Compliantly Engage Contractors in Poland

Our workforce compliance guide to Poland covers everything you need to compliantly engage, onboard, manage and pay independent contractors in Poland

Local Time

Currency

Polish Zloty (PLN)Official Language(s)

PolishPopulation

37.96 Million (Dec 20)Economic Region

European UnionGDP

594 Billion USD (Dec 20)GDP Growth rate

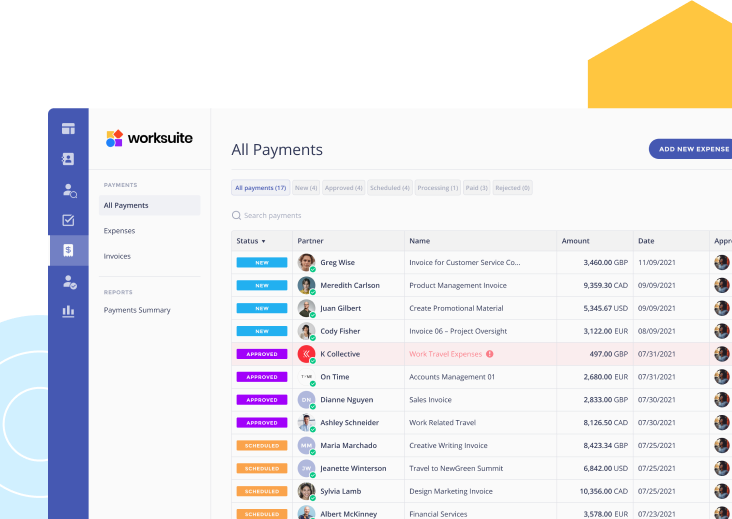

5.3% (Sep 21)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Poland

Poland has become an attractive center for global investment and operations in Europe, making it a prime location for businesses looking to expand their footprint across Central and Eastern European markets.

Combined with a lower cost of living and a rapidly rising pool of professional talent, Poland is one of the best places to find talent. We work with the best legal partners in Poland to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questionnaires will help you determine the worker status in compliance with the labor law in Poland, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Poland

Any business hiring in Poland should understand the important legal distinction between who classifies as an independent contractor, and who can be hired as an employee. Fines or penalties may be issued to businesses who are hiring contractors under the guise of employment. It is important to work with a partner like Worksuite to ensure a compliant engagement framework that accurately classifies freelancers as independent contractors for you and lets you know when freelance talent must be engaged as a payrolled contractor or employed directly. Common talent classification factors weighed in Poland include:

- What degree of control and supervision does the company have over the worker?

- Who provides equipment, work space, amenities, internet, etc.?

- What is the nature of the relationship, and how long is the period of work?

- Do both parties have the authority to terminate cooperation?

- Has a contractor independently established their business?

Understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Poland.

Factors

Employee

Independent Contractor

Employment Laws

Governed by The Polish Labour Code.

Civil law contracts regulated by the Civil Code.

Hiring Practice

The potential employee must submit their resume. Once approved, the employer must deliver a formal job offer in writing, and acquire personal information such as date of birth, marital status, citizenship, NIP (Taxpayer Identification Number), etc

Polish law does not strictly govern the use of civil contracts. They do not receive certain benefits from a company and file taxes independently. He or she is in control of their work method and schedule and is not limited to one client.

The parties are completely free to choose the basis of cooperation from the following:

- Self-Employed

- Commission Contrac

- Contract of Mandate

Tax Filing Documents

The employer must give employees their Personal Income Tax (e.g. PIT-11) form, and the employee should submit documents no later than April 30th to the tax office. The most convenient way of submitting PIT is online via e-Urząd Skarbowy.

The contractor is responsible for submitting their Personal Income Tax (e.g. PIT-37) form to the tax office no later than April 30th.

Payer Tax Filing Requirements

The employer reports all amounts paid during the tax year typically on a PIT-11 form, and gives it to the employee.

The contractor must report on all income earned typically on a PIT form:

- PIT-36 is for self-employed

- PIT-37 for incomes from contract of mandate or commission

Other Tax Filing Details

In addition to the PIT forms, employees may also be obliged to submit additional forms, for example, Social Insurance Institution (ZUS). Most tax forms may be submitted electronically online via e-Urząd Skarbowy.

- Corporate Income Tax (CIT)

- Value Added Tax (VAT)

In addition to the PIT form, Independent contractors must often submit the following information online via e-Urząd Skarbowy, which includes, but is not limited to:

- Client contract

- PESEL number (the national identification number used in Poland)

- NIP Number (Tax Identification Number)

Remuneration

Earns either an hourly rate or a salary

Invoice-based payments (typically once a month) for contractors under a business entity. Individuals without a business entity may simply receive remuneration via their preferred payment method, but often a payment receipt may be needed.

Worker’s Rights

The Labour Code governs minimum wage, working time standards, the admissible number of overtime hours and work on Sundays and public holidays, annual leave, maternity leave and termination.

Labour laws do not apply to employees performing work on the basis civil contract, and thus cannot be infringed upon by the employer. This does not mean that the parties

Benefits

All employee benefits are paid for and delivered by the employing company.

Freedom of contract allows the both parties to establish their own benefit agreements. Contractors are responsible for their own retirement pension insurance, disability insurance, health insurance, accident insurance, etc.

When Paid

An employee pay period must remain the same unless formally changed. In Poland the payment should fall on, or before, the last business day before it is due.

A contractor sends an invoice, and the employing company is responsible for paying it based on details agreed upon in the contract. Contractors are not paid by payroll in most businesses.

Employee

Employment Laws

Governed by The Polish Labour Code.

Hiring Practice

The potential employee must submit their resume. Once approved, the employer must deliver a formal job offer in writing, and acquire personal information such as date of birth, marital status, citizenship, NIP (Taxpayer Identification Number), etc

Tax Filing Documents

The employer must give employees their Personal Income Tax (e.g. PIT-11) form, and the employee should submit documents no later than April 30th to the tax office. The most convenient way of submitting PIT is online via e-Urząd Skarbowy.

Payer Tax Filing Requirements

The employer reports all amounts paid during the tax year typically on a PIT-11 form, and gives it to the employee.

Other Tax Filing Details

In addition to the PIT forms, employees may also be obliged to submit additional forms, for example, Social Insurance Institution (ZUS). Most tax forms may be submitted electronically online via e-Urząd Skarbowy.

- Corporate Income Tax (CIT)

- Value Added Tax (VAT)

Remuneration

Earns either an hourly rate or a salary

Worker’s Rights

The Labour Code governs minimum wage, working time standards, the admissible number of overtime hours and work on Sundays and public holidays, annual leave, maternity leave and termination.

Benefits

All employee benefits are paid for and delivered by the employing company.

When Paid

An employee pay period must remain the same unless formally changed. In Poland the payment should fall on, or before, the last business day before it is due.

Independent Contractor

Employment Laws

Civil law contracts regulated by the Civil Code.

Hiring Practice

Polish law does not strictly govern the use of civil contracts. They do not receive certain benefits from a company and file taxes independently. He or she is in control of their work method and schedule and is not limited to one client.

The parties are completely free to choose the basis of cooperation from the following:

- Self-Employed

- Commission Contrac

- Contract of Mandate

Tax Filing Documents

The contractor is responsible for submitting their Personal Income Tax (e.g. PIT-37) form to the tax office no later than April 30th.

Payer Tax Filing Requirements

The contractor must report on all income earned typically on a PIT form:

- PIT-36 is for self-employed

- PIT-37 for incomes from contract of mandate or commission

Other Tax Filing Details

In addition to the PIT form, Independent contractors must often submit the following information online via e-Urząd Skarbowy, which includes, but is not limited to:

- Client contract

- PESEL number (the national identification number used in Poland)

- NIP Number (Tax Identification Number)

Remuneration

Invoice-based payments (typically once a month) for contractors under a business entity. Individuals without a business entity may simply receive remuneration via their preferred payment method, but often a payment receipt may be needed.

Worker’s Rights

Labour laws do not apply to employees performing work on the basis civil contract, and thus cannot be infringed upon by the employer. This does not mean that the parties

Benefits

Freedom of contract allows the both parties to establish their own benefit agreements. Contractors are responsible for their own retirement pension insurance, disability insurance, health insurance, accident insurance, etc.

When Paid

A contractor sends an invoice, and the employing company is responsible for paying it based on details agreed upon in the contract. Contractors are not paid by payroll in most businesses.

Who classifies as an Independent Contractor in Poland?

Contractor relationships are not bound by the typical Polish labor laws that govern full-time employment relationships. The key differences to note between employment and non-employed workers are as follows:

- No entitlement to ZUS benefits (healthcare, pension, etc.)

- No entitlement to paid time off

- No notice period before termination

- No formal payment methods required

- Must meet minimum wage requirements

- The service agreement (contract) is used to establish details such as working hours, commitment level, payment for services rendered, role, benefits, and so on.

Employment vs. Independent Contractors

The distinction between employment and independent contractor is very specific in Poland and has wide-reaching implications for companies looking to hire from abroad. Self-employment is very popular across professionals who have set up their own freelance business entity, who then forge business-to-business (B2B) contracts with their ‘clients’ from abroad.

However, in some cases, this relationship can lead to legal risks, which involve reclassifying the individual to an employee. In practice, if a relationship between the contractor and their client/company proves to be a lawful employment relationship, significant financial penalties may apply. It is, therefore, important to have an employment service partner like Worksuite to ensure that independent contractors fall under the correct working relationship with your business.

While traditional employees fall under Labor Code contracts and protections under Polish labor law, independent contractors typically fall under business-to-business contracts known as civil law agreements.

Civil Law Agreements & B2B Contracts

Under civil law agreements, “workers” function more like contractors rather than employees. The contracts engage workers to perform specific tasks, and they operate outside the labor laws that generally apply to Polish employees. It is critical to always properly distinguish the services provided by a B2B contractor to not establish an employment relationship.

In Poland, criteria specified in the Labor Code are useful for determining whether a worker is a contractor or an employee. The Polish Labor Code stipulates several different criteria that companies should use to differentiate their contractors from their employees. Workers are generally employees rather than contractors if they meet the following criteria:

- They perform work of a specified type.

- They accomplish that work under direct employer supervision.

- They perform work at the place and time the employer dictates.

- The working relationship is relatively continuous.

On the other hand, workers who perform their jobs with minimal direct employer supervision, choose when and where they work, and take on a series of short-term projects of their choice are more likely to be classified as contractors.

Contracting Models

There are three main types of Civil Law Agreements in Poland:

- A contract of mandate (Umowa zlecenia)

- A contract to perform specific work (Umowa o dzieło), otherwise known as Contract for Specific Work, or Contract of Commission.

- A service-level agreement between two business entities (Umowa o świadczenie usług)

Contract of Mandate (Umowa zlecenia)

Umowa Zlecenia differs from service agreements and B2B contracts, acting more as an employment contract with an individual but with fewer obligations for the employer. Employers should consider it as an informal employment relationship, where the working role, location, hours, and commitment are well established, and the employer has more supervision over the worker.

Contract for Specific Work (Umowa o dzieło)

Umowa o dzieło is a contract made for individual workers who have a specialized role or professional activity that cannot be easily performed by others. Employers can think of this as a project-based contract, where a mutual agreement is formed between a company and a worker under fixed scope and time. Note that consecutive contracts for Umowa o dzieło must be unique—a worker cannot end Umowa o dzieło and begin the same work for the same project again.

B2B Contract (Umowa o świadczenie usług)

B2B agreements are commonly used in Poland for the purpose of establishing a working relationship similar to employment. The key difference between classic employment and “B2B employment” is that the contractor operates under their own business entity, and is responsible for paying their own income taxes. This type of contract is convenient for the “employer” in terms of less headache with payroll and employment laws, while also allowing the contractor to retain a higher net remuneration. As long as B2B contracts are not contrary to judicial Polish laws or rules of social conduct, these types of agreements allow a wide range of freedoms.

Contractor Payments

Payment to independent contractors is extremely flexible and can simply be determined by both parties within the contract. There are no laws in Poland that require a specific payment method or time of delivery—although the typical window from the contractor sending an invoice to payment falls within 14 days of issuance.

When working with independent contractors, you’ll need to have an established process for paying them correctly and on time within the contract. The most common payment methods include:

Invoicing: Typical payroll does not apply to contractors, as only employees are part of payroll systems where withholdings from paychecks are used to pay the necessary payroll taxes. Contractors typically submit invoices for their work and process their payments through your accounts payable department. However, some payroll services companies have structures that allow you to pay your independent contractors using their services.

Banks: Your company might consider working with a bank to pay independent contractors. However, some Polish banks may not work with a company that has not officially registered in Poland, and the paperwork and requirements associated with opening a bank account may make this option impracticable.

Money transfer services: Money transfer services enable your company to send funds to your contractors’ bank accounts. If you have set up a subsidiary in Poland, you will already have a bank account from which to transfer funds through your accounts payable department. This process is an excellent option for paying contractors in Poland because it is relatively quick and convenient, allowing you to reduce delays and maintain a good working relationship with your independent contractors. Money transfer services also often offer several transfer method options, high transfer limits, and dependable security. However, be aware that you will likely incur currency transfer fees if you pay contractors in currency other than Polish złoty. These fees are generally percentages, so large transfers may cost you more.

Working with a hiring partner: If you work with a hiring partner, you often streamline your contractor payment processes significantly. A dependable partner can help you hire your contractors legally and pay them quickly, accurately, in the local currency, and in a way that complies with Polish regulations.

Contractor Taxes

Most independent contractors are responsible for contributing to ZUS individually. Employers are not responsible for withholding any payroll taxes or contributing on the workers behalf to ZUS—the employing company only pays what is shown in the service agreement when hiring independent contractors. Insurance typically covers the same realms as employment, including retirement pensions, disability, health and workplace injury. Health insurance payment plans are reserved for the contractor. Students under 26 are not required to pay into compulsory social or health insurance funds.

Employment in Poland

We can simplify hiring full-time workers in Poland by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Poland without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Poland

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Poland?

Look no further

Talk to an Expert