Compliantly Engage Contractors in Ireland

Our workforce compliance guide to Ireland covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Ireland.

Local Time

Currency

Euro (EUR)Official Language(s)

EnglishPopulation

4.995 Million (2020)Economic Region

European UnionGDP

418.6 Billion USD (2020)GDP Growth rate

3.4% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Ireland.

We work with the best legal partners in Ireland to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with Irish law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Ireland

Any business hiring in Ireland should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses who are hiring contractors under the guise of employment.

In Ireland, merely describing an individual as an independent contractor has no legal significance. Instead, various factors are taken into account to determine the true legal status of the individual. Therefore, understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Ireland. Instances of ‘false self-employment,’ as defined under The Competition (Amendment) Act 2017, may lead to the worker losing both employment rights and social welfare benefits.

It is important to work with a partner like Worksuite to ensure that you have an engagement framework that properly classifies freelancers able to work as independent contractors. Alternatively, Worksuite can automatically alert you when freelance talent must be engaged directly as employees, or contractors on payroll.

Factors

Employee

Independent Contractor

Employment Laws

General employment law in Ireland comes from a combination of several different pieces of legislation, including:

- The Organisation of Working Time Act 1997

- The Workplace Relations Act 2015

- The General Data Protection Regulation

- Common law

- Statutory provisions

- Rights enshrined in the Irish Constitution

- European Community legislation

- Decisions from the Court of Justice of the European Union

Independent contractors are not protected by general employment laws in the same way employees are. However, the Companies Act 2014 and the General Data Protection Regulation do still apply.

Hiring Practice

Hiring practices generally involve the employer preparing a job description, advertising the role (e.g., online), conducting job interviews and other candidate tests, and then making an offer to the candidate. Employers must ensure the worker has the legal right to work in Ireland. They must also secure a copy of the new employee’s latest P45 certificate, agree upon a salary, and register their employment with the Revenue

Independent contractors in Ireland must formally agree upon a contract for service with their client(s). This specifies the work the contractor will complete and the agreed fee the contractor will receive.

Tax Filing Documents

Most employees do not need to file a tax return. However, there are some circumstances in which this is necessary. An employee in Ireland must complete an income tax return (form 12S or Income Tax Form 11) if they wish to:

- Claim additional tax credits, reliefs or expenses

- Declare any income generated outside their employment

- Obtain a Statement of Liability

- Claim refunds for overpaid tax or USC.

Employees can also use their myAccount service to inform the Revenue when they have ceased an existing job or started a new job.

Independent contractors must either complete an income tax return or, if they trade as a company, a corporation tax return, including filing a CT1 Form and a 46G Form (Company).

Payer Tax Filing Requirements

Employers must withhold and report both tax and PRSI payments. All deductions should be reported to the Office of the Revenue Commissioners.

Payments to an independent contractor are usually made without any tax deductions. Independent contractors in Ireland are not covered by the PAYE system.

Other Tax Filing Requirements

Employees in Ireland pay directly from their gross pay income tax, pay-related social insurance (PRSI) and, if they earn more than €13,000 per year, a universal social charge (USC). In some cases, the employer as well as the employee pays PRSI contributions.

Independent contractors in Ireland can set up and operate their activity through a limited company. This involves filing Form A1 with the Companies Registration Office

Remuneration

Employees are paid on an hourly, weekly, or monthly basis

Independent contractors in Ireland typically submit an invoice on a monthly basis.

Workers Rights

Employees in Ireland are entitled to maternity leave, paternity leave, adoptive leave, parental leave, parent’s leave, carer’s leave, equality in the workplace, whistleblowing protection, redundancy payments, protection from unfair dismissal, sick pay, public holidays, and a national minimum wage.

Independent contractors in Ireland have few statutory rights. Their work can be terminated in adherence with the terms of their contract for service.

Benefits

All employee benefits are paid by the employer. Employers do not have to make mandatory pension contributions, but Ireland is in the process of moving towards auto-enrolment.

Some employees also benefit from income tax credits and reliefs.

Independent contractors in Ireland are not entitled to the benefits typically given to employees. A contractor’s clients do not make PRSI, pension or health insurance contributions on the contractor’s behalf. Contractors are also not entitled to maternity, paternity, or sick pay

Employee

Employment Laws

General employment law in Ireland comes from a combination of several different pieces of legislation, including:

- The Organisation of Working Time Act 1997

- The Workplace Relations Act 2015

- The General Data Protection Regulation

- Common law

- Statutory provisions

- Rights enshrined in the Irish Constitution

- European Community legislation

- Decisions from the Court of Justice of the European Union

Hiring Practice

Hiring practices generally involve the employer preparing a job description, advertising the role (e.g., online), conducting job interviews and other candidate tests, and then making an offer to the candidate. Employers must ensure the worker has the legal right to work in Ireland. They must also secure a copy of the new employee’s latest P45 certificate, agree upon a salary, and register their employment with the Revenue

Tax Filing Documents

Most employees do not need to file a tax return. However, there are some circumstances in which this is necessary. An employee in Ireland must complete an income tax return (form 12S or Income Tax Form 11) if they wish to:

- Claim additional tax credits, reliefs or expenses

- Declare any income generated outside their employment

- Obtain a Statement of Liability

- Claim refunds for overpaid tax or USC.

Employees can also use their myAccount service to inform the Revenue when they have ceased an existing job or started a new job.

Payer Tax Filing Requirements

Employers must withhold and report both tax and PRSI payments. All deductions should be reported to the Office of the Revenue Commissioners.

Other Tax Filing Requirements

Employees in Ireland pay directly from their gross pay income tax, pay-related social insurance (PRSI) and, if they earn more than €13,000 per year, a universal social charge (USC). In some cases, the employer as well as the employee pays PRSI contributions.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis

Workers Rights

Employees in Ireland are entitled to maternity leave, paternity leave, adoptive leave, parental leave, parent’s leave, carer’s leave, equality in the workplace, whistleblowing protection, redundancy payments, protection from unfair dismissal, sick pay, public holidays, and a national minimum wage.

Benefits

All employee benefits are paid by the employer. Employers do not have to make mandatory pension contributions, but Ireland is in the process of moving towards auto-enrolment.

Some employees also benefit from income tax credits and reliefs.

Independent Contractor

Employment Laws

Independent contractors are not protected by general employment laws in the same way employees are. However, the Companies Act 2014 and the General Data Protection Regulation do still apply.

Hiring Practice

Independent contractors in Ireland must formally agree upon a contract for service with their client(s). This specifies the work the contractor will complete and the agreed fee the contractor will receive.

Tax Filing Documents

Independent contractors must either complete an income tax return or, if they trade as a company, a corporation tax return, including filing a CT1 Form and a 46G Form (Company).

Payer Tax Filing Requirements

Payments to an independent contractor are usually made without any tax deductions. Independent contractors in Ireland are not covered by the PAYE system.

Other Tax Filing Requirements

Independent contractors in Ireland can set up and operate their activity through a limited company. This involves filing Form A1 with the Companies Registration Office

Remuneration

Independent contractors in Ireland typically submit an invoice on a monthly basis.

Workers Rights

Independent contractors in Ireland have few statutory rights. Their work can be terminated in adherence with the terms of their contract for service.

Benefits

Independent contractors in Ireland are not entitled to the benefits typically given to employees. A contractor’s clients do not make PRSI, pension or health insurance contributions on the contractor’s behalf. Contractors are also not entitled to maternity, paternity, or sick pay

Who classifies as an Independent Contractor in Ireland?

In Ireland, five main factors are considered when determining if a worker is an employee or an independent contractor. These were outlined in a 2021 Code of Practice developed by The Office of the Revenue Commissioners and the Department of Social, Community and Family Affairs. They are:

- Mutuality of obligation. Is there an obligation for either the company to provide work, or for the worker to accept it?

- Substitution. Can the worker task someone else with completing the work? And if so, who pays the new worker?

- The enterprise test. Is the worker either able to profit, through their own efficiency, or accrue a loss, through poor service or practice, while completing the work?

- Integration. Is the worker embedded in the business, or simply providing an external service that is peripheral to the organization?

- Control. Can the person or business paying for the work decide how, where and when the work should be completed?

Contracting Models

Independent contractors in Ireland work under one of two main categories: a self-employed freelancer (either through a limited company or as a sole trader – see section 4.1), or through a third-party umbrella company (either PAYE or Director – see section 4.2).

- Self-employed freelancer: Independent contractors can work as freelancers without establishing their own company, or they can establish a limited company through which they offer their services. In either instance, the contractor issues an invoice for the work done and the client pays the contractor in full. No deductions are made at source.

- Operating through an umbrella company: Independent contractors can work through a third-party umbrella company. These arrangements normally ease the financial and legal administrative burden faced by a contractor.

Engagement Models

There are two primary engagement models for working with independent contractors in Ireland:

- Direct engagement of the independent contractor as self-employed or registered via their own limited company.

- Contract for service: Under these agreements, a contractor commits to completing a specified job for an agreed fee. The contractor has control over how, when and where the work is completed. They may also subcontract the work to other people. Under a contract for service, the contractor also provides any materials necessary to complete the job and is able, through their own entrepreneurial talents, to profit from the work.

- Third party: Two options are popular for independent contractors in Ireland.

- Umbrella company (PAYE): Under this model, which is ideal for short-term contracts or where work permits or visas do not allow for being self-employed, the contractor ‘joins’ a PAYE umbrella company. The contractors tax and PRSI contributions are deducted at source, freeing the contractor from the administrative burden of operating their own company. However, contractors using a PAYE umbrella company will pay both the employee and employer PRSI contributions.

- Umbrella company (director): Under this model, the contractor enjoys the same benefits of running a limited company, but has to endure none of the hassle and costs of actually setting up and running a limited company. The umbrella company completes all of the contractor’s invoicing and tax affairs for a fixed monthly fee. This set-up is usually used by contractors working on agreements that last six months or more.

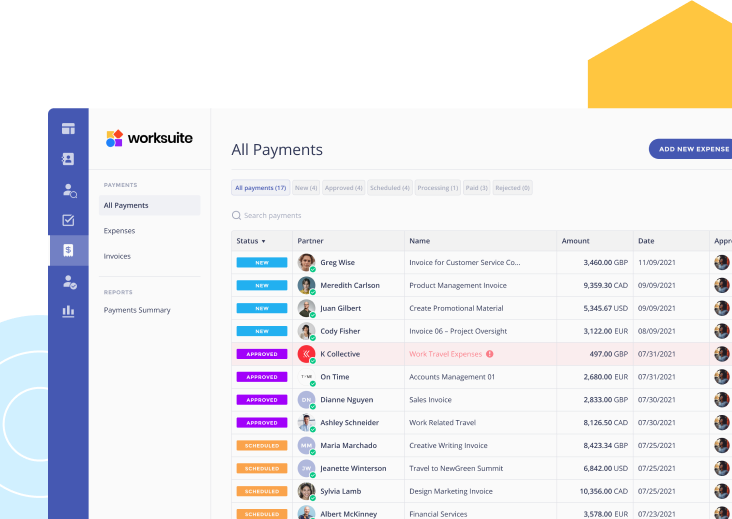

Contractor Payments

Companies hiring independent contractors in Ireland should avoid making payments directly through their payroll system. The contract for service should stipulate agreed fees, payment methods and payment dates.

Taxes and social security

Independent contractors hired via direct engagement are not paid as part of an Irish company’s payroll. Their fees are paid without any deductions at source for tax or other benefits.

Independent contractors in Ireland pay class S of PRSI at a rate of 4%. Contractors earning more than €100,000 per year are obliged to pay a universal social charge surcharge of 3%. Contractors are not eligible for a range of benefits, including invalidity benefit and illness benefit.

Independent contractors hired through an umbrella company may be liable for extra PRSI payments at a rate of 10.95%. In return, they are able to enjoy state benefits.

Looking to compliantly engage contractors in Ireland?

Look no further

Talk to an Expert