The IRS E-Filing Mandate (What You Need to Know)

As a business owner managing dozens or hundreds of contractors, staying up-to-date with the latest tax regulations is vital to avoiding penalties and unnecessary costs. Being well-informed about tax compliance requirements will help you avoid any rogue spend on independent contractors, which can lead to financial risks and wasted resources. Not to mention, tax season itself can lead to extra administrative burden on your team – pulling important focus away from the strategic areas of your business.

The Internal Revenue Service (IRS) and Treasury have released new tax-filing regulations impacting most businesses. Starting in 2024, businesses that file 10 or more returns annually must file those returns electronically, including Forms 1099-NEC, per the new IRS e-filing mandate.

The IRS shared that it receives over 4 billion tax forms annually, with around 40 million submitted on paper. To deal with the backlog of paper and electronic returns from the past few years, the tax agency hopes that a new process will help them work more efficiently.

Here’s what to know about the IRS e-filing mandate.

What this new regulation means for your business

The new e-filing mandate indicates that businesses that file 10 or more returns with the IRS annually will be required to file electronically.

Previously, only organizations that filed over 250 information returns in a year had to file them electronically, and that was for each type of return separately. This means that a business that previously had 150 W-2 forms and 200 1099 forms didn’t need to file electronically. But, with this new e-filing requirement, those numbers surpass the threshold requirement and you must e-file to avoid penalties.

The first thing you must do as you prepare to file your 2023 tax return is tally the total number of returns you have. And yes, this includes Forms 1099-NEC if you pay freelancers.

All businesses must follow this new process if they file at least 10 of the listed tax forms annually:

- Information returns to report payments, such as W-2 forms and 1099 forms

- Partnership returns (including organizations with more than 100 partners)

- Registration statements

- Disclosure statements

- Notifications

- Corporate income tax returns (including nonprofits and corporations that report total assets under $10 million at the end of their taxable year)

- Unrelated business income tax returns

- Withholding tax returns for U.S. Source Income of Foreign Persons

- Actuarial reports

- Certain excise tax returns, among others.

How to file online

The Internal Revenue Service (IRS) has launched a new online portal called the Information Returns Intake System (IRIS) to assist businesses in transitioning to the new tax e-filing procedures. The IRIS platform allows users to securely create, upload, edit, and view completed copies of nearly 20 different types of NEC-1099 forms.

This platform is available to businesses of all sizes and supports small and large volumes of 1099 forms, which can be entered manually or by uploading a specific template. This is especially important for businesses with large contingent workforces with many freelancer payments.

The IRS may waive the e-filing requirements for businesses that have difficulty complying with the new rules. The only exception to the new tax filing requirement is employment tax returns, like Form 940 and Form 941.

What are the risks and penalties of not e-filing in 2024?

Your team must review all freelancer payments and other returns to make sure to comply with the new requirements. If you do not e-file, the IRS will reject your filing and penalize you for failure to file.

It’s important to file your forms correctly to avoid penalties. In 2024, the penalty for incorrect filing can reach a maximum of $310 per form. If you are a small business with annual gross receipts of less than $5 million, the maximum penalty may be around $1.2 million annually. The penalty amount may increase for businesses with higher revenue and team size, and there is no limit to the penalty amount. However, penalty amounts change every year.

How Worksuite helps your business stay compliant

The IRS’s new e-filing mandate can create chaos for your HR and Finance teams this year, especially if they are not already responsible for managing the independent contractors in your company. They must have a centralized view of all the 1099-NEC forms (and other returns) filed in 2024 to ensure that the total returns filed electronically are accurate and avoid penalties.

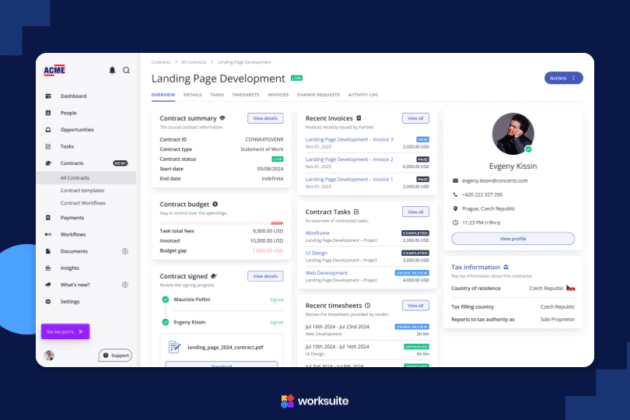

A freelancer payment platform like Worksuite can dramatically reduce administrative burden and manual errors. This also helps automate contractor onboarding, streamline project management, and facilitate timely payments.

With Worksuite Global Pay, you can quickly process freelancer payments in 120 currencies while managing your onboarding and compliance from a centralized place. Worksuite handles all the tax filings on your company’s behalf, as well, and automates the generation of your W9 and 1099 tax forms. Taking this “digital paperwork” off your plate is just one of the many ways Worksuite strives to reduce admin work, so you can stay focused on the strategic work.

Need help compliantly paying your contingent workforce? Have questions about filing 1099 tax forms? Consult with a workforce specialist from Worksuite today.