure that you have an engagement framework that thoroughly and compliantly assesses all facets of the classification determination. This includes an understanding of how the contractual and practical framework of projects, tasks, and other work assignments can materially impact the propriety of the classification decision.

The Internal Revenue Service (IRS) of the United States, each state revenue office, and multiple other federal and state agencies, all have set rules and criteria for determining independent contractor status. While there is significant overlap of the criteria across federal and state agencies, there are also many unique and specific requirements at the state and or agency level to be aware of. There is no one single test for independent contractor determination in the U.S. However, there are several key factors that are generally common across all jurisdictions to determine employee or contractor status:

- “Right of Control” tests determine who controls delivery of the services, the client company or the worker?

- Is the worker an “independently established business” and conducting their business as such?

- Does the worker maintain “financial control” over her or his business, including financial risk for delivery of the services to the client company?

- How distinct are the worker’s services from the “usual course of business” conducted by employees of the client company?

Factors

Employee

Independent Contractor

Employment Laws

Governed by federal, state, and common law legislation. Employees have their rights protected under the Fair Labor Standards Act and as governed by the Department of Labor and the National Labor Relations Board. State unemployment compensation commissions, worker’s compensation agencies, and state labor agencies, all represent jurisdiction over the independent contractor determination.

Contractual agreements must comply with federal, state employment and civil law legislation.

Hiring Practice

Employers make a formal offer of employment by issuing a written, binding contract that does not contravene any applicable legislation. When remuneration is agreed upon, and the worker provides written acceptance of the contract offer, the employee is hired. Irrespective of the employee’s preferences, U.S. employment contracts must comply with federal and state agency rules and regulations

Formal written agreements between a company and an independent contractor should be titled Independent Contractor Agreement or Statements of Work. Such agreements should specifically acknowledge the relationship of the worker to the client company as an independent contractor. Work must then be strictly completed on the basis of the terms detailed in the agreement. It is each individual engagement (i.e. body or work or services performed) that must be deemed to meet independent contractor status or not.

Tax Documents

Employers must complete all necessary federal (IRS) and state tax forms (i.e. Form W2) and deduct and withhold federal and state taxes from employee payments. Employees must file annual federal and state income tax returns.

Independent contractors must pay self employment taxes annually, as part of their personal income tax return or as a separate business tax return. Client companies must issue to independent contractors and file with the IRS annually Form 1099 – NEC to report non-employee compensation paid. Form 1099-NEC is only required for annual payments to individuals in excess of $600

Payer's Tax Withholding & Reporting Requirements

Employers must deduct and withhold employee taxes according to federal and state regulations – deduct and withhold federal.

Federal and state deductions are not required for payments made to independent contractors.

Remuneration

Either hourly or salary. The employer must ensure that all remuneration is at least equal to minimum wage requirement and aligns with other wage and hour rules (i.e. overtime, holiday pay, sick leave, etc.).

Common practice in the U.S. is for independent contractors to issue periodic, usually monthly, invoices to their client companies for payment of fees. Independent contractors are not due (and should not receive) overtime, holiday pay, or sick leave payments from client companies.

Workers’ Rights

Employers must comply with federal and state minimum wage guidelines.

They must also abide by statutory overtime, paid time off, holiday pay, and sick leave pay rules, as well as paid leaves of absence, including pregnancy, parental, sick and family medical leave.

Employers may terminate employment at will.

In general, independent contractors in the U.S. enjoy far fewer workplace rights than employee counterparts. Contractors are not entitled to the minimum wage, statutory holidays, maternity leave, etc., are not protected from certain workplace abuses, and are not protected from early termination other than what is written in their agreements.

Benefits

Employees are protected from workplace injuries in the form of workers compensation insurance required to be carried by employers.

Minimum healthcare benefits are required and most employers offer / provide extended healthcare benefits to employees.

Employers also offer retirement savings benefits (i.e. 401(k) contributions).

No requirement on the employer to pay any benefits, including workers compensation, unemployment insurance contributions, and retirement or pension payments.

When Paid

Varies by employer, but generally bi-weekly, semi-monthly (approximately 15th and 30th of each month), or monthly.

Typical contractor invoices are issued monthly on net 30-day terms. Each invoice usually details:

- Invoice number and date

- Client name and address

- Agreed contract price

- The contractor’s bank details

- Agreed payment terms and due date

Employee

Employment Laws

Governed by federal, state, and common law legislation. Employees have their rights protected under the Fair Labor Standards Act and as governed by the Department of Labor and the National Labor Relations Board. State unemployment compensation commissions, worker’s compensation agencies, and state labor agencies, all represent jurisdiction over the independent contractor determination.

Hiring Practice

Employers make a formal offer of employment by issuing a written, binding contract that does not contravene any applicable legislation. When remuneration is agreed upon, and the worker provides written acceptance of the contract offer, the employee is hired. Irrespective of the employee’s preferences, U.S. employment contracts must comply with federal and state agency rules and regulations

Tax Documents

Employers must complete all necessary federal (IRS) and state tax forms (i.e. Form W2) and deduct and withhold federal and state taxes from employee payments. Employees must file annual federal and state income tax returns.

Payer's Tax Withholding & Reporting Requirements

Employers must deduct and withhold employee taxes according to federal and state regulations – deduct and withhold federal.

Remuneration

Either hourly or salary. The employer must ensure that all remuneration is at least equal to minimum wage requirement and aligns with other wage and hour rules (i.e. overtime, holiday pay, sick leave, etc.).

Workers’ Rights

Employers must comply with federal and state minimum wage guidelines.

They must also abide by statutory overtime, paid time off, holiday pay, and sick leave pay rules, as well as paid leaves of absence, including pregnancy, parental, sick and family medical leave.

Employers may terminate employment at will.

Benefits

Employees are protected from workplace injuries in the form of workers compensation insurance required to be carried by employers.

Minimum healthcare benefits are required and most employers offer / provide extended healthcare benefits to employees.

Employers also offer retirement savings benefits (i.e. 401(k) contributions).

When Paid

Varies by employer, but generally bi-weekly, semi-monthly (approximately 15th and 30th of each month), or monthly.

Independent Contractor

Employment Laws

Contractual agreements must comply with federal, state employment and civil law legislation.

Hiring Practice

Formal written agreements between a company and an independent contractor should be titled Independent Contractor Agreement or Statements of Work. Such agreements should specifically acknowledge the relationship of the worker to the client company as an independent contractor. Work must then be strictly completed on the basis of the terms detailed in the agreement. It is each individual engagement (i.e. body or work or services performed) that must be deemed to meet independent contractor status or not.

Tax Documents

Independent contractors must pay self employment taxes annually, as part of their personal income tax return or as a separate business tax return. Client companies must issue to independent contractors and file with the IRS annually Form 1099 – NEC to report non-employee compensation paid. Form 1099-NEC is only required for annual payments to individuals in excess of $600

Payer's Tax Withholding & Reporting Requirements

Federal and state deductions are not required for payments made to independent contractors.

Remuneration

Common practice in the U.S. is for independent contractors to issue periodic, usually monthly, invoices to their client companies for payment of fees. Independent contractors are not due (and should not receive) overtime, holiday pay, or sick leave payments from client companies.

Workers’ Rights

In general, independent contractors in the U.S. enjoy far fewer workplace rights than employee counterparts. Contractors are not entitled to the minimum wage, statutory holidays, maternity leave, etc., are not protected from certain workplace abuses, and are not protected from early termination other than what is written in their agreements.

Benefits

No requirement on the employer to pay any benefits, including workers compensation, unemployment insurance contributions, and retirement or pension payments.

When Paid

Typical contractor invoices are issued monthly on net 30-day terms. Each invoice usually details:

- Invoice number and date

- Client name and address

- Agreed contract price

- The contractor’s bank details

- Agreed payment terms and due date

Who classifies as an Independent Contractor in the United States?

The three most important steps of structuring an independent contractor relationship in the U.S. are to

- document the nature of the relationship between the parties as independent contractor,

- document the services to be delivered (i.e. deliverables or expected results) and compensation to be paid based on that delivery, and

- ensure that all work is delivered according to the terms of the contract and not similar to existing employer-employee relationships.

Without these steps, workers initially classified as independent contractors are at risk to be reclassified as employees. The misclassification claim, and ultimately the final classification decision, would be made by any of the myriad of governmental authorities noted above or by a court of law.

Who is an independent contractor?

- In general, independent contractors are people in business for themselves. They typically provide services that client companies cannot or do not provide as their regular course of business or they perform work that requires specialized skills. They also typically provide their services to multiple customers or clients, set their own prices or fees, work from their own place of business (i.e. home or remote), use their own tools and resources for delivery of their services, and control how and when the work is to be done.

- According to the IRS: Whether people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer (client company) has the right to control or direct only the result of the work and not what will be done and how it will be done. You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

- Each state defines independent contractor status or criteria differently.

Contracting Models

There are two general contractor models in the U.S.

Agency Contractors. Contractors who work for or rely upon agencies to place them and to provide certain administrative and risk management functions on their behalf.

Independent Contractors. Independent contractors typically sign an Independent Contractor Agreement, not relying upon support of an agency for placement or management.

Engagement Models

There are two primary engagement models for working with freelancers who are to be engaged as independent contractors in the U.S.

A. Direct engagement of the worker as an Independent Contractor. Under this model, the hiring company engages directly with the independent contractor and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the independent contractor agreement or statement of work contract.

B. Agent of Record. Agent of Record (AOR) firms screen and engage freelancers as independent contractors on their client’s behalf. AORs specialize in the proper classification of workers as independent contractors and managing the ongoing risk of misclassification during the workers’ engagement with client companies.

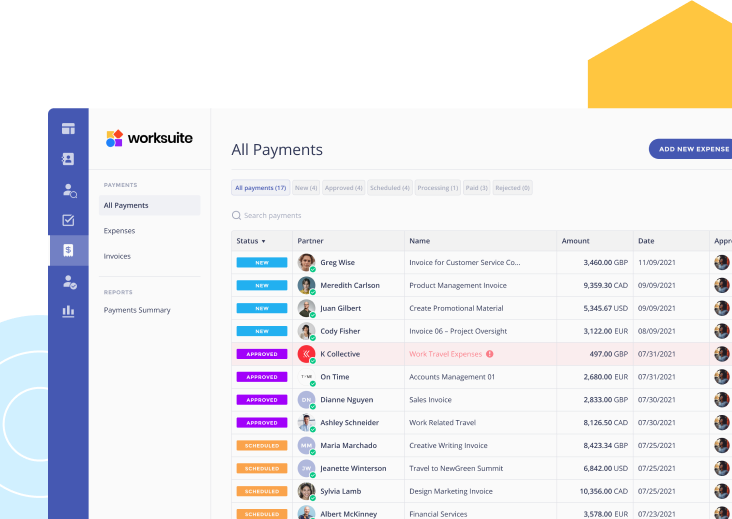

Contractor Payment

Companies hiring independent contractors in the U.S. should make payments to independent contractors as they would any other third-party vendor or business they engage.

If you work with an agent of record or a freelance management system like Worksuite, the contractor payment processes are significantly streamlined and foreign exchange risks are effectively managed. A dependable partner can help you hire your contractors legally and pay them quickly, accurately, in the local currency, and in a way that complies with U.S. regulations.

Contractor Taxes

Independent contractors in the U.S. are responsible for reporting and paying their own income tax. Client companies file Form 1099-NEC with the IRS when payments to individual independent contractors exceed $600 annually. Independent contractors also receive the Form 1099-NEC from the client company for use in their individual or business tax filings.

Income Tax

The Internal Revenue Service requires individuals to pay self employment taxes on all earnings as an independent contractor. Further, the IRS requires quarterly estimated tax reporting and payments on income derived from independent contractor or 1099 classified engagements.

Compared to employees, independent contractors have access to significant tax advantages. They can write off several business expenses, giving them the potential to reduce their relative taxable income.

At the same time, employers can be tempted to classify workers as independent contractors by the prospect of lower costs (no employer side payroll taxes or employee benefit contributions) and lessened administrative burdens (no payroll deductions).

These double-sided incentives are one of the main reasons why employees frequently end up wrongly classified as independent contractors in the U.S. Employers should take significant care to avoid this situation. Working with a partner like Worksuite is a major step towards ensuring ongoing compliance with all relevant United States federal and individual state legislation.

Employment in the US

We can simplify hiring full-time workers in the United States by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in the US without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in the US

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in the US?

Look no further.

Talk to an Expert