Independent Contractors Insurance

Easy, Affordable, On-Demand Insurance for Freelancers

Whether you need coverage for a specific project or ongoing protection, our solution ensures that every freelancer is covered, reducing risks to your business and protecting your brand.

Empower Your Freelancers with Comprehensive Insurance

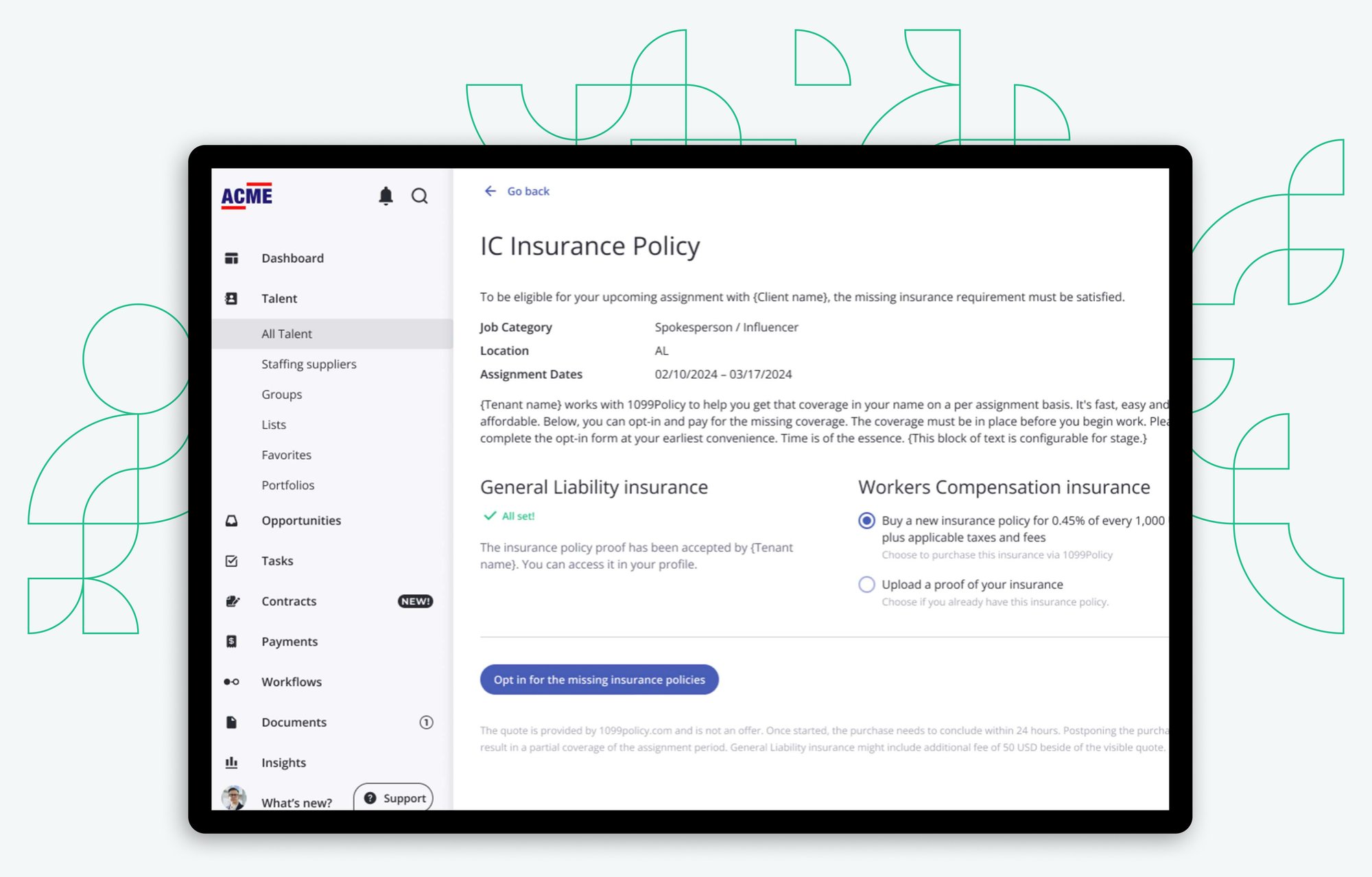

Our partnership with 1099Policy makes it simple for contractors to get the coverage they need, when they need it—directly through Worksuite. This helps safeguard both your business and your freelancers, ensuring that everyone is protected with the right insurance coverage for each assignment.

Mitigate Risk to Your Brand

Ensure that every freelancer has the proper business insurance, including general liability insurance, for each job. By doing so, you reduce exposure to PR risks, legal fees, and legal costs, keeping your brand safe and compliant. Protect your brand by guaranteeing that every contractor meets insurance companies' requirements.

Protect Your Freelancers

Keep your freelancers safe by providing a streamlined experience to purchase professional liability insurance, errors and omissions insurance, and workers compensation insurance. Whether you're covering independent contractors or subcontractors, this ensures they're compliant and protected from costly mistakes.

Easy, Affordable, Hassle-Free

Save administrative time for your team and your freelancers by offering easy access to insurance coverage through 1099Policy. The plans are affordable and designed for independent contractors, covering essential needs like commercial auto insurance, commercial property insurance, and business interruption protection.

General Liability Insurance

Provides essential protection for independent contractors by covering a variety of risks:

- Coverage for property damage claims

- Protection against bodily injury lawsuits

- Shields freelancers from costly legal fees

- Helps prevent reputational harm from legal issues

- Ensures compliance with insurance companies' requirements

Workers Compensation Insurance

Critical for freelancers with subcontractors or employees, offering:

- Coverage for workplace injuries and medical expenses

- Protection for lost wages due to injury

- Ensures compliance with legal requirements

- Reduces the risk of legal costs for your business

“The diligence around paperwork, legal contracts, and insurance certificates have been tightened up much more too, so we can be assured that we’ve always got the right securities in place and trust that the Worksuite platform is handling everything.”

Carly Bolton

Commercial Manager

Etch UK

Let’s Build Your Custom Demo Experience

Share your challenges and priorities. From there, we’ll design a personalized demo that highlights exactly how our platform can deliver results for your business.