Compliantly Engage Contractors in France

Our workforce compliance guide to France covers everything you need to compliantly hire, onboard, manage and pay independent contractors in France.

Local Time

Currency

Euro (EUR)Official Language(s)

FrenchPopulation

67 Million (2020)Economic Region

European UnionGDP

2603 Billion USD (2020)GDP Growth rate

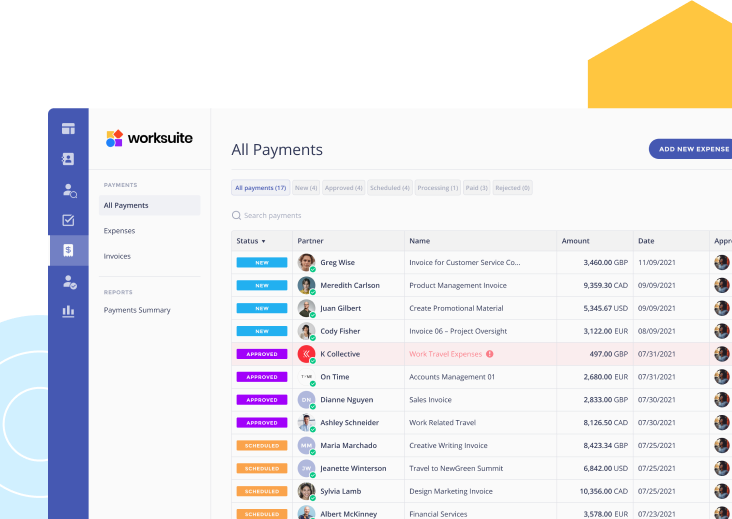

-8.1% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in France.

We work with the best legal partners in France to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with the French law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in France

Any business hiring in France should understand the important legal distinction between who is classified as an employee, and who can be engaged as an independent contractor. Fines or penalties may be issued to businesses that are hiring employees under the guise of independent contractors or freelancers.

In France, merely describing an individual as an independent contractor has no legal significance. Instead, various factors are taken into account to determine the true legal status of the individual. Therefore, understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in France.

It is important to work with a partner like Worksuite to ensure that you have an engagement framework that properly classifies freelancers able to work as independent contractors. Alternatively, Worksuite can automatically alert you when freelance talent must be engaged directly as employees, or contractors on the payroll.

Factors

Employee

Independent Contractor

Employment Laws

French Labour Code (Code du Travail) and case law (including court rulings), along with collective bargaining agreements, which cover roughly 75 percent of French employees (unionized and non-unionized).

Case law (including court rulings).

Hiring Practice

Candidates are typically required to submit a CV, cover letter, copies of references and relevant certificates, and often also a photo.

To hire workers in France, hiring companies must notify Pole Emploi, France’s employment service, of every vacancy. After approving a new hire, employers must submit a document unique d’embauche (DUE) to the URSSAF (Unions de Recouvrement des Cotisations de Sécurité Sociale et d’Allocations Familiales), which in turn needs to issue an acknowledgment before the new employee starts work.

The French Labor Code does not account for hiring practices for contractors.

The most common contractor operating models are:

- Entreprise individuelle (EI) (micro-entreprise)

- Entreprise Unipersonelle à Responsibilité Limitée (EURL) (i.e., personal service company)

- Société à responsabilité limitée (SARL) (i.e., limited liability company)

Portage salarial (umbrella company)

Tax Filing Documents

From 2020, employees’ income taxes are deducted directly from their salaries by the employer under a system known as prélèvement à la source (PAS). This is similar to the Pay-As-You-Earn (PAYE) system in other European countries.

Contractors do not have their tax deducted by the hiring company. Contractors must register as self-employed and handle their own tax and social security payments. Contractors pay income tax on a monthly or quarterly basis.

Payer Tax Filing Requirements

Employers are required to withhold employees’ tax and other social security contributions at the time of payment to the employee.

Hiring companies do not withhold any of the contractor’s payment for tax purposes or social security contributions

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Contractors typically submit an invoice on a monthly basis.

Worker’s Rights

Employees’ rights have strong protections under the French Labor Code. This includes overtime, paid leave, termination, the maximum number of weekly working hours, and support from the Unemployment Fund following dismissal.

In particular, the ability for employers to terminate an employee’s contract is strongly regulated, especially during special periods (such as sick leave).

Contractors receive some limited protection under French law. This includes the right to indemnity compensation for unfair termination if a hiring company fails to comply with a contract’s notice period.

Benefits

Employee benefits (pension and healthcare) are paid by the employer, along with a share of the employee’s social security contributions.

Contractors do not receive social security benefits, national pension, or unemployment benefits. However, contractors must still pay social security contributions, which is typically around 30% of their income.

Since January 2018, some contractors working for digital platforms/companies have additional protections if the hiring company meets certain criteria.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. The schedule of payments is not subject to variation.

Contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most businesses.

Employee

Employment Laws

French Labour Code (Code du Travail) and case law (including court rulings), along with collective bargaining agreements, which cover roughly 75 percent of French employees (unionized and non-unionized).

Hiring Practice

Candidates are typically required to submit a CV, cover letter, copies of references and relevant certificates, and often also a photo.

To hire workers in France, hiring companies must notify Pole Emploi, France’s employment service, of every vacancy. After approving a new hire, employers must submit a document unique d’embauche (DUE) to the URSSAF (Unions de Recouvrement des Cotisations de Sécurité Sociale et d’Allocations Familiales), which in turn needs to issue an acknowledgment before the new employee starts work.

Tax Filing Documents

From 2020, employees’ income taxes are deducted directly from their salaries by the employer under a system known as prélèvement à la source (PAS). This is similar to the Pay-As-You-Earn (PAYE) system in other European countries.

Payer Tax Filing Requirements

Employers are required to withhold employees’ tax and other social security contributions at the time of payment to the employee.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Worker’s Rights

Employees’ rights have strong protections under the French Labor Code. This includes overtime, paid leave, termination, the maximum number of weekly working hours, and support from the Unemployment Fund following dismissal.

In particular, the ability for employers to terminate an employee’s contract is strongly regulated, especially during special periods (such as sick leave).

Benefits

Employee benefits (pension and healthcare) are paid by the employer, along with a share of the employee’s social security contributions.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. The schedule of payments is not subject to variation.

Independent Contractor

Employment Laws

Case law (including court rulings).

Hiring Practice

The French Labor Code does not account for hiring practices for contractors.

The most common contractor operating models are:

- Entreprise individuelle (EI) (micro-entreprise)

- Entreprise Unipersonelle à Responsibilité Limitée (EURL) (i.e., personal service company)

- Société à responsabilité limitée (SARL) (i.e., limited liability company)

Portage salarial (umbrella company)

Tax Filing Documents

Contractors do not have their tax deducted by the hiring company. Contractors must register as self-employed and handle their own tax and social security payments. Contractors pay income tax on a monthly or quarterly basis.

Payer Tax Filing Requirements

Hiring companies do not withhold any of the contractor’s payment for tax purposes or social security contributions

Remuneration

Contractors typically submit an invoice on a monthly basis.

Worker’s Rights

Contractors receive some limited protection under French law. This includes the right to indemnity compensation for unfair termination if a hiring company fails to comply with a contract’s notice period.

Benefits

Contractors do not receive social security benefits, national pension, or unemployment benefits. However, contractors must still pay social security contributions, which is typically around 30% of their income.

Since January 2018, some contractors working for digital platforms/companies have additional protections if the hiring company meets certain criteria.

When Paid

Contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission, unless otherwise stipulated in the contract. Contractors are not paid by payroll in most businesses.

Who classifies as an Independent Contractor in France?

In defining the distinction between an employee and an independent contractor, French law focuses on the nature of the relationship between the individual and the hiring company. The core factor is known as the subordination relationship. In short, an individual can be considered an independent contractor if they:

- Carry out their tasks or projects autonomously.

- Can schedule their work for whatever time they see fit and do not have to comply with standard working hours.

- Provide their own equipment to complete the assigned task.

- Have been hired to perform a task or set of tasks which the hiring company is largely unable to do using its own employee workforce.

- Are not issued frequent tasks or instructions by the hiring company beyond what the individual was initially tasked to do.

- Are not subject to punishments or reprimands by the hiring company for violating their duties.

- Are paid a single sum upon fulfillment of their responsibilities, rather than receiving a regular payment.

- Are likely to be working for multiple clients, often in parallel.

Contracting Models

Independent contractors in France may operate under one of several contractor models. The key contractor models include:

- Entreprise individuelle (EI) (micro-entreprise): EI is tax status and is common for individuals who want to work as contractors but without creating a separate legal entity. The individual will have unlimited liability for all debts incurred in running the business. Contractors can only operate as EI if their turnover is below a certain threshold.

- Entreprise Unipersonelle à Responsibilité Limitée (EURL) (personal service company): A EURL is a limited company owned by a single person, likely the contractor themself. EURL contractors can choose to pay tax as personal income tax or as corporation tax.

- Société à responsabilité limitée SARL (limited liability company): A SARL is also a limited company, but it has more than one owner. SARL companies pay corporation tax.

Engagement Models

There are two primary engagement models for working with independent contractors in France.

A. Direct engagement of the worker as self-employed or registered via their own limited company. Under this model, the hiring company engages directly with the independent contractor and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the contract.

B. Work Contract: Under a work contract, the contractor is required to deliver a piece of work or a certain outcome in exchange for a one-off fixed remuneration. Each contract relates to the delivery of a single ‘work’. The contractor bears the risk under this contract and is obliged to fix any errors or other defects until the contractual specifications of the work are achieved.

- Umbrella company (Portage salarial). These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Staffing agency. Some contractors may work under an umbrella company. In this case, the contractor is responsible for finding and fulfilling their work, but they are an employee of the umbrella company, which manages payroll and applies an administration fee on the contractor’s earnings portage salarial companies are subject to some collective bargaining parameters.

- Hiring Partners. The hiring company can also work with a hiring partner who helps them vet potential contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Advantages & disadvantages: Micro-enterprise vs Portage Salarial (Umbrella Company)

Since 2009, an easy business status has been created to facilitate the setting up of a small enterprise in France. At first named auto-entrepreneur, it’s now known as micro-enterprise. Those adopting this status run the enterprise as micro-entrepreneur.

As for the Portage Salarial status, it is the best way to benefit from the entrepreneur process and the social advantages of the employee status whilst being completely independent.

Contractor Taxes

Contractors operating in France pay tax via personal income tax or corporation tax. Contractors operating as EI pay personal income tax (although they can choose corporate tax under some conditions). Contractors operating as a EURL company pay income tax or corporate tax, depending on whether the contractor is listed as a non-legal entity or a legal entity. Contractors operating as a SARL company typically pay corporate tax unless the company is under five years old.

Social Security

Even though contractors do not receive social security benefits, they must still make social security contributions. Contractors who are registered as a micro-enterprise or a EURL company or are a majority shareholder in a SARL company pay their social security contributions via the régime des non salariés (TNS). Contractors who are a minority or equal shareholder in a SARL company pay contributions via the régime des salariés (TS)

Employment in France

We can simplify hiring full-time workers in France by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in France without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in France

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Engage Contractors in France?

Look no further.

Contact us