The Smarter Way to Manage

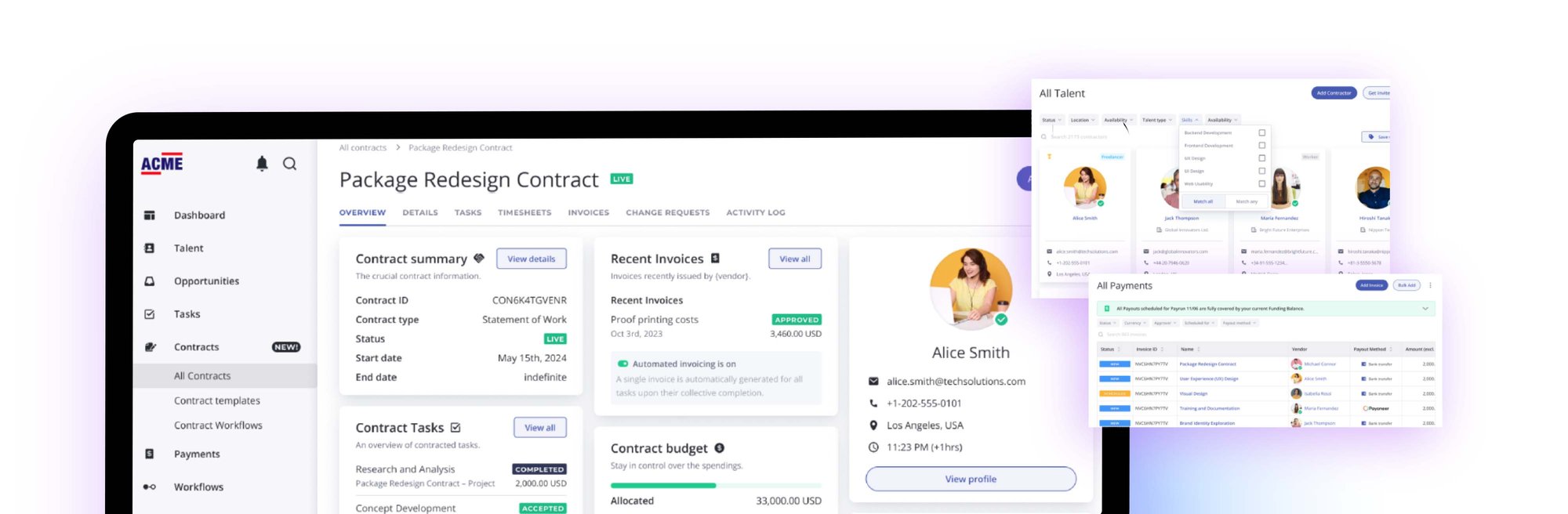

Your Freelancers

Onboard, classify, manage, and pay your global freelance talent

- easily and compliantly - with Worksuite.

Contingent Workforce Management

Find, Onboard, and Grow Your Contingent Workforce

- Quickly find your top freelancers when you need them.

- Customize onboarding workflows to suit your needs.

- Track, manage, and expand your freelance talent pool.

Global Pay

Pay your freelancers – wherever they are in the world

- Manage multi-currency payments for seamless transactions

- Get support throughout the payment process.

- Easily file 1099 forms for freelancers.

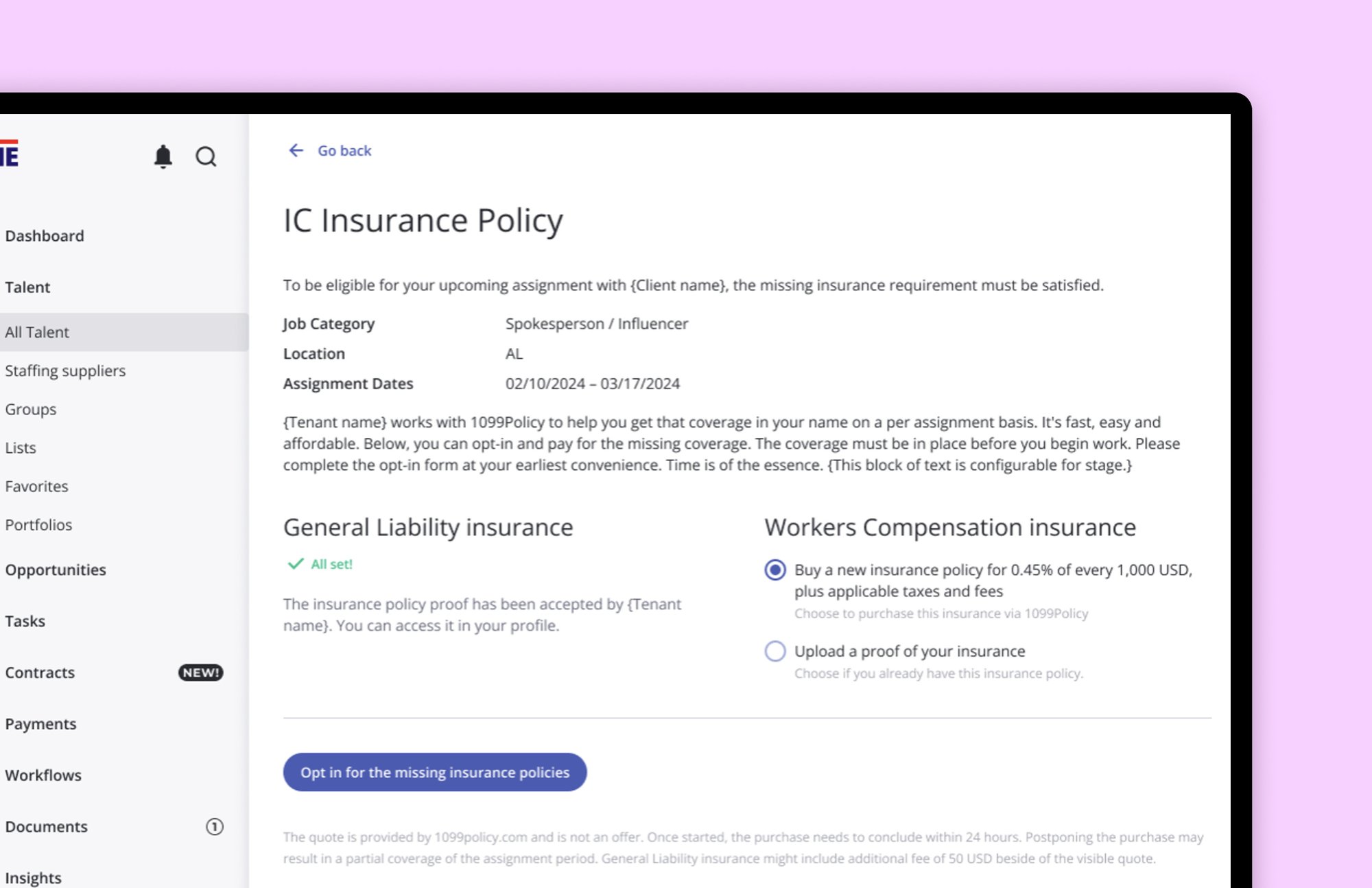

Independent Contractors Insurance

Freedom to scale your coverage for short-term or temporary teams.

Let's Talk About Your Growth Goals

Collaborate with one of our experts for a genuine conversation about your current challenges and business growth objectives. No sales pitch, just an honest discussion about what you're working to achieve and how we might help.

Driving Success Across Industries

Select an option below:

- Enterprise

- Editorial Content Management

- Events Management

- Digital Media & Publishing

- Brand & Creative

- Coaching & Consulting

Coaching & Consulting

Managing consultants and coaches while ensuring they adhere to project timelines, meet client expectations, and are compensated accurately can be complex. Worksuite offers a centralized platform for sourcing, managing, and paying.

Read Case Study

Enterprise Solutions

Whether your organization employs a team of 100 or 1000, Worksuite seamlessly integrates a scalable Freelancer Management System (FMS) designed to align with the unique requirements of enterprise-level operations.

Ready Case Study

How Correlation One uses Worksuite to manage their rapidly scaling freelancer network

Digital Media & Publishing

Worksuite allows for efficient digital publisher onboarding, task management, and payment processing, ensuring streamlined content workflows.

Read Case Study

Brand & Creative

Managing creative freelancers across multiple projects can lead to delays and inconsistencies. Worksuite helps agencies efficiently assign tasks, track progress, and control budgets.

Read Case Study

How Worksuite helped Jack Morton slash hours of time a week off their freelance onboarding & management processes.

Events Management

Worksuite simplifies hiring, onboarding, and payments, giving event managers real-time control over their freelance workforce and helping meet deadlines smoothly.

Read Case Study

Editorial Content Management

Worksuite streamlines task assignment, content tracking, and payments, ensuring editorial teams can produce high-quality content on time without administrative overload.