Compliantly Engage Contractors in India

Our workforce compliance guide to India covers everything you need to compliantly hire, onboard, manage and pay independent contractors in India.

Local Time

Currency

Indian Rupee (INR)Official Language(s)

HindiPopulation

1360 Million (2021)GDP

2622 Billion USD (2020)GDP Growth rate

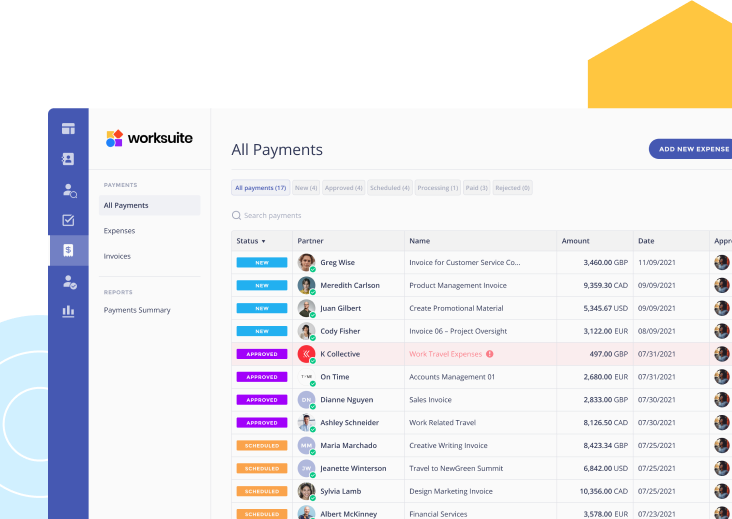

8.9% (2021)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in India

We work with the best legal partners in India to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with Indian law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in India

Any business hiring in India should understand the important legal distinction between who classifies as an independent contractor, and who can be hired as an employee. Fines or penalties may be issued to businesses who are hiring contractors under what qualifies as legal employment in India. It is important to work with a partner like Worksuite to establish a legal hiring framework that falls under compliance. Common factors weighed include:

- What degree of control and supervision does the company have over the worker?

- Who provides equipment, work space, amenities, internet, etc.?

- Does the company provide benefits such as pension, insurance, or vacation pay?

- What is the nature of the relationship, and how long is the period of work?

- Who has the authority to terminate cooperation?

Factors

Employee

Independent Contractor

Employment Laws

Governed by The Central Government of India, The Ministry of Labour & Employment, and Supreme Court case decisions.

Contractors, freelancers and consultants are protected by the Contract Labour Regulation and Abolition Act, 1970.

Hiring Practice

Employers must deliver a formal offer letter, conduct background checks, and expressly state that the person’s employment with the organization is contingent upon passing the background tests and vetting of educational and job qualifications. Employers must also show data protection compliance under the Personal Data Protection Bill.

A foreign company can hire contractors directly to work from India, or many companies also hire an existing Indian company on a contract basis who will manage workers.

A contract for service should establish no control or supervision from the employer. It is important to not confuse this term with ‘contract of service’ which is essentially the opposite type of contract..

Tax Documents

Employers can find relevant Tax Criteria, Calendars and Calculators to submit at the convenient e-Filing Portal for foreign entities.

The e-Filing portal by the Government of IndiaThe e-Filing portal makes it easy and secure for Independent contractors to file forms related to their line of work. The two most important filings are:

- ITR – Income Tax Return

- GST – Goods & Services Tax

Employers may want to acquire the following information from contractors:

- PAN (Personal Account Number) for taxes

- Aadhaar card number

- Bank account for receiving payments

- Certificates of educational qualifications and other credentials

- A C.V. with detailed information of skills, past employment experience, etc.

Payer’s Tax Reporting Requirements

An employer is required to withhold tax at the time of payment of salary to employees. The salary paid to an employee may include benefits and allowances that the employee is entitled to, which is beneficial to the employee from a tax perspective.

Clients who are required to comply with TDS provisions as per the Income Tax Act, 1961 are liable to deduct TDS from payment of fees for professional services at the prescribed rates (10%) if the payment exceeds the threshold limit in a year (currently INR 30,000).

Other Tax Requirements

Employees generally only need to file their own Income Tax Return (ITR) online

All freelancers are liable to pay GST if their annual income exceeds INR 20 lakh, and invoices must be compliant with India’s GST regulations.

Remuneration

Earns either an hourly rate or a salary

Invoice-based payments (typically once a month)

Worker’s Rights

The Ministry of Labour & Employment governs minimum wage, working time standards, the admissible number of overtime hours, public holidays, annual leave, maternity leave and termination.

Labor laws do not apply to employees performing work on the basis of a contract for service.

Benefits

Foreign employers in India typically contribute up to 12% for the Employees’ Provident Fund (pension fund), 4.75% to health insurance, and smaller denominations for filing fees.

An independent contractor is not entitled to any benefits, as it may be considered terms of employment in India.

When Paid

India conforms to a monthly payroll cycle, with wages paid on or after the 28th of each month. The 13th salary in India is often mandatory (a percentage of the annual salary).

A contractor sends an invoice, and the employing company is responsible for paying it based on details agreed upon in the contract. Contractors are not paid by payroll in most businesses, and often include the following information on invoices:

- Invoice Number and Date

- Client Name and Address

- Client TIN / GST number, if applicable

- Details of work completed

- Amount in INR

- Bank account details with PAN

Employee

Employment Laws

Governed by The Central Government of India, The Ministry of Labour & Employment, and Supreme Court case decisions.

Hiring Practice

Employers must deliver a formal offer letter, conduct background checks, and expressly state that the person’s employment with the organization is contingent upon passing the background tests and vetting of educational and job qualifications. Employers must also show data protection compliance under the Personal Data Protection Bill.

Tax Documents

Employers can find relevant Tax Criteria, Calendars and Calculators to submit at the convenient e-Filing Portal for foreign entities.

Payer’s Tax Reporting Requirements

An employer is required to withhold tax at the time of payment of salary to employees. The salary paid to an employee may include benefits and allowances that the employee is entitled to, which is beneficial to the employee from a tax perspective.

Other Tax Requirements

Employees generally only need to file their own Income Tax Return (ITR) online

Remuneration

Earns either an hourly rate or a salary

Worker’s Rights

The Ministry of Labour & Employment governs minimum wage, working time standards, the admissible number of overtime hours, public holidays, annual leave, maternity leave and termination.

Benefits

Foreign employers in India typically contribute up to 12% for the Employees’ Provident Fund (pension fund), 4.75% to health insurance, and smaller denominations for filing fees.

When Paid

India conforms to a monthly payroll cycle, with wages paid on or after the 28th of each month. The 13th salary in India is often mandatory (a percentage of the annual salary).

Independent Contractor

Employment Laws

Contractors, freelancers and consultants are protected by the Contract Labour Regulation and Abolition Act, 1970.

Hiring Practice

A foreign company can hire contractors directly to work from India, or many companies also hire an existing Indian company on a contract basis who will manage workers.

A contract for service should establish no control or supervision from the employer. It is important to not confuse this term with ‘contract of service’ which is essentially the opposite type of contract..

Tax Documents

The e-Filing portal by the Government of IndiaThe e-Filing portal makes it easy and secure for Independent contractors to file forms related to their line of work. The two most important filings are:

- ITR – Income Tax Return

- GST – Goods & Services Tax

Employers may want to acquire the following information from contractors:

- PAN (Personal Account Number) for taxes

- Aadhaar card number

- Bank account for receiving payments

- Certificates of educational qualifications and other credentials

- A C.V. with detailed information of skills, past employment experience, etc.

Payer’s Tax Reporting Requirements

Clients who are required to comply with TDS provisions as per the Income Tax Act, 1961 are liable to deduct TDS from payment of fees for professional services at the prescribed rates (10%) if the payment exceeds the threshold limit in a year (currently INR 30,000).

Other Tax Requirements

All freelancers are liable to pay GST if their annual income exceeds INR 20 lakh, and invoices must be compliant with India’s GST regulations.

Remuneration

Invoice-based payments (typically once a month)

Worker’s Rights

Labor laws do not apply to employees performing work on the basis of a contract for service.

Benefits

An independent contractor is not entitled to any benefits, as it may be considered terms of employment in India.

When Paid

A contractor sends an invoice, and the employing company is responsible for paying it based on details agreed upon in the contract. Contractors are not paid by payroll in most businesses, and often include the following information on invoices:

- Invoice Number and Date

- Client Name and Address

- Client TIN / GST number, if applicable

- Details of work completed

- Amount in INR

- Bank account details with PAN

Engagement models

In India, there is a distinction between a contract of service and a contract for service. An independent contractor in India works under a contract for service, which must explicitly lack any degree of control or supervision from the employer. Be careful to not confuse this term with ‘contract of service’ which is essentially an employment contract.

A contract of service implies a relationship of boss and employee, which establishes a hierarchical degree of power and authority. Note that this type of contract excludes those employed as manager or administrative roles.

A contract for services implies an agreement where one party simply provides for another, using their own resources, skill and knowledge to deliver the service. Consultants, freelancers and agencies fall under this category.

Contracting Models

The most important step of structuring a contractor relationship in India is to document the working relationship properly, as to not establish an employee relationship. The risks of reclassification (from contractor to employee) will lead to legal and financial disputes that may harm business.

The key considerations to make when differentiating an Employee vs. an Independent Contractor:

- A contract for service should establish no control or supervision from the employer. It is important to not confuse this term with ‘contract of service’ which is essentially the opposite type of contract.

- India labor laws greatly weigh the degree of authority over a worker to be the key indicator of Employee vs. Independent Contractor. The contract should not establish how the work is performed, when it is performed, or any day-to-day management requirements.

- Employers may list qualifications or skills required by the contractor, or conduct regular quality control inspections without being classified as an employer.

- Benefits provided to permanent employees should not be provided to independent contractors or consultants, as this could be construed as employment.

- The termination clause should allow termination without cause, in order to prevent any stipulations or requirements that might show a degree of control, and thus employment.

- Independent contractors should be paid via invoices or directly. Payment with a recurring salary may indicate that the relationship is one for employment.

Contractor Payments

Payment to independent contractors is extremely flexible and can simply be determined by both parties within the contract. When working with independent contractors, freelancers or agencies, you’ll need to have an established process for paying them correctly and on time within the contract for service. The most common payment methods include:

- Direct deposits: Direct deposit in India is popular, safe and convenient. The downsides may include transfer fees or exchange rates depending on the financial institution.

- Paper check: While not the safest or most convenient method of payment, less developed regions of India may only offer this option

- Money orders: Money orders are similar to paper checks in that they are a good option in less developed regions, and they give you and the contractor a strong paper trail for recordkeeping and taxes.

- Virtual wallets: Global providers of digital wallets may provide a direct way to pay contractors, which they can then move themselves to their bank accounts or debit cards. Keep in mind that not all residents of India may have access to the same payment gateways, so it’s important to establish the payment relationship beforehand.

Contractor Taxes

Independent contractors are responsible for paying income tax if their annual total net income exceeds INR 2.5 lakh. Any income earned from foreign employing entities will be taxed like local income, but there. India’s government offers an easy online e-Filing portal to make the process easy, quick and secure for independent contractors to file tax forms. Independent contractors, freelancers, and consultants are primarily concerned with two tax filings:

- Income Tax Return

A contractor is required to file an income tax return (ITR) for every financial year as outlined by the Income Tax Act. The e-Filing portal has a convenient calculator to help contractors file automatically. - Goods & Services Tax

Contractors are liable to pay GST if their annual income exceeds INR 20 lakh. Service-based contractors may charge up to 18% GST from clients, to be deposited with the government. Contractors can claim any additional taxation automatically after filing on the online portal. However, they must ensure that their invoices are GST-compliant, so that the invoices are able to be claimed on tax filings.

Employment in India

We can simplify hiring full-time workers in India by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in India without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in India

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in India?

Look no further

Talk to an Expert