Compliantly Engage Contractors in Canada

Our workforce compliance guide to Canada covers everything you need to compliantly hire, onboard, manage and pay independent contractors in Canada.

Local Time

Currency

Canadian Dollar (CAD)Official Language(s)

English FrenchPopulation

38 Million (2020)GDP

1.643 Billion USD (2020)GDP Growth rate

-5.4% (2020)Worksuite offers a whole range of professional services and compliance tools, making it easy to compliantly engage independent contractors in Canada

We work with the best legal partners in Canada to create contract templates that are compliant with local laws to protect you and your contractors from fines and penalties.

Our bespoke onboarding workflows and screening questioners will help you determine the worker status in compliance with Canada law, based on which you can decide to engage a worker as a contractor or full-time worker—all without needing to set up your business entity.

Contractor Classification in Canada

Any business hiring in Canada should understand the important legal distinction between who is classified as an employee, and who can be engaged as an independent contractor. Fines or penalties may be issued to businesses that are hiring employees under the guise of independent contractors or freelancers.

In Canada, merely describing an individual as an independent contractor has no legal significance. Instead, various factors are taken into account to determine the true legal status of the individual. Therefore, understanding the distinctions between employees and independent contractors is critical to compliantly engaging workers in Canada.

It is important to work with a partner like Worksuite to ensure that you have an engagement framework that properly classifies freelancers able to work as independent contractors. Alternatively, Worksuite can automatically alert you when freelance talent must be engaged directly as employees, or contractors on the payroll.

The Canada Revenue Agency (CRA) generally uses a four-point test to determine employee or contractor status:

- What degree of control does the company have over the worker?

- Who provides the tools necessary to complete the work?

- What degree of financial risk is the worker taking?

- Is the worker’s job fully integrated into the employer’s business?

Factors

Employee

Independent Contractor

Employment Laws

Governed by federal, provincial, and common law legislation. Employees working within federally regulated sectors have their rights protected under the Canada Labour Code. Employers must also comply with the Canadian Human Rights Act and the Employment Equity Act.

Contractual agreements must comply with federal, provincial, and common law legislation.

Hiring Practice

Employers make a formal offer of employment by issuing a written, binding contract that does not contravene any applicable legislation. When remuneration is agreed upon, and the worker provides written acceptance of the contract offer, the employee is hired. Irrespective of the employee’s preferences, Canadian employment contracts must comply with:

- Minimum employment standards

- Occupational health and safety legislation

- Human rights legislation

Formal written agreements between a company and an independent contractor should be titled Independent Contractor Agreement or Contract for Services, but never Contract of Services. Work must then be strictly completed on the basis of the terms detailed in the agreement. Both parties must be careful not to fall into the typical behaviors of an employer-employee relationship.

Tax Documents

Employers must complete all necessary payroll deductions and documents as specified by the Canada Revenue Agency (CRA). Employees must file an annual personal income tax return with the CRA

Independent contractors must complete Form T2125 (Statement of Business or Professional Activities) annually, as well as a personal income tax return.

Payer's Tax Withholding & Reporting Requirements

Employers must make all necessary deductions at source.

No deductions should be taken from payments made to independent contractors.

In the event a hiring company has paid a T4A contractor more than $500 in a calendar year, or deducted tax from any payment, the hiring company must give the contractor a T4A slip and file the slip with the Canada Revenue Agency (CRA).

Remuneration

Either hourly or salary. The employer must ensure that all remuneration is at least equal to minimum wage requirements, factoring in the number of hours the employee has worked.

Most independent contractors in Canada issue monthly invoices to recoup their fees.

Workers’ Rights

Employers must comply with their province’s minimum wage guidelines.

They must also provide vacation pay (minimum two weeks [three weeks in Saskatchewan]), statutory holiday pay (6-10 days), and paid leaves of absence, including pregnancy, parental, sick and family medical leave.

Employers must provide a notice period of termination (or pay in lieu thereof) and, in many cases, severance pay.

In general, independent contractors in Canada enjoy far fewer workplace rights than employees. The specifics vary from province to province, but in Ontario, for example, contractors are not entitled to the minimum wage, statutory holidays, maternity leave, or the right to refuse unsafe work.

There is also no required notice of termination, unless stated otherwise in an agreed contract.

Benefits

Employees can benefit from workplace safety and insurance policies.

Medical benefits are often provided if the employee negotiates well.

Employers also make payments to government programs, including Employment Insurance (EI) and the Canada Pension Plan (CPP).

No requirement on the employer to pay EI or CPP contributions. The contractor can choose whether to make their own contributions separately. If they choose not to make contributions, they waive their right to receive these benefits

When Paid

Varies by province and employer, but generally bi-weekly, semi-monthly (approximately 15th and 30th of each month), or monthly.

Typical contractor invoices are issued monthly on net 30-day terms. Each invoice usually details:

- Invoice number and date

- Client name and address

- Agreed contract price

- Goods and services tax (GST), if applicable

- Harmonized sales tax (HST), if applicable

- The contractor’s GST/HST numbers, if applicable

- The contractor’s bank details

- Agreed payment terms and due date

Employee

Employment Laws

Governed by federal, provincial, and common law legislation. Employees working within federally regulated sectors have their rights protected under the Canada Labour Code. Employers must also comply with the Canadian Human Rights Act and the Employment Equity Act.

Hiring Practice

Employers make a formal offer of employment by issuing a written, binding contract that does not contravene any applicable legislation. When remuneration is agreed upon, and the worker provides written acceptance of the contract offer, the employee is hired. Irrespective of the employee’s preferences, Canadian employment contracts must comply with:

- Minimum employment standards

- Occupational health and safety legislation

- Human rights legislation

Tax Documents

Employers must complete all necessary payroll deductions and documents as specified by the Canada Revenue Agency (CRA). Employees must file an annual personal income tax return with the CRA

Payer's Tax Withholding & Reporting Requirements

Employers must make all necessary deductions at source.

Remuneration

Either hourly or salary. The employer must ensure that all remuneration is at least equal to minimum wage requirements, factoring in the number of hours the employee has worked.

Workers’ Rights

Employers must comply with their province’s minimum wage guidelines.

They must also provide vacation pay (minimum two weeks [three weeks in Saskatchewan]), statutory holiday pay (6-10 days), and paid leaves of absence, including pregnancy, parental, sick and family medical leave.

Employers must provide a notice period of termination (or pay in lieu thereof) and, in many cases, severance pay.

Benefits

Employees can benefit from workplace safety and insurance policies.

Medical benefits are often provided if the employee negotiates well.

Employers also make payments to government programs, including Employment Insurance (EI) and the Canada Pension Plan (CPP).

When Paid

Varies by province and employer, but generally bi-weekly, semi-monthly (approximately 15th and 30th of each month), or monthly.

Independent Contractor

Employment Laws

Contractual agreements must comply with federal, provincial, and common law legislation.

Hiring Practice

Formal written agreements between a company and an independent contractor should be titled Independent Contractor Agreement or Contract for Services, but never Contract of Services. Work must then be strictly completed on the basis of the terms detailed in the agreement. Both parties must be careful not to fall into the typical behaviors of an employer-employee relationship.

Tax Documents

Independent contractors must complete Form T2125 (Statement of Business or Professional Activities) annually, as well as a personal income tax return.

Payer's Tax Withholding & Reporting Requirements

No deductions should be taken from payments made to independent contractors.

In the event a hiring company has paid a T4A contractor more than $500 in a calendar year, or deducted tax from any payment, the hiring company must give the contractor a T4A slip and file the slip with the Canada Revenue Agency (CRA).

Remuneration

Most independent contractors in Canada issue monthly invoices to recoup their fees.

Workers’ Rights

In general, independent contractors in Canada enjoy far fewer workplace rights than employees. The specifics vary from province to province, but in Ontario, for example, contractors are not entitled to the minimum wage, statutory holidays, maternity leave, or the right to refuse unsafe work.

There is also no required notice of termination, unless stated otherwise in an agreed contract.

Benefits

No requirement on the employer to pay EI or CPP contributions. The contractor can choose whether to make their own contributions separately. If they choose not to make contributions, they waive their right to receive these benefits

When Paid

Typical contractor invoices are issued monthly on net 30-day terms. Each invoice usually details:

- Invoice number and date

- Client name and address

- Agreed contract price

- Goods and services tax (GST), if applicable

- Harmonized sales tax (HST), if applicable

- The contractor’s GST/HST numbers, if applicable

- The contractor’s bank details

- Agreed payment terms and due date

Who classifies as an Independent Contractor in Canada?

The two most important steps of structuring an independent contractor relationship in Canada are to

- document the working relationship properly, and

- ensure that all work is delivered under the terms of the contract and not through the standard modus operandi of an employer-employee relationship.

Without these steps, it can be common for workers initially classified as independent contractors in Canada to actually be reclassified as employees. The final decision would be made by a governmental authority or court.

The 1986 case of Wiebe Door Services Ltd v Canada (Minister of National Revenue) determined four key tests that are most commonly used to determine whether a worker in Canada can be classified as an independent contractor. The four tests relate to control, tools, financial risk, and integration.

- Control: does the independent contractor control when and where they work?

- Tools: does the independent contractor own their own tools and equipment used to complete the work?

- Financial risk: is the independent contractor exposed to financial risk or has the potential to make a profit?

- Integration: is the independent contractor’s work integrated into the employer’s business, or is it ancillary to the organization?

Contracting Models

Aside from employed and independent contractors, a new category of employment status has also emerged in Canadian law. The status of ‘dependent contractors’ is considered a halfway house between independent contracting and employment.

A dependent contractor is a contractor who is economically dependent on a single company. They may be entitled to a notice period, although this will likely be a shorter notice period than equivalent employees. Employers could expose themselves to further financial obligations should a worker declared as an independent contractor actually be found to be a dependent contractor.

Independent contractors typically sign an Independent Contract Agreement or Contract for Services.

Engagement Models

There are two primary engagement models for working with independent contractors in Canada.

A. Direct engagement of the worker as self-employed or registered via their own limited company. Under this model, the hiring company engages directly with the independent contractor and establishes a direct contract for the provision of services. The hiring company then pays the independent contractor directly, in accordance with the terms of the contract.

- Work Contract

A Contract of Services establishes an employer-employee relationship, where the employee is expected to work when the employer requires, use the employer’s tools and equipment, and work at the employer’s premises - Service Contract

A Contract for Services establishes a business relationship. It defines what services one business will provide to another. This set-up creates much more autonomy for the worker, who is expected to provide a set service for a set fee by using their own tools, knowledge, and expertise. That level of independence is crucial for proving, should it ever be questioned, that the relationship between the employer and worker was that of an independent contractor rather than an employee. Treating the independent contractor as a separate business entity is an easy rule of thumb for employers trying to navigate this area.

B. Umbrella company. These firms, often referred to in Canada as Employer of Record or Contractor Payroll providers, come in two forms and both are specially designed to vet and engage freelancers compliantly as either contract employees or independent contractors on your behalf.

- Staffing agency: Some contractors may work under an umbrella company. In this case, the contractor is responsible for finding and fulfilling their work, but they are an employee of the umbrella company, which manages payroll and applies an administration fee on the contractor’s earnings.

- Hiring partner: The hiring company can also work with a hiring partner who helps them vet potential contractors, set up contracts, ensure the contractor is properly classified, onboard and manage contractors, and pay contractors.

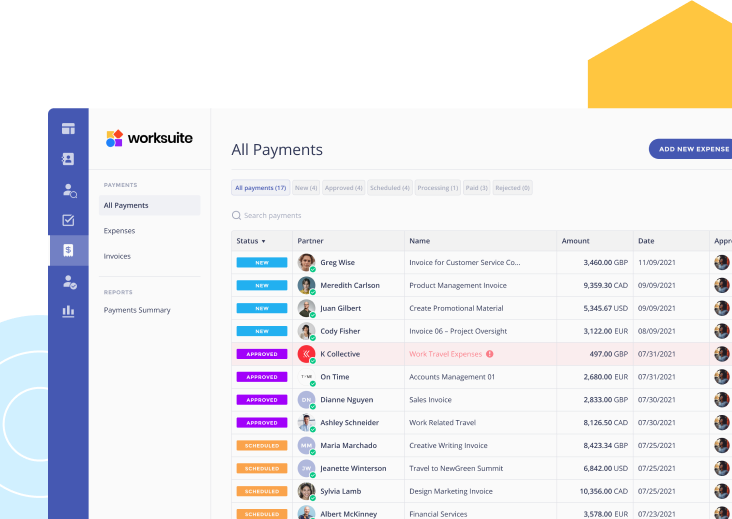

Contractor Payments

Companies hiring independent contractors in Canada should avoid making payments directly through their payroll system. Beyond these guidelines, there are a wide range of lawful methods to deliver payment to contractors in Canada. The contract should stipulate the preferred payment method agreed upon by both parties. The typical window for paying a contractor is 14 days or 28 days from the date of issuance of the invoice.

If you work with a hiring partner, you often streamline your contractor payment processes significantly. A dependable partner can help you hire your contractors legally and pay them quickly, accurately, in the local currency, and in a way that complies with Canadian regulations.

Contractor Taxes

Independent contractors in Canada are responsible for reporting and paying income tax, as well as potentially goods and services tax (GST) and harmonized sales tax (HST) if their annual income exceeds CAD$30,000 and they are operating as a defined business.

Income Tax

The Canada Revenue Agency enables independent contractors to file their personal income tax returns online. Independent contractors must complete Form T2125 (Statement of Business or Professional Activities) each year.

Compared to employees, independent contractors have access to significant tax advantages. They can write off several business expenses, giving them the potential to enjoy higher net earnings than a similar-level employee.

At the same time, employers can be tempted to classify workers as independent contractors by the prospect of lower costs (no employer contributions to Employment Insurance [EI] or the Canada Pension Plan [CPP]) and lessened administrative burdens (no payroll deductions).

These double-sided incentives are one of the main reasons why employees frequently end up wrongly classified as independent contractors in Canada. Employers should take significant care to avoid this situation. Working with a partner like Worksuite is a major step towards ensuring ongoing compliance with all relevant Canadian legislation.

Employment in Canada

We can simplify hiring full-time workers in Canada by acting as the Employer of Record (EOR) on your behalf, handling everything from contracts, onboarding, documentation, payroll, benefits, and workforce management. Reduce your time-to-hire by 90%, slash your overheads, and remain fully compliant.

- Quickly find, hire, and onboard talent in Canada without setting up your entity

- Prevent expensive legal, contractual, or tax mistakes in Canada

- Manage contracts, payroll, and global tax forms all in one Worksuite

Looking to Compliantly Engage Contractors in Canada?

Look no further.

Talk to an Expert