Compliantly Engage Contractors in Brazil

Our workforce compliance guide to Brazil covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Brazil.

Local Time

Currency

Real (BRL)Official Language(s)

PortuguesePopulation

212.6 Million (2020)GDP

1.445 Billion USD (2020)GDP Growth rate

-4.1% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Brazil

We work with the best legal partners in Brazil to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with the Brazilian law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Brazil

Any business hiring in Brazil should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses that are hiring contractors under the guise of employment.

Understanding the distinctions between employees and independent contractors (or self-employed workers) is critical to compliantly engaging workers in Brazil. It is important to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies freelancers as independent contractors for you and lets you know when freelance talent must be engaged as a payrolled contractor or employed directly.

In Brazil, fines or penalties (including the equivalent of five years’ worth of social security contributions) may be issued to businesses who are hiring independent contractors under the guise of employment. In Brazil, a common labor claim made by individuals is that they have been misclassified as independent contractors when they should in fact be employees.

Factors

Employee

Independent Contractor

Employment Laws

Brazilian Labour Code (Consolidação das Leis do Trabalho or “CLT”).

Brazilian Civil Law.

Hiring Practice

The general hiring approach will involve the candidate submitting a CV and/or cover letter, followed by an interview, and the selection of the successful candidate. An offer of employment sent to the employee is considered legally binding, and the potential employee can sue the company if the company doesn’t proceed with the hire.

Under Brazilian law, hiring companies cannot run a criminal check on potential candidates. Also, foreign companies are required to work through a local entity to hire employees in Brazil.

Independent contractors can be hired directly or via an intermediary temp agency. Independent contractors may be found via word of mouth, jobs boards, social networks, industry bodies, or other forums.

The key independent contractor categories are:

-

- Micro empreendedor individual (MEI)

- Empresário Individual (EI)

- Empresa Individual de Responsabilidade Limitada (EIRELI)

- Sociedade Limitada Individual (SLI)

- Profissional autônomo

Tax Documents

Employees pay their income tax, health insurance, and other social security contributions directly from their salary. Employees do not need to file their own tax returns

Independent contractors operating as individuals do not process their own social security contributions and income tax. Independent contractors operating as a company pay their own social security contributions along with varying corporate taxes.

Payer's Tax Withholding & Reporting Requirements

Employers are required to withhold employees’ income tax and social security contributions from the employee’s salary

If hiring an independent contractor who is operating as an individual, the hiring company pays social security contributions to the government and must also deduct income tax from the independent contractor’s monthly payments.

If hiring an independent contractor who is operating as an individual, the hiring company pays no social security contributions to the government and deducts no income tax from the contractor’s payments.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Independent contractors typically submit an invoice on a monthly basis.

Workers’ Rights

Rights include: minimum notice of termination, protection from unfair dismissal, minimum wage, maximum of 44 working hours per week, a 13th month salary, transportation vouchers, overtime pay, 30 days’ annual paid holiday, 3 days per year worked for termination pay

Labor laws do not apply to employees performing work on the basis of civil contract, and thus cannot be infringed upon by the employer.

Benefits

Employers pay the employee’s social security contributions. Brazil has a number of trade unions which also impose collective bargaining agreements depending on the industry.

Independent contractors do not receive any benefit by law. Everything depends on the contract.

When Paid

Employees are typically paid on an hourly or monthly basis.

Independent contractors are paid upon completion of the contract or task(s) and following submission of an invoice by the contractor.

Employee

Employment Laws

Brazilian Labour Code (Consolidação das Leis do Trabalho or “CLT”).

Hiring Practice

The general hiring approach will involve the candidate submitting a CV and/or cover letter, followed by an interview, and the selection of the successful candidate. An offer of employment sent to the employee is considered legally binding, and the potential employee can sue the company if the company doesn’t proceed with the hire.

Under Brazilian law, hiring companies cannot run a criminal check on potential candidates. Also, foreign companies are required to work through a local entity to hire employees in Brazil.

Tax Documents

Employees pay their income tax, health insurance, and other social security contributions directly from their salary. Employees do not need to file their own tax returns

Payer's Tax Withholding & Reporting Requirements

Employers are required to withhold employees’ income tax and social security contributions from the employee’s salary

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

Workers’ Rights

Rights include: minimum notice of termination, protection from unfair dismissal, minimum wage, maximum of 44 working hours per week, a 13th month salary, transportation vouchers, overtime pay, 30 days’ annual paid holiday, 3 days per year worked for termination pay

Benefits

Employers pay the employee’s social security contributions. Brazil has a number of trade unions which also impose collective bargaining agreements depending on the industry.

When Paid

Employees are typically paid on an hourly or monthly basis.

Independent Contractor

Employment Laws

Brazilian Civil Law.

Hiring Practice

Independent contractors can be hired directly or via an intermediary temp agency. Independent contractors may be found via word of mouth, jobs boards, social networks, industry bodies, or other forums.

The key independent contractor categories are:

-

- Micro empreendedor individual (MEI)

- Empresário Individual (EI)

- Empresa Individual de Responsabilidade Limitada (EIRELI)

- Sociedade Limitada Individual (SLI)

- Profissional autônomo

Tax Documents

Independent contractors operating as individuals do not process their own social security contributions and income tax. Independent contractors operating as a company pay their own social security contributions along with varying corporate taxes.

Payer's Tax Withholding & Reporting Requirements

If hiring an independent contractor who is operating as an individual, the hiring company pays social security contributions to the government and must also deduct income tax from the independent contractor’s monthly payments.

If hiring an independent contractor who is operating as an individual, the hiring company pays no social security contributions to the government and deducts no income tax from the contractor’s payments.

Remuneration

Independent contractors typically submit an invoice on a monthly basis.

Workers’ Rights

Labor laws do not apply to employees performing work on the basis of civil contract, and thus cannot be infringed upon by the employer.

Benefits

Independent contractors do not receive any benefit by law. Everything depends on the contract.

When Paid

Independent contractors are paid upon completion of the contract or task(s) and following submission of an invoice by the contractor.

Engaging Contractors in Brazil

Self-employment as an independent contractor is a popular income model for many individuals. In fact, due to a weak formal labor market, approximately one-third of Brazil’s entire workforce are self-employed contractors.

Depending on the individual’s classification as either an employee or an independent contractor, this can have significant implications for companies looking to hire contractors in Brazil. For the hiring company, engaging with independent contractors may be legally and financially risky, especially given the possibility of an independent contractor becoming re-classified as an employee of the hiring company.

As in many countries, if the real substance of the company-contractor relationship proves to effectively be an employment relationship, the hiring company may suffer legal and financial penalties (including payroll taxes). Therefore, it is important to leverage an employment service partner like Worksuite when hiring in Brazil to ensure that independent contractors fall under the correct working relationship with your business.

Who classifies as an Independent Contractor in Brazil?

In Brazil, the primary criteria for distinguishing between an employee and an independent contractor is whether the individual is overly dependent on the hiring company. This applies for both direction and control of the services being provided, and whether the contribution of a single client’s compensation is a dominant portion of the independent contractor’s overall income. This can involve a full assessment of personal dependency and economic dependency. This is known as the “prevalence of facts” test. In this sense, individuals are generally considered independent contractors if they:

- Can determine their own time and place of work.

- Are not providing work that is necessary for the company’s core business.

- Are not subject to the hiring company’s operational rules.

- Do not work under direct supervision, directives, or instructions.

- Are not in a position of professional subordination to the hiring company.

- Can (or have the right to) substitute someone else to perform the work.

Contracting Models

There are several categories under which independent contractors can operate in Brazil:

- Micro empreendedor individual (MEI): This category is equivalent to self-employed sole trader. It includes independent contractors who earn up to BRL60,000 in annual gross revenue. MEI status provides several benefits to independent contractors, including an exemption from some taxes and also using a simplified tax system called Simples Nacional. However, an MEI can only involve one person.

- Empresário Individual (EI): This involves the independent contractor operating as a business owner under their own name. However, an EI is not a legal entity. All liabilities incurred by the EI are the responsibility of the individual.

- Empresa Individual de Responsabilidade Limitada (EIRELI): Operating as an individual liability company allows an independent contractor to incorporate as a legal entity as the single owner. Under Brazilian law, incorporating as an EIRELI requires that the entity possess corporate capital totaling at least one hundred times Brazil’s highest minimum salary rate.

- Sociedade Limitada Individual (SLI): Individual limited liability companies are legal entities where the liability of the owner is limited to the company’s earned capital, which provides some degree of financial protection for the independent contractor who runs the company. This is a very common operating model for independent contractors in Brazil.

- Profissional autônomo: This category means self-employed workers. It includes individuals who earn above BRL81,000 in annual gross revenue or who otherwise choose not to register as MEI. Individuals seeking profissional autônomo status must register with the Registry of Brazilian Securities (Cadastro de Contribuintes Mobiliários or “CCM”) as a ‘service provider’.

- Temporary workers: It is important to note that in Brazil, it is illegal to hire through an agency anybody other than temporary workers. Under Brazilian law (Laws 6,019/1974 and 13,429/2017), temporary workers can only be hired (a) for a fixed term as substitutes for regular employees, or (b) to support with an increase in business or workload.

Engagement Models

There are two primary engagement models for working with independent contractors in Brazil:

A. Direct engagement of the independent contractor as self-employed or registered via their own limited company.

- Work contract: Under this model, the hiring company engages directly with the independent contractor and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the contract.

- Self-employed: Self-employed independent contractors in Brazil do not need to register as a business, although doing so provides increased assurance and confidence for hiring companies.

B. Third party: These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Temp agency: Companies can hire temporary workers via a staffing agency, which in turn supplies one of its own contractors to deliver the contracted services. The hiring company pays the staffing agency directly, in accordance with the terms of the contract. The contract is therefore between the hiring company and the staffing agency, while the agency pays the independent contractor through a separate contractual arrangement. In Brazil, it is illegal to hire through an agency anybody other than temporary workers. Hiring companies should check the agency has registered with the Ministry of Labour and employment (MTE) and has a contract in place with their temporary workers.

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

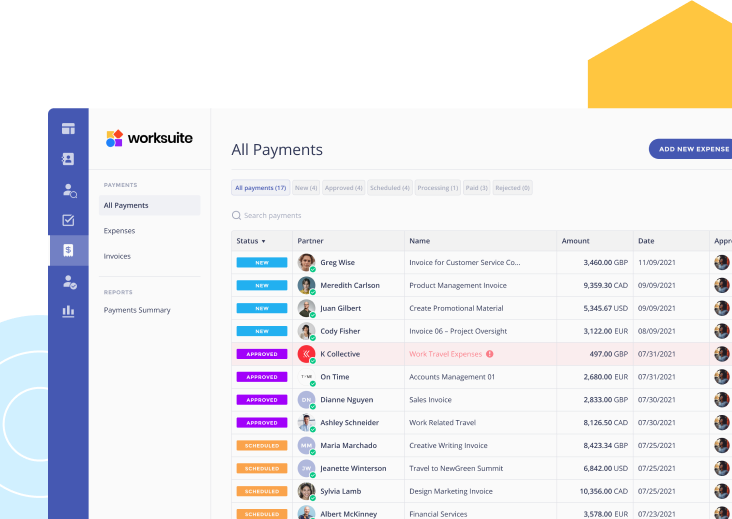

Contractor Payments

Companies hiring independent contractors in Brazil should avoid making payments directly through their payroll system. Beyond these guidelines, there are a wide range of lawful methods to deliver payment to independent contractors in Brazil. The contract should stipulate the preferred payment method agreed upon by both parties. The typical window for paying a contractor is 14 days or 28 days from the date of issuance of the invoice.

By working with a hiring partner, companies can streamline contractor payment processes significantly. A dependable partner can help you hire your contractors legally and pay them quickly, accurately, in the local currency, and in a way that complies with Brazilian regulations.

Contractor Taxes

Income tax and social security are slightly more complex than in some other countries. The rates depend on whether the independent contractor is incorporated as a legal entity or business. If an independent contractor operates as an individual, their income tax and social security contributions are deducted from their payments by the hiring company, which also pays the government an additional social security contribution as a percentage of the contractor’s fee. On the other hand, if the contractor operates as a company, they pay corporate income taxes (rather than individual tax) and make their own social security contributions – and the hiring company does not make additional social security payments.

Employment in Brazil

We can simplify hiring full-time workers in Brazil by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Brazil without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Brazil

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Brazil?

Look no further.

Talk to an Expert