Compliantly Engage Contractors in Austria

Our workforce compliance guide to Austria covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Austria.

Local Time

Currency

Euro (EUR)Official Language(s)

GermanPopulation

8.917 Million (2020)Economic Region

European UnionGDP

Billion USD ()GDP Growth rate

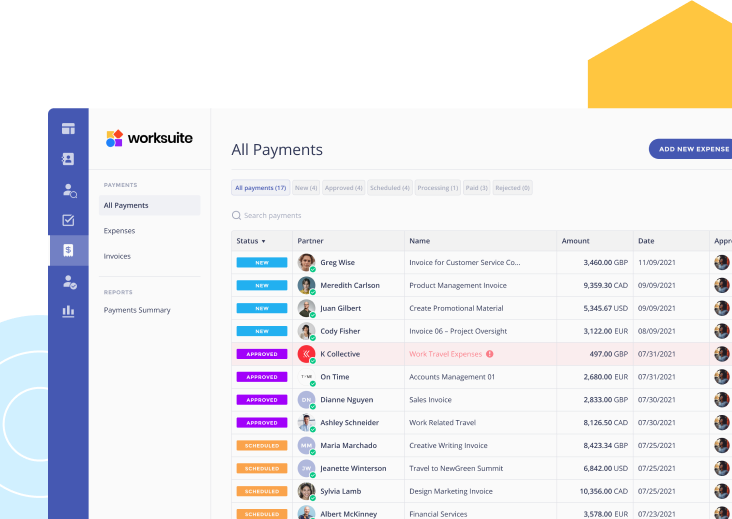

% ()Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Austria.

We work with the best legal partners in Austria to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with Austrian law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Austria

Any business hiring in Austria should understand the important legal distinction between who classifies as an independent contractor and who can be hired as an employee. Fines or penalties may be issued to businesses that are hiring contractors under the guise of employment. In Austria, companies can be ordered to pay fines of up to EUR 50,000 for each employee who is incorrectly classified as a contractor.

Understanding the distinctions between employees and independent contractors is therefore critical to compliantly engaging workers in Austria. It is important to work with a partner like Worksuite to ensure you put in place an engagement framework that accurately classifies independent contractors for you and lets you know when contractor talent must be engaged as a payrolled contractor or employed directly.

Factors

Employee

Independent Contractor

Employment Laws

Austria’s primary employment laws are codified within the following legislation:

- Austrian General Civil Code (Allgemeines Bürgerliches Gesetzbuch)

- Labor Constitution Act (Arbeitsverfassungsgesetz, ArbVG)

- Salaried Employee Act (Angestelltengesetz, AngG)

- Working Hours Act (Arbeitszeitgesetz, AZG)

Other relevant employee legislation includes:

- Austrian Law against Wage and Social Dumping (Lohn und Sozialdumping Bekämpfungsgesetz)

- Labor Law and General Social Insurance Amendment Act (ASRÄG)

- Income Tax Act 1988 (EStG)

Independent contractors are not strictly defined in Austrian law. As in many European countries, there is a reliance upon precedence in case law.

Hiring Practice

A candidate must submit their CV or resumé to the employer. Once a decision has been made, the employer can issue an employment contract either in writing or verbally. If the contract is verbal, the employer must still issue the employee with a written service contract (Dienstzettel), which details the employee’s rights and responsibilities.

If there are gaps between what is included in the service note and what was verbally agreed, this can expose the employer to legal and financial risks.

Independent contractors can be hired directly or via an intermediary, such as a staffing agency or umbrella company. Independent contractors may be found via word of mouth, jobs boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the independent contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The four key independent contractor categories are:

- Liberal professional

- New self-employed

- Self-employed via free / regulated business license

- Independent contractor

Tax Documents

Employees are subject to wage tax which is taken at source. This means employees are not required to submit any tax forms in relation to their income earned via employment.

However, they will need to include some details from these forms as part of any tax self-assessments for additional self-employed work.

Independent contractors are subject to income tax and must file their own income taxes on an annual basis. Independent contractors pay tax on all income above EUR11,000 (single income) or EUR12,000 (multiple incomes). VAT applies to individuals with income over EUR30,000 per year.

Independent contractors must submit, at minimum, a Declaration on Employee Tax Assessment (Erklärung zur Arbeitnehmerinnenveranlagung) L1 form, which can be filed at the government tax office portal FinanzOnline, via a local tax office, or by downloading each form from the Ministry of Finance and manually submitting them

Payer's Tax Withholding & Reporting Requirements

Employers are required to withhold employees’ tax and national insurance at time of payment to the employee.

Hiring companies do not withhold any of the independent contractor’s payment for tax purposes. However, for independent contractors whose monthly income is less than the marginal earnings threshold, the hiring company must enroll them in the accident insurance institution (Unfallversicherung).

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

There is no statutory minimum wage in Austria. Instead, minimum wages are set by industry-specific collective bargaining agreements.

Independent contractors operating as a business typically submit an invoice on a monthly basis. Independent contractors operating without a business (i.e., as a sole trader) may be paid via any preferred method and often require a payment receipt.

The hiring company and independent contractor may also negotiate a payment structure, including any up-front payment, partial payments, and a final payment upon completion of the work

Workers’ Rights

Employees typically have a holiday allowance, maternity leave/pay, sick leave/pay, protection against dismissal, social security contributions, gender equality, and other rights. All employers must issue new employees with a written document (Dienstzettel) specifying their rights as contained in their contract.

Further rights may be contained in collective bargaining agreements.

Independent contractors generally do not have employee rights unless detailed in a specific agreement with the hiring company.

Benefits

The employer pays all employee benefits, with health and social insurance being mandatory.

Independent contractors’ benefits are governed by the content of the contract. However, the client must process the independent contractor’s health insurance (which is mandatory in Austria), usually through the Austrian health insurance provider (ÖGK).

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. Notably, employees’ annualized salaries can also include an additional one or two months’ worth of pay, known as the 13th and 14th month salaries.

Employees are often rewarded via bonuses, which are paid either monthly or yearly.

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Employee

Employment Laws

Austria’s primary employment laws are codified within the following legislation:

- Austrian General Civil Code (Allgemeines Bürgerliches Gesetzbuch)

- Labor Constitution Act (Arbeitsverfassungsgesetz, ArbVG)

- Salaried Employee Act (Angestelltengesetz, AngG)

- Working Hours Act (Arbeitszeitgesetz, AZG)

Other relevant employee legislation includes:

- Austrian Law against Wage and Social Dumping (Lohn und Sozialdumping Bekämpfungsgesetz)

- Labor Law and General Social Insurance Amendment Act (ASRÄG)

- Income Tax Act 1988 (EStG)

Hiring Practice

A candidate must submit their CV or resumé to the employer. Once a decision has been made, the employer can issue an employment contract either in writing or verbally. If the contract is verbal, the employer must still issue the employee with a written service contract (Dienstzettel), which details the employee’s rights and responsibilities.

If there are gaps between what is included in the service note and what was verbally agreed, this can expose the employer to legal and financial risks.

Tax Documents

Employees are subject to wage tax which is taken at source. This means employees are not required to submit any tax forms in relation to their income earned via employment.

However, they will need to include some details from these forms as part of any tax self-assessments for additional self-employed work.

Payer's Tax Withholding & Reporting Requirements

Employers are required to withhold employees’ tax and national insurance at time of payment to the employee.

Remuneration

Employees are paid on an hourly, weekly, or monthly basis.

There is no statutory minimum wage in Austria. Instead, minimum wages are set by industry-specific collective bargaining agreements.

Workers’ Rights

Employees typically have a holiday allowance, maternity leave/pay, sick leave/pay, protection against dismissal, social security contributions, gender equality, and other rights. All employers must issue new employees with a written document (Dienstzettel) specifying their rights as contained in their contract.

Further rights may be contained in collective bargaining agreements.

Benefits

The employer pays all employee benefits, with health and social insurance being mandatory.

When Paid

Employees are usually paid in arrears on or before the last day of the month for which payment is due. Notably, employees’ annualized salaries can also include an additional one or two months’ worth of pay, known as the 13th and 14th month salaries.

Employees are often rewarded via bonuses, which are paid either monthly or yearly.

Independent Contractor

Employment Laws

Independent contractors are not strictly defined in Austrian law. As in many European countries, there is a reliance upon precedence in case law.

Hiring Practice

Independent contractors can be hired directly or via an intermediary, such as a staffing agency or umbrella company. Independent contractors may be found via word of mouth, jobs boards, social networks, industry bodies, or other forums. Although the hiring practices vary, the independent contractor may be asked to provide a CV, portfolio, and references, and possibly sign an NDA.

The four key independent contractor categories are:

- Liberal professional

- New self-employed

- Self-employed via free / regulated business license

- Independent contractor

Tax Documents

Independent contractors are subject to income tax and must file their own income taxes on an annual basis. Independent contractors pay tax on all income above EUR11,000 (single income) or EUR12,000 (multiple incomes). VAT applies to individuals with income over EUR30,000 per year.

Independent contractors must submit, at minimum, a Declaration on Employee Tax Assessment (Erklärung zur Arbeitnehmerinnenveranlagung) L1 form, which can be filed at the government tax office portal FinanzOnline, via a local tax office, or by downloading each form from the Ministry of Finance and manually submitting them

Payer's Tax Withholding & Reporting Requirements

Hiring companies do not withhold any of the independent contractor’s payment for tax purposes. However, for independent contractors whose monthly income is less than the marginal earnings threshold, the hiring company must enroll them in the accident insurance institution (Unfallversicherung).

Remuneration

Independent contractors operating as a business typically submit an invoice on a monthly basis. Independent contractors operating without a business (i.e., as a sole trader) may be paid via any preferred method and often require a payment receipt.

The hiring company and independent contractor may also negotiate a payment structure, including any up-front payment, partial payments, and a final payment upon completion of the work

Workers’ Rights

Independent contractors generally do not have employee rights unless detailed in a specific agreement with the hiring company.

Benefits

Independent contractors’ benefits are governed by the content of the contract. However, the client must process the independent contractor’s health insurance (which is mandatory in Austria), usually through the Austrian health insurance provider (ÖGK).

When Paid

Independent contractors send an invoice (or other form of payment request) and typically require payment within 14 days or 28 days of submission unless otherwise stipulated in the contract. Independent contractors are not paid by payroll in most cases.

Who classifies as an Independent Contractor in Austria?

As in many countries, there is no strict definition of employees and independent contractors in Austrian law. However, individuals are generally considered independent contractors if they:

- Are not subject to the hiring company’s operational rules

- Can choose their own working hours or schedule

- Can choose their own place to work from (unless the work is site-specific)

- Provide their own equipment to carry out assigned tasks

- Do not work under direct supervision, directives, or instructions

- Are paid on the basis of time spent on work, not for deliverables

- Are not subject to disciplinary procedures

In particular, an individual’s personal ‘dependence’ on the employer – which usually implies economic dependence too – is typically taken as the hallmark of being an employee.

It is worth noting that unlike the employee-contractor distinction in many other countries, Austrian independent contractors typically do not (or would not be expected) to hire their own employees nor work for multiple clients. For this reason, these independent contractors are often referred to as ‘dependent employees’, even though in legal terms they are self-employed independent contractors.

Contracting Models

Austria has four main categories of independent contractors:

- Liberal professional (Freiberuer): These independent contractors operate under a freelance contract (Freier Dienstvertrag). This category includes doctors, architects, and lawyers.

- New self-employed (Neue Selbständige): So-called ‘new self-employed’ (Neue Selbstständige) independent contractors operate under a service contract (Werkvertrag). This tends to include artists, writers, scientists, and academics.

- Self-employed via free / regulated business license (Freie Gewerbe / Reglementierte Gewerbe): This category includes independent contractors who require a license to operate, such as IT professionals, financial advisors, and construction workers.

- Independent contractor (Freie Dienstnehmer): These contractors typically work for clients sequentially, with each contract being a specific period of time.

Regardless of the category, the individual has to register at their local Economic Chamber (Wirtschaftskammer), along with registering for freelance income tax, health insurance, and social security.

Engagement Models

There are two primary engagement models for working with independent contractors in Austria:

A. Direct engagement: Under this model, the hiring company engages directly with the independent contractor and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the contract.

B. Third party: These firms come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Agency: Here, the hiring company engages with a staffing agency, which in turn supplies one of its own contractors to deliver the contracted services. The hiring company pays the staffing agency directly, in accordance with the terms of the contract. The contract is therefore between the hiring company and the staffing agency, while the agency pays the independent contractor through a separate contractual arrangement.

- Umbrella company: Austrian independent contractors can also work through an umbrella company. This turns a ‘self-employed’ individual into a legal ‘employee’ of the umbrella company and therefore helps avoid complications around tax and other issues. The contractual relationship is between the umbrella company and the client, with the umbrella company running payroll and administration for the independent contractor. The umbrella company invoices the client directly, while paying the contractor as a standard employee. Umbrella companies levy a fee on the contractor to cover their costs.

- Employer of record (EOR): Like an umbrella company, an EOR can also act as the independent contractor’s legal employer, while the hiring company is effectively a customer of the EOR. However, unlike the limited scope of an umbrella company, an EOR’s responsibilities are wider-ranging and can include all aspects of payroll, taxes, and HR (including onboarding and offboarding).

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential independent contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

Contractor Payments

Companies hiring independent contractors in Austria should avoid making payments directly through their payroll system. Beyond these guidelines, there are no specific lawful requirements related to paying independent contractors in Austria. The contract should stipulate the preferred payment method agreed upon by both parties.

Contractor Taxes

Self-employed independent contractors are liable for their own income tax, which they pay on an annual basis. Independent contractors are taxed on earnings above EUR11,000 per year if they have a single income, or above EUR12,000 per year if they have multiple incomes. Independent contractors also pay 27.68% of their annual profits towards social security contributions, which are also tax-deductible. Social security contributions are paid on all earnings up to EUR71,820. Earnings beyond this level are social security-free.

Independent contractors whose income is above the earnings threshold (Unfallversicherung) are required to register with the Austrian health insurer (Krankenversicherungsträger) in order to be covered by pension insurance and accident health insurance, along with registering for unemployment insurance to receive unemployment benefits (Arbeitslosengeld) in case of bankruptcy. Independent contractors who have multiple employment relationships, each below the marginal earnings threshold (Unfallversicherung), can also receive sick pay and maternity pay if their total income is above the threshold. However, they do not need to register for unemployment insurance and do not receive unemployment benefits.

Employment in Austria

We can simplify hiring full-time workers in Austria by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Austria without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Austria

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Austria?

Look no further

Talk to an Expert