Compliantly Engage Contractors in Singapore

Our workforce compliance guide to Ireland covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Ireland.

Local Time

Currency

Singapore Dollar (SGD)Official Language(s)

EnglishPopulation

5.686 Million (2020)GDP

340 Billion USD (2020)GDP Growth rate

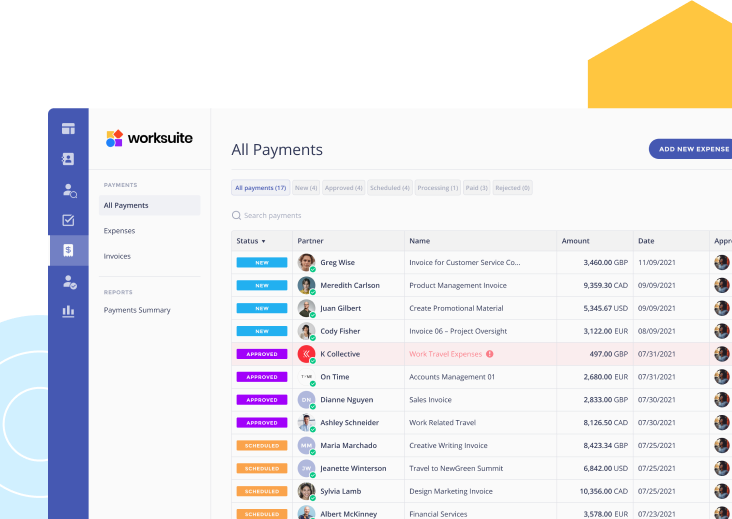

-5.4% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Singapore.

We work with the best legal partners in Singapore to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with Irish law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Singapore

Any business hiring in Singapore should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses that are hiring independent contractors under the guise of employment. Moreover, if an individual whom the Courts reclassify from independent contractor to employee is a Singaporean citizen or permanent resident, the hiring company will then be liable to pay additional statutory contributions to Singapore’s Central Provident Fund (CPF).

Understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Singapore. It is important to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies freelancers as independent contractors for you and lets you know when freelance talent must be engaged as a payrolled independent contractor or employed directly. This is critical to compliantly engaging workers in Singapore and thereby avoiding severe legal, financial, and other penalties.

Factors

Employee

Independent Contractor

Employment Laws

Employment Act of Singapore (“Employment Act”) (applies to all employees regardless of nationality); Income Tax Act of Singapore.

There are no specific laws governing the hiring of independent contractors in Singapore.

Hiring Practice

Hiring practices are similar to many other countries. Candidates will typically submit a CV (which may include a photo) and a 1-page cover letter. Hiring steps include one or more rounds of interviews and possibly assessments. Employers issue successful candidates with an offer letter, after which the employment contract is signed and the employee is onboarded. Employees must be issued with the statutory Key Employment Terms (KETs) within 14 days of hiring, which include: details of employment (such as title, start date, and responsibilities), working hours, salary, medical benefits, and leave

Independent contractors who are citizens or permanent residents can be hired directly or via an intermediary, such as a staffing agency or umbrella company. They may be found via word of mouth, job boards, social networks, industry bodies, or other forums. Foreign nationals and non-residents will need to be hired as employees.

For citizens and permanent residents, the two main categories of an independent contractor are:

- Self-employed

- Limited company

Tax Filing Documents

Income tax rates depend on resident status. Citizens or permanent residents pay a progressive tax rate of up to 22% of their monthly salary (rising to 24% in 2023), while foreign nationals pay 15% or the progressive rate, whichever is higher. Annual personal tax returns for the preceding year must be submitted to IRAS (Inland Revenue Authority of Singapore) by 15 April (paper) or 18 April (electronic) of the current year. E-filing can be completed at IRAS’s myTax Portal

Singaporean citizens and permanent residents also pay mandatory contributions to the Central Provident Fund (CPF), which funds their retirement, housing, and healthcare

For independent contractors who are citizens or residents, the progressive tax rate of up to 22% (24% in 2023) also applies. Contractors operating as a business entity (i.e., an LLC) pay a flat corporate tax rate of 17%.

Contractors can file tax returns and pay taxes via the IRAS myTax Portal.

As only Singaporean citizens or permanent residents can legally work as self-employed independent contractors, all contractors will by definition also need to pay mandatory contributions to the CPF

Payer Tax Withholding and Reporting Requirements

For all their employees who are citizens or permanent residents of Singapore, employers pay mandatory contributions to the Central Provident Fund (CPF). Employers pay up to 17% per qualifying employee.

Hiring companies do not withhold any tax from independent contractors’ payments.

Other Tax Filing Requirements

N/A

N/A

Remuneration

Employees are typically paid monthly.

Independent contractors are paid according to a schedule defined within the contract.

Workers’ Rights

Under the Employment Act, benefits for most employees include: paid public holidays; paid sick leave; minimum 7 days’ annual leave; maternity leave; childcare leave (for citizens and permanent residents); overtime pay; protection from unfair termination; minimum notice period. There is no minimum wage

There are no statutory rights for independent contractors.

Benefits

Enrolment in the CPF is mandatory for all citizens and permanent residents. Beyond this, other benefits will be discretionary.

Independent contractors’ benefits are governed by the content of the contract. There are no statutory benefits.

When Paid

Employees are paid on a monthly basis directly into their bank account.

Independent contractors send an invoice (or another form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Employee

Employment Laws

Employment Act of Singapore (“Employment Act”) (applies to all employees regardless of nationality); Income Tax Act of Singapore.

Hiring Practice

Hiring practices are similar to many other countries. Candidates will typically submit a CV (which may include a photo) and a 1-page cover letter. Hiring steps include one or more rounds of interviews and possibly assessments. Employers issue successful candidates with an offer letter, after which the employment contract is signed and the employee is onboarded. Employees must be issued with the statutory Key Employment Terms (KETs) within 14 days of hiring, which include: details of employment (such as title, start date, and responsibilities), working hours, salary, medical benefits, and leave

Tax Filing Documents

Income tax rates depend on resident status. Citizens or permanent residents pay a progressive tax rate of up to 22% of their monthly salary (rising to 24% in 2023), while foreign nationals pay 15% or the progressive rate, whichever is higher. Annual personal tax returns for the preceding year must be submitted to IRAS (Inland Revenue Authority of Singapore) by 15 April (paper) or 18 April (electronic) of the current year. E-filing can be completed at IRAS’s myTax Portal

Singaporean citizens and permanent residents also pay mandatory contributions to the Central Provident Fund (CPF), which funds their retirement, housing, and healthcare

Payer Tax Withholding and Reporting Requirements

For all their employees who are citizens or permanent residents of Singapore, employers pay mandatory contributions to the Central Provident Fund (CPF). Employers pay up to 17% per qualifying employee.

Other Tax Filing Requirements

N/A

Remuneration

Employees are typically paid monthly.

Workers’ Rights

Under the Employment Act, benefits for most employees include: paid public holidays; paid sick leave; minimum 7 days’ annual leave; maternity leave; childcare leave (for citizens and permanent residents); overtime pay; protection from unfair termination; minimum notice period. There is no minimum wage

Benefits

Enrolment in the CPF is mandatory for all citizens and permanent residents. Beyond this, other benefits will be discretionary.

When Paid

Employees are paid on a monthly basis directly into their bank account.

Independent Contractor

Employment Laws

There are no specific laws governing the hiring of independent contractors in Singapore.

Hiring Practice

Independent contractors who are citizens or permanent residents can be hired directly or via an intermediary, such as a staffing agency or umbrella company. They may be found via word of mouth, job boards, social networks, industry bodies, or other forums. Foreign nationals and non-residents will need to be hired as employees.

For citizens and permanent residents, the two main categories of an independent contractor are:

- Self-employed

- Limited company

Tax Filing Documents

For independent contractors who are citizens or residents, the progressive tax rate of up to 22% (24% in 2023) also applies. Contractors operating as a business entity (i.e., an LLC) pay a flat corporate tax rate of 17%.

Contractors can file tax returns and pay taxes via the IRAS myTax Portal.

As only Singaporean citizens or permanent residents can legally work as self-employed independent contractors, all contractors will by definition also need to pay mandatory contributions to the CPF

Payer Tax Withholding and Reporting Requirements

Hiring companies do not withhold any tax from independent contractors’ payments.

Other Tax Filing Requirements

N/A

Remuneration

Independent contractors are paid according to a schedule defined within the contract.

Workers’ Rights

There are no statutory rights for independent contractors.

Benefits

Independent contractors’ benefits are governed by the content of the contract. There are no statutory benefits.

When Paid

Independent contractors send an invoice (or another form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Engaging Contractors in Singapore

Self-employment as an independent contractor is a popular income model for many individuals in Singapore, with nearly 15% of the workforce operating as self-employed as of June 2020. In Singapore, employees tend to work under what’s called a “contract of service”, while independent contractors will have a “contract for service” or a “freelance service contract”. However, as with many other countries, there are various factors that the Courts will consider when making this determination.

Regardless of how the hiring company and the individual describe their relationship, if the real substance of the company-contractor relationship proves to effectively be an employment relationship, the hiring company may suffer legal and financial penalties (including payroll taxes). It is therefore important to leverage an employment service partner like Worksuite when hiring in Singapore to ensure that independent contractors fall under the correct working relationship with your business.

As in some countries, in Singapore it is illegal for foreign nationals or non-residents to work as independent contractors or self-employed freelancers. All such individuals require employment sponsorship to cover each of their working engagements. This means that hiring an individual in Singapore who is a foreign national or non-resident effectively requires hiring them as an employee for the duration of the engagement.

Who classifies as an Independent Contractor in Singapore

In Singapore, as in many countries, the hiring company’s level of direct control and supervision (otherwise known as “legal subordination”) is a key factor in determining whether an individual is an employee or an independent contractor. Employees will be subject to the employer’s rules, policies and procedures, while independent contractors will not. Because this is often difficult to determine in reality, the Courts will assess additional factors. Beyond legal subordination, individuals are generally considered to be independent contractors if they:

- Do not have fixed hours of work that are determined by the hiring company

- Can choose the location from which they work.

- Provide their own equipment, rather than receive it from the hiring company.

- Have a share in the profits and face the risk for any losses, relating to the work.

- Are not integrated into the hiring company’s organizational structure.

- Are paid for a specific project or task rather than on a regular basis.

- Are not listed on the hiring company’s normal payroll.

- Have the right (or are expected) to work for multiple clients.

In the event of a dispute over whether someone who is currently classified as an independent contractor is actually an employee, the burden of proof will generally be on the contractor to demonstrate that they are, in fact, an employee.

Contracting Models

There are two main categories under which independent contractors operate in Singapore:

Self-employed freelancer: This refers to individuals who work as independent contractors but have not formed their own company. Self-employed freelancers must file and pay their own taxes and social security contributions, and they naturally have unlimited liability for any business debts they incur. Note: All foreign nationals and non-residents who are not involved in running a limited company will need employee sponsorship from the hiring company, as there is no work permit available for self-employment in Singapore.

Limited liability company (LLC): Independent contractors can also operate through running an LLC. The most common types of LLC in Singapore are: Private Limited Company (where company names are often suffixed with “Private Limited”, “Pte Ltd”, or “Ltd”), which comprises the majority of companies in Singapore; and Public Limited Company. (The third type of public LLC, the Public Company Limited by Guarantee, is reserved for non-profit purposes). All companies must register with the Accounting and Corporate Regulatory Authority (ACRA). Each of these LLC structures entails different tax implications, and all LLCs require at least one Singaporean director.

Engagement models

There are two main types of contracting models for working with independent contractors in Singapore.

A. Direct engagement of the contractor as self-employed or registered via their own company. Under this model, the hiring company engages directly with the independent contractor – either as an individual self-employed freelancer or as a limited company (see above) – and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, under the terms of the contract. If the would-be contractor is not a Singaporean citizen or permanent resident, the hiring company will need to sponsor their work visa.

B. Third party. These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Temp agency: Here, the hiring company engages with a staffing agency, which in turn supplies one of its own independent contractors to deliver the contracted services. The hiring company pays the staffing agency directly, under the terms of the contract. The contract is, therefore, between the hiring company and the staffing agency, while the agency pays the independent contractor through a separate contractual arrangement.

- Umbrella company: Independent contractors can also work through an umbrella company. This turns a ‘self-employed’ individual into a legal ‘employee’ of the umbrella company. The contractual relationship is between the umbrella company and the client, with the umbrella company running payroll and administration for the independent contractor. The umbrella company invoices the client directly while paying the contractor via PAYE as a standard employee. Umbrella companies levy a fee on the contractor to cover their costs.

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Payments

Companies hiring independent contractors in Singapore should avoid making payments directly through their payroll system. The exception is when hiring foreign nationals or non-residents, who will require visa sponsorship and will therefore need to be paid as employees for the duration of their engagement. Beyond these guidelines, there are no specific legal requirements related to paying contractors in Singapore. The contract should stipulate the preferred payment method agreed upon by both parties.

Tax and Social Security

Income tax rates depend on residency status. Employees and independent contractors who are Singaporean citizens or permanent residents pay a progressive tax rate up to 22% (rising to 24% in 2023), while foreign nationals pay 15% or the progressive rate, whichever is higher. Contractors operating as a business entity (i.e., an LLC) pay a flat corporate tax rate of 17%. The tax year in Singapore aligns with the calendar year (1 January to 31 December). Annual personal tax returns for the preceding year must be submitted to IRAS (Inland Revenue Authority of Singapore) by 15 April (paper) or 18 April (electronic) of the current year. Employees and contractors can submit their tax returns and pay taxes via IRAS’s myTax Portal.

Whether working as an employee or contractor, all Singaporean citizens and permanent residents must enroll in and pay mandatory contributions to the Central Provident Fund (CPF), which funds retirement, housing, and healthcare. Also, for all their employees who are citizens or permanent residents, employers pay additional mandatory contributions to the Central Provident Fund (CPF) at 17% per qualifying employee’s salary.

Looking to Compliantly Engage Contractors in Singapore?

Look no further.

Talk to an Expert