INDEPENDENT CONTRACTOR CLASSIFICATION

Reduce Legal Risks and Avoid Costly Penalties

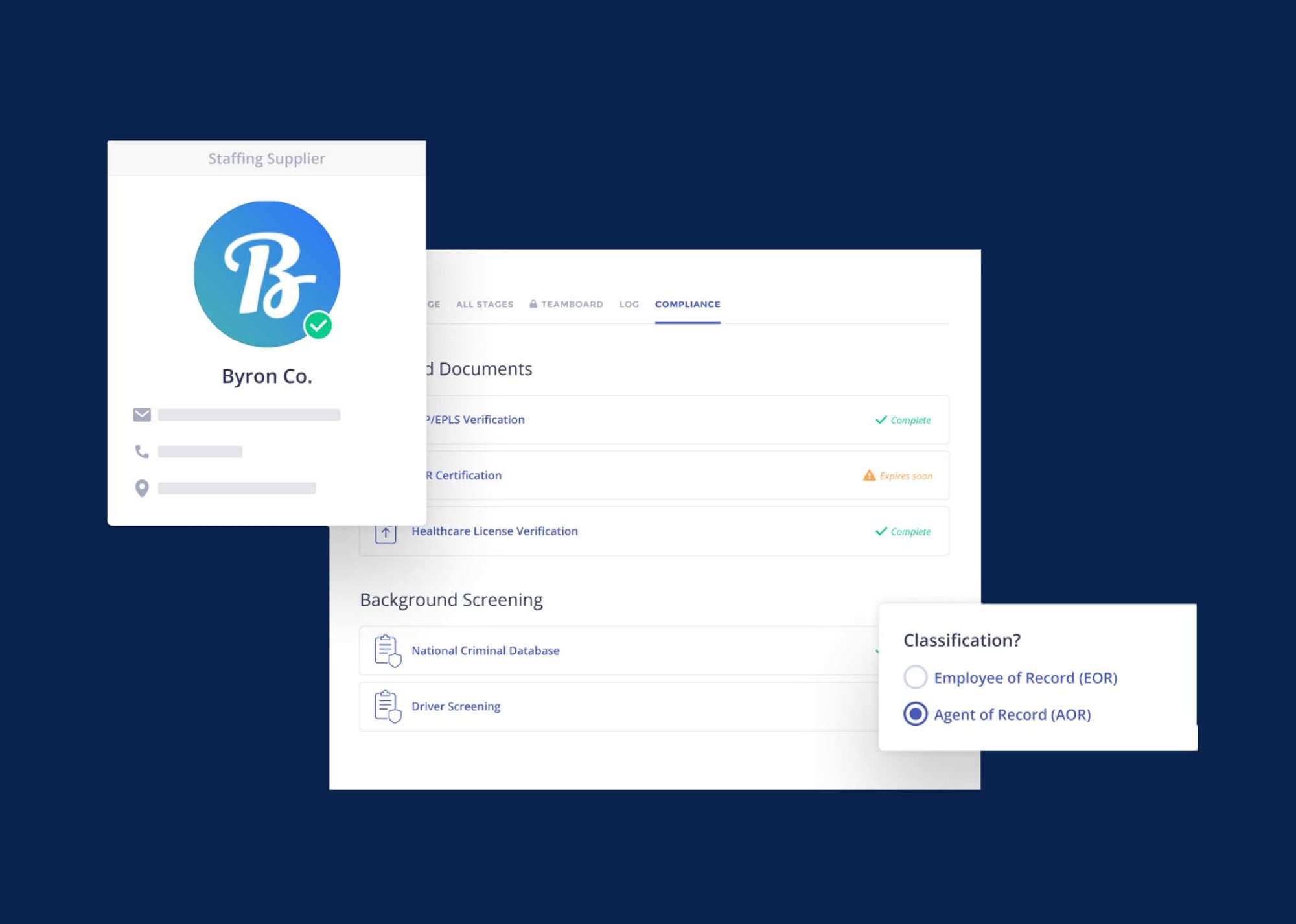

Stay Compliant With Contractor Classification

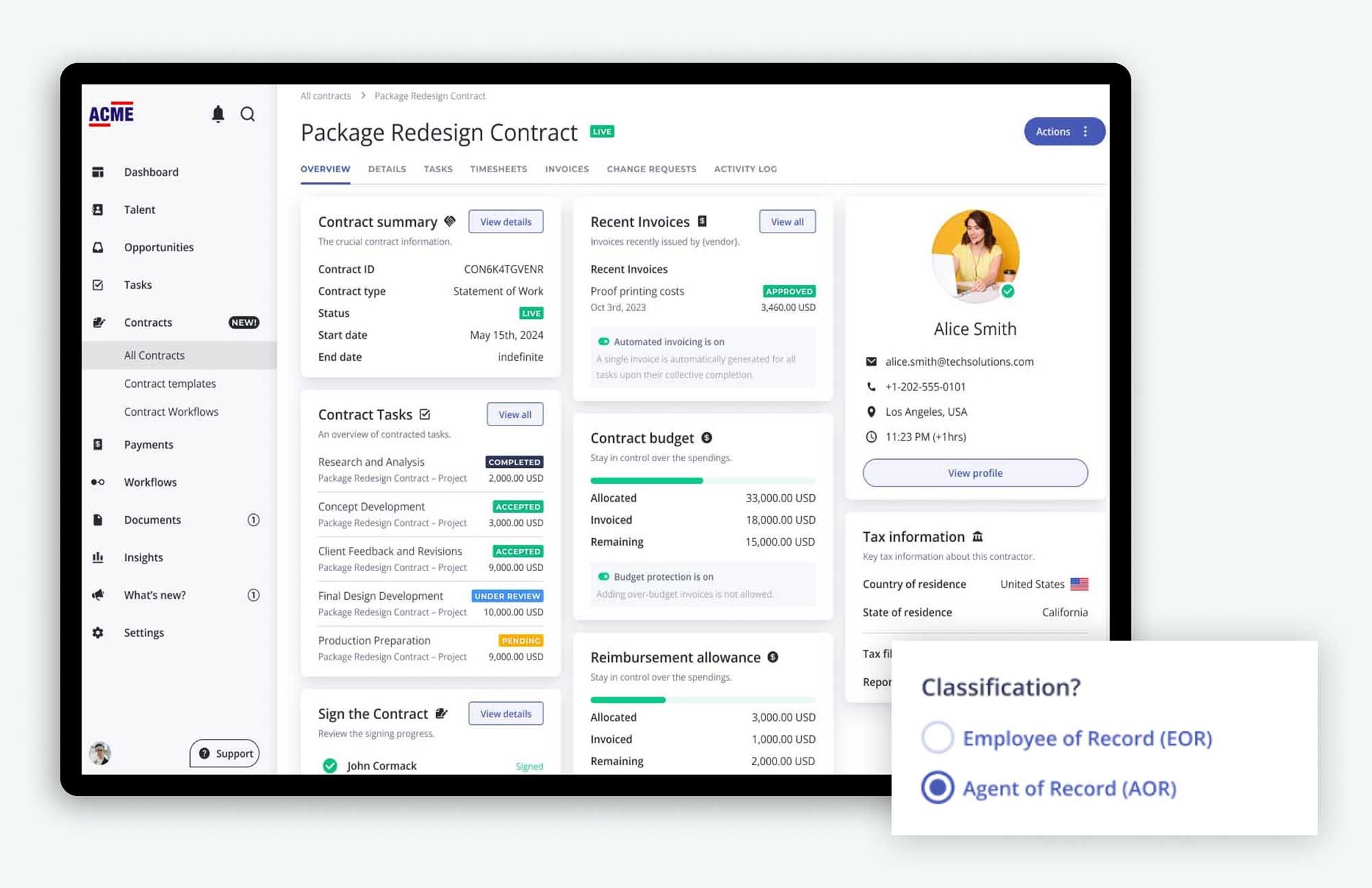

Our streamlined Independent Contractor Classification service helps you navigate labor laws without the complexity. With real-time compliance tracking and misclassification protection, you can confidently determine whether a worker is an employee or independent contractor.

Expert Classification Analysis

Gain immediate, expert-level insight into worker classification status. Ensure compliance without compromising speed-because staying compliant shouldn't slow your business down.

Misclassification Indemnification

Peace of mind with built-in protection against misclassification risks. Our Compliance Service includes indemnification, audit support, and streamlined access to defense files—so you're covered when it counts.

Localized Contracts & Compliance Tracking

Stay compliant at every level-national, state, and local. Our in-region experts actively monitor legislative changes and regulatory nuances, from sweeping federal updates to region-specific laws like California's AB5 and its many exemptions under AB 2253. With Worksuite, you're always ahead of the curve.

Let’s Talk About Your Needs—Schedule a Call Today

Schedule a call to explore how Worksuite can meet your needs. Discuss pricing and specific requirements to ensure our solution aligns with your goals.